Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 10 Apr, 2024

By Nathan Stovall and Ronamil Portes

Bond portfolio restructuring appears to have slowed in recent months as higher rates and seasoning of portfolios slowed transaction activity.

After a flurry of restructuring activity in the fourth quarter of 2023, fewer loss trades in bank bond portfolios have emerged in recent months amid increases in intermediate and long-term rates. While those moves could be temporary, with the Federal Reserve expected to cut rates in the second half of 2024, the increase in rates has pushed bank bond portfolios further underwater and made loss trades slightly more punitive in the near term. The prospect of lower rates and seasoning of portfolios should temper larger-scale restructuring activity as unrealized losses in the portfolios will wane as securities move closer to maturity. Still, incremental pruning and repositioning of bond portfolios should continue, with banks selling portions of their portfolios and using proceeds to pay down high-cost borrowings while reinvesting in higher-yielding securities.

Repositioning improves the earnings steam or bond portfolios

Banks took advantage of declines in the intermediate and long-term rates in the fourth quarter to selectively prune their underwater bond portfolios and use the proceeds to pay down high-cost borrowing and reinvest in higher-yielding securities. Nearly 30 publicly traded banks executed loss trades in the fourth quarter, usually selling 10% to 25% in their portfolios, rather than engaging in full-scale restructurings.

The Street largely took those loss trades in stride, and banks welcomed the opportunity to put the underwater positions and the drag they served on their margins behind them. A handful of institutions have continued the trend in the first quarter, with BOK Financial Corp. most recently announcing a partial restructuring of its bond portfolio by selling just over 6% of its available-for-sale (AFS) securities. BOK reinvested the proceeds of the sale into higher-yielding securities that carried an average yield nearly 300 basis points higher than the securities sold. The bank plans to offset the loss from the sale by participating in a Visa share exchange where it monetizes some of its class B-1 shares in the company.

Truist Financial Corp. said after selling its remaining insurance business that it could use the proceeds from the sale to reposition its balance sheet. And Regions Financial Corp. said at an investor conference in February that it could use capital to engage in some loss trades and take more duration in its investment portfolio.

However, many other banks appear to have remained on the sidelines from the restructuring trade in recent months. Through March 26, the yields on 2-year and 5-year Treasurys had risen 33 basis points and 38 basis points, respectively, since year-end 2023, pushing bank bond portfolios further underwater and accordingly increasing the regulatory capital hit associated with any restructuring.

While banks must mark their AFS portfolios to market on a quarterly basis, and those marks are captured in accumulated other comprehensive income (AOCI) and impact tangible common equity, they do not impact banks' regulatory capital, save for large banks classified as US global systemically important banks (G-SIBs).

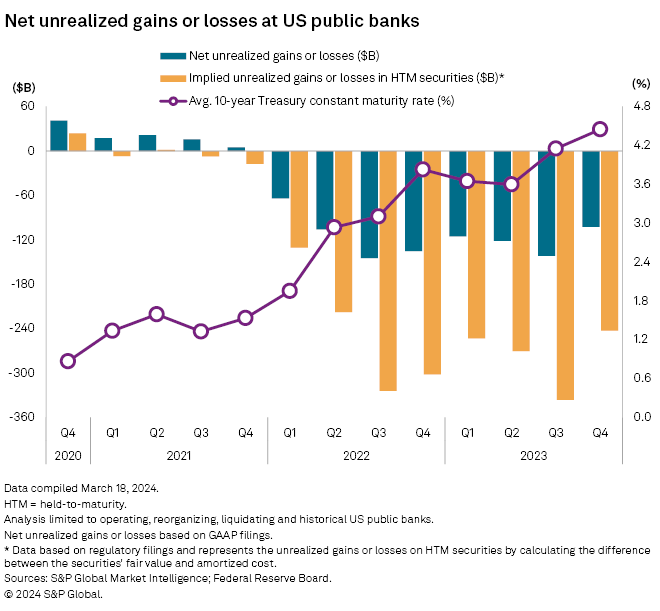

Decreases in rates in the fourth quarter softened the hit to tangible book value, with institutions including US commercial banks, savings banks, and savings and loan associations that file GAAP financials reporting $102.7 billion in unrealized losses in their AFS portfolios, compared to $142.0 billion in unrealized losses in the prior quarter.

Liquidity, bond portfolios remain in focus for regulators

Bank regulators have focused on the negative impact from AOCI on bank capital and the impact that underwater bond portfolios have on banks' access to liquidity. Banks faced deposit outflows throughout 2022 and much of 2023, and regulators recognized that institutions could not look at their securities portfolios as the same source of liquidity as they have historically due to high levels of unrealized losses. Regulators have said high levels of unrealized losses have led to downgrades on liquidity ratings in some bank exams.

