Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 22 Nov, 2023

By David Hayes

Bankers turned more optimistic on loan growth in S&P Global Market Intelligence's latest US Bank Outlook Survey, but commercial real estate credit quality remained a top concern.

➤ More than one in three respondents anticipate a decline in commercial real estate credit quality over the next 12 months.

➤ Roughly 38.5% of C-suite respondents said their institutions do not stress test their CRE portfolio.

➤ Almost 57% of bankers surveyed expect to see loan growth over the next year, up from 51% in the second-quarter survey.

Pullback from commercial real estate expected to continue

S&P Global Market Intelligence conducted an online survey between Sept. 5 and Oct. 3 and found that the continued prevalence of remote work following the COVID-19 pandemic has put pressure on commercial real estate loans, especially in the office sector, as tenants decide to downsize or even close entire locations as leases come up for renewal.

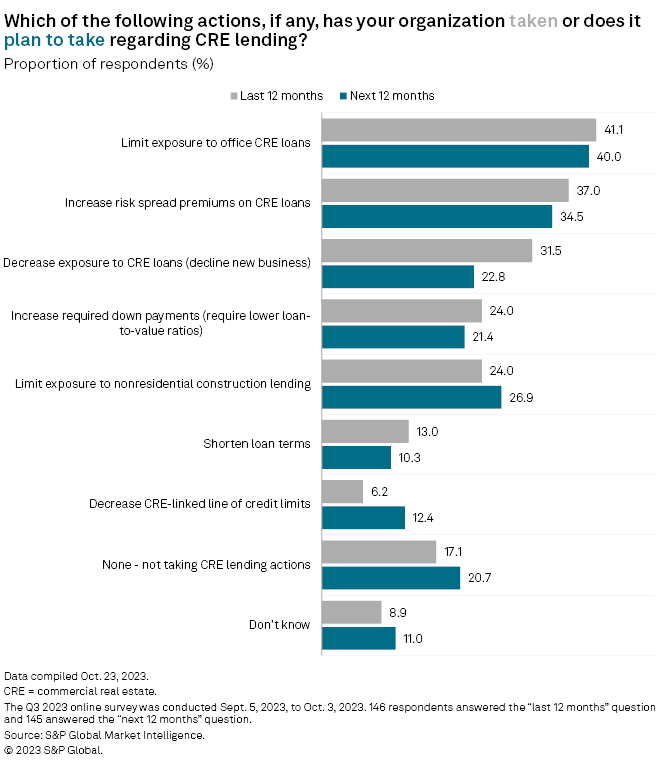

Against this backdrop, 41.1% of respondents indicated that their institution had limited exposure to office CRE loans over the last 12 months, and 40.0% expect to limit that exposure over the next year.

In addition, some bankers are choosing to raise risk premiums to compensate for the higher perceived risk. Thirty-seven percent of bankers surveyed said their institution raised risk spread premiums on CRE loans over the last year, while 34.5% of respondents plan to do so over the next 12 months.

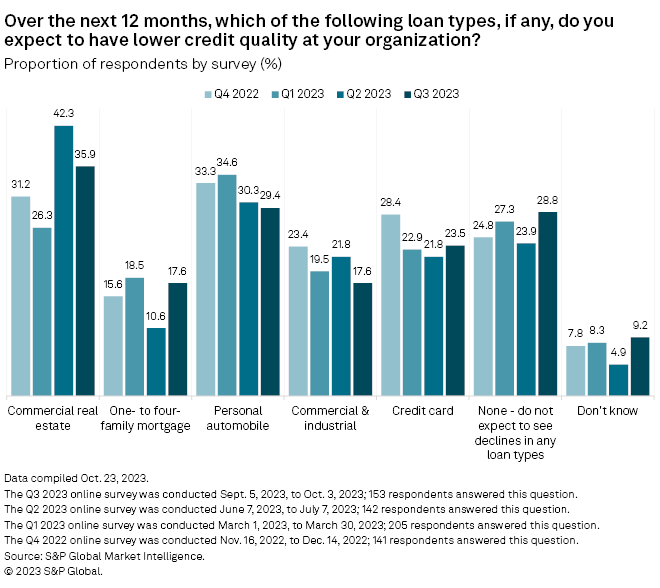

S&P found almost 36% of bankers surveyed expect to see credit quality decline in their commercial real estate loan portfolio over the next 12 months, the highest rate among the five loan types in the survey. This was however an improvement from 42.3% in the second-quarter survey.