Contingency liquidity plans have received far greater attention from regulators, with examiners looking at key fundamental ratios such as banks' liquid assets — cash, federal funds sold, securities purchased under agreements to resell and securities, including unrealized gains/loss on securities less pledged securities — to uninsured deposits to measure an institution's ability to meet potential deposit outflows.

Regulators want to see that banks have plans to handle potential stress and have conducted tabletop liquidity exercises simulating a run on the bank. They also want to see that banks have outlined various levers to pull to access funding in times of stress — including from the Fed's discount window — and see evidence that the institutions have tested those plans.

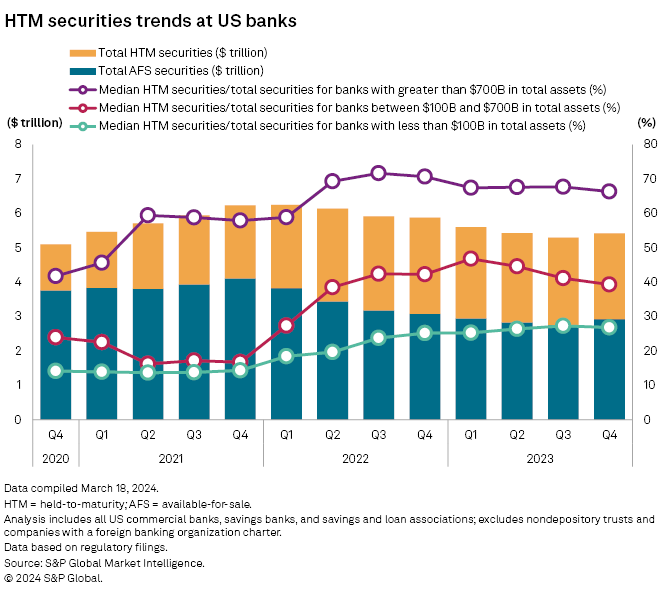

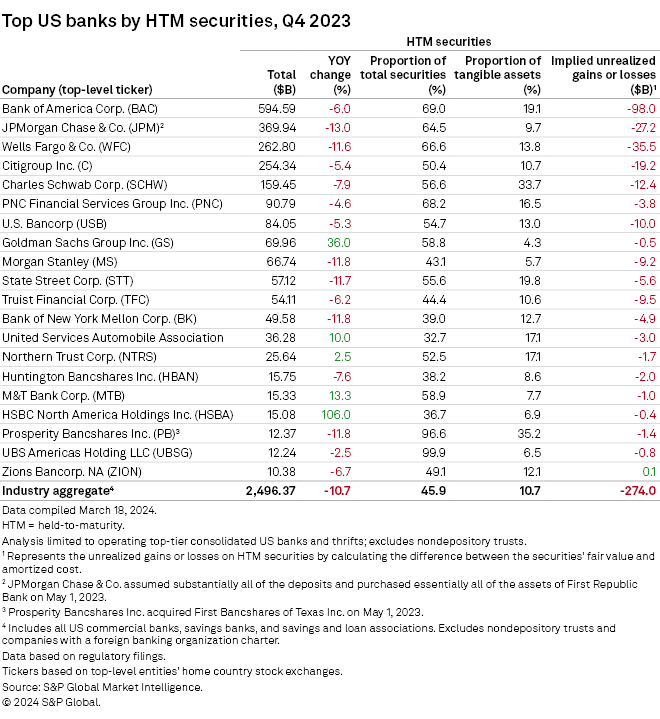

Banks have taken actions in the past to mitigate the impact from AOCI by parking larger portions of longer-term bonds, often seen as loan surrogates, in held-to-maturity (HTM) securities portfolios. Those positions remained significantly underwater in the fourth quarter. Some banks, particularly the nation's largest institutions, relied heavily on the HTM designation since changes in AOCI impact tangible book value.

For large banks classified as G-SIBs, those with more than $700 billion in assets, changes in AOCI also impact regulatory capital. At those institutions, the median HTM securities-to-total securities was more than 65% at the end of the fourth quarter. Under the proposed capital rules, dubbed the Basel III endgame, changes in AOCI will also impact regulatory capital at banks with more than $100 billion in assets. Among banks with assets between $100 billion and $700 billion, the median HTM securities-to-total securities was 39% at the end of the fourth quarter.

Unrealized losses in HTM portfolios at institutions that file GAAP financials totaled $242.62 billion in the fourth quarter of 2023, down from $336.46 billion in the prior quarter.

Since the Fed began its tightening cycle early in 2022, the investment community has examined the ratio of loans plus HTM securities-to-deposits at a bank to see how many deposits are tied up in less liquid assets. The ratio is also effectively a measure of duration risk on bank balance sheets as HTM portfolios built when rates were low have served as a drag on bank earnings streams.

Given the negative view from the investment and regulatory community, banks could look at HTM designations differently in the future. It seems possible that institutions will place higher value on the liquidity rather than the earnings generated by their investment portfolios and that could result in less reliance on HTM designations.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.