Meanwhile, 17.6% of survey respondents expect credit quality to decline in their one-to four-family mortgage portfolio, a 7 percentage-point increase from the previous survey.

On a positive note, the proportion of respondents expecting a decline in personal auto loan credit quality fell to 29.4%, the lowest mark among the first four surveys conducted by S&P Global Market Intelligence. Similarly, those expecting a decline in commercial and industrial loan credit quality fell to 17.6%, which was also the lowest proportion yet.

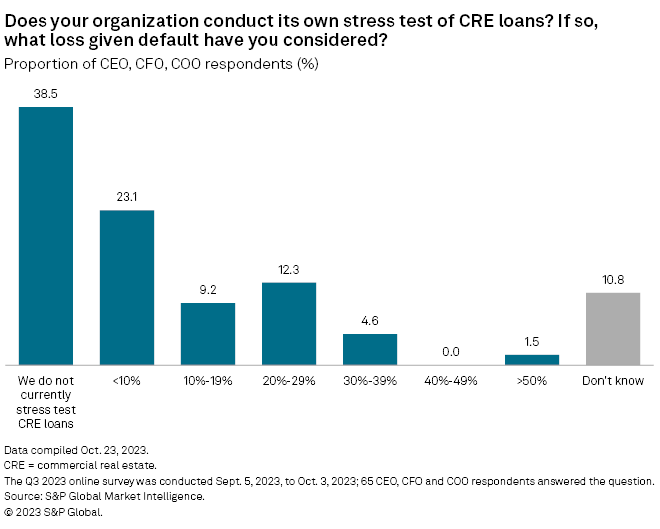

Despite growing concern surrounding commercial real estate loans, 38.5% of C-suite respondents, which include CEOs, CFOs and COOs, stated that their institution does not currently stress test its portfolio.

Meanwhile, among the 33 C-suite respondents that indicated that their institution does stress test, 15 noted that their institution assumes a loss given default of 10% or less. Another eight respondents indicated that their institution assumes a 20% to 29% loss given default, while six respondents indicated a 10% to 19% loss given default rate.

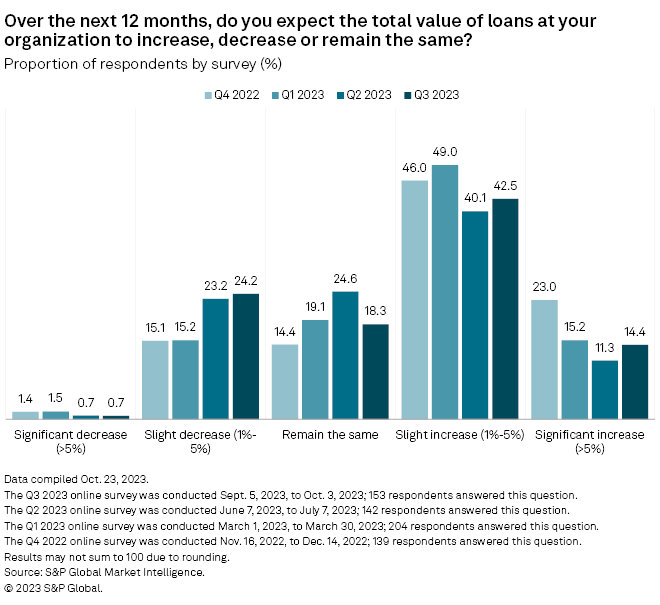

Loan growth optimism improves

The outlook for loan growth improved slightly. S&P found that 56.9% of bankers surveyed expect to see loan growth over the next 12 months, up from 51.4% second-quarter survey, but down significantly from 69.0% in the fourth-quarter 2022 survey. However, the percentage of respondents that expect loans to decline over the next 12 months increased to 24.9% of respondents, up from 23.9% in the second-quarter survey and the highest mark yet in S&P's first four surveys.

Total loans and leases at US banks and thrifts increased in the third quarter 0.4% from the prior quarter and 2.8% year over year to $12.343 trillion, according to the latest call report data.

During the third quarter, loans at JPMorgan Chase & Co., the US's largest bank by assets, increased by 1% quarter over quarter even as C&I loans remained flat. During the company's third-quarter earnings call, CFO Jeremy Barnum noted that he expected credit card loans to continue growing, but perhaps at a slower pace, while home loans remain constrained by high interest rates.

Regional banks have reported mixed outlooks for loan growth. Wisconsin-based Associated Banc-Corp reported that loans grew 1% quarter over quarter in the third quarter, but noted that the pace of loan growth has slowed recently.

"And it's clear that pipelines have also slowed as customers make a more cautious approach in what appears to be a higher for longer rate environment," President and CEO Andrew Harmening said during its third-quarter earnings call.

Western Alliance said during its third-quarter earnings call that it expects loan growth to be flat to $300 million against its nearly $50 billion portfolio in the fourth quarter but forecasts a return of its quarterly growth target of more than $500 million in loans in 2024.

In the Federal Reserve's recent senior loan office survey, respondent banks reported tighter standards and weaker demand across multiple loan categories, including commercial and industrial loans and commercial real estate loans. In addition, demand fell for all residential real estate loan categories.

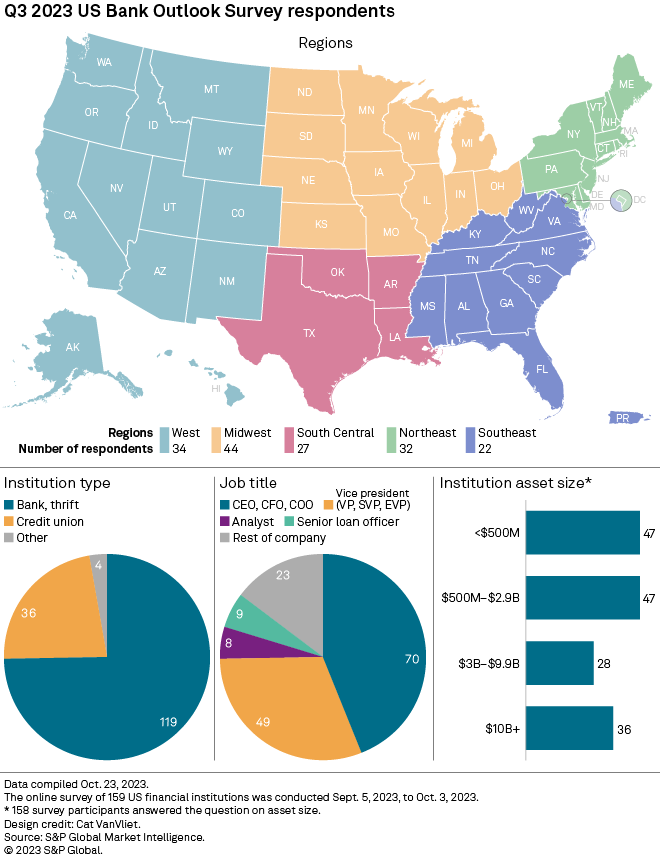

S&P Global Market Intelligence surveyed 159 US financial institution clients on various topics including expected loan and deposit growth, projected interest rates and commercial real estate trends. Of the 159 participants, 119 worked for commercial banks or thrifts, 36 for credit unions and four for other US institutions.

The online survey was conducted between Sept. 5, 2023, and Oct. 3, 2023.

The margin of error for topline statistics is +/- 8 percentage points at the 95% confidence level.

If you would like to participate in future US banking surveys, please contact david.hayes@spglobal.com.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.