Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 4 May, 2023

By Jay Lyman

It has been nearly 10 years since we first covered the emerging open-source Docker application container technology, which has transformed from a new tool that more universally and consistently packages applications to the basis of modern software designs, including microservices, Kubernetes and serverless. Containers have also extended beyond application packaging to serve as the building blocks of innovative use cases in data science, AI/machine learning and at the edge.

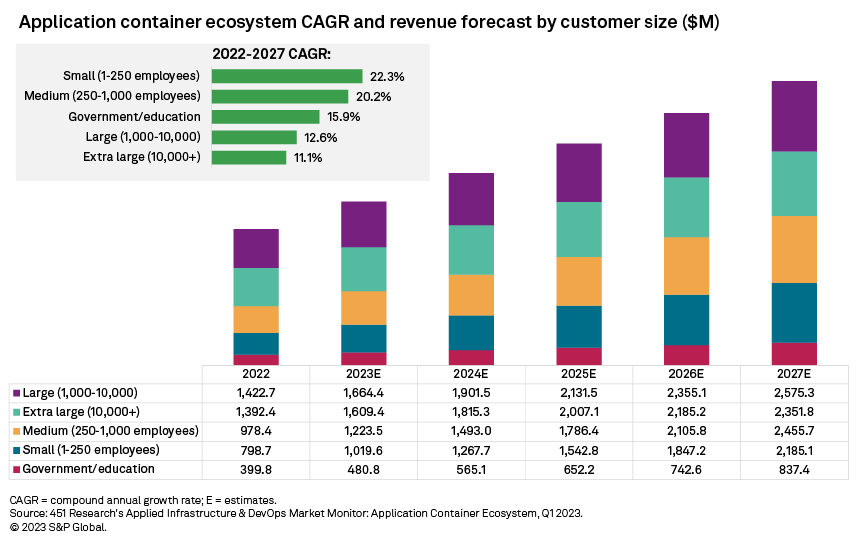

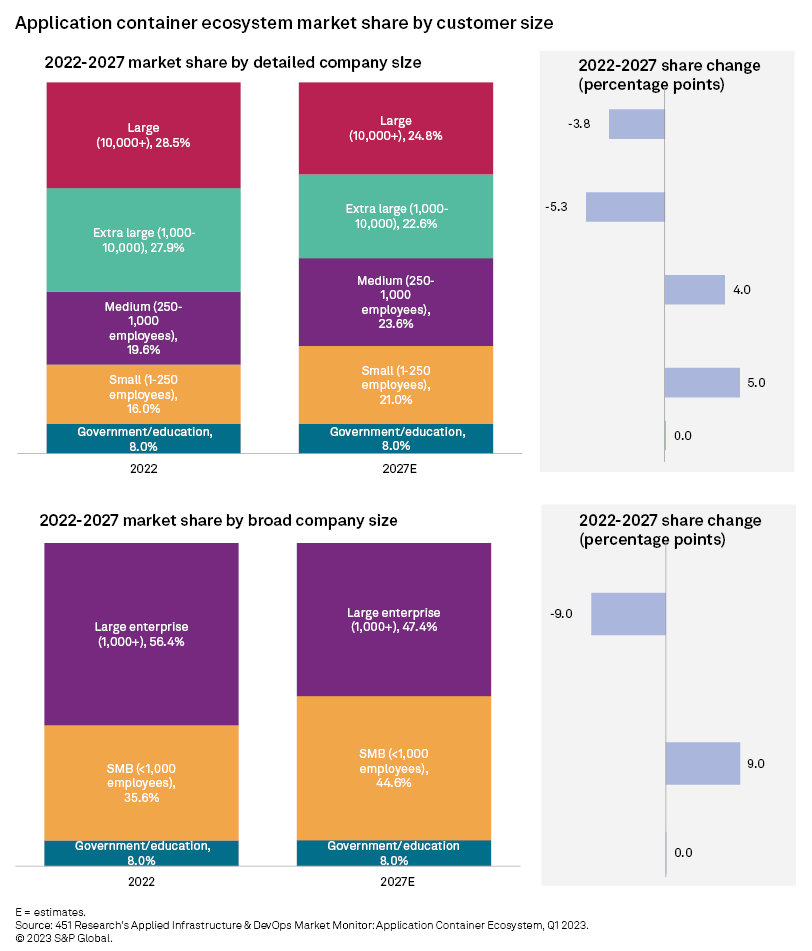

Our Market Monitor service has published updated and extended forecasts for the evolving application container ecosystem. Although the updated figures reflect continued enterprise adoption of containers, the new detailed forecasts included in our dataset highlight the unequal dispersion of container revenue generation across company size, vertical industry, infrastructure, delivery model and application type. Many of these differences center on whether organizations have the expertise and staff to deploy containers at scale or in production, the alignment of use cases with the ephemeral nature of containers, and where organizations are on their digital transformation and cloud-native journeys.

Context

After a decade of coverage, our latest Market Monitor market sizing analysis of the application container ecosystem across several subsegments — including management and orchestration; monitoring, logging and alerting; and data management and services — reveals continued growth among different customer sizes and verticals despite current economic conditions.

Although there is a higher level of scrutiny on IT spending, containers seem to be delivering value to customers, with IT operations efficiency ranked the top benefit of cloud-native in 451 Research's DevOps, Workload and Key Projects 2022 survey. Containers are also playing a prominent role in cloud migration, application modernization and overall digital transformation.

The product and service ecosystem and market around modern application containers are also evolving, along with growing scale and production use in the enterprise. While revenue generation from vendors differs across company size, vertical industry, infrastructure, delivery model and application type, we continue to see more enterprise applications built around and run on containers.

In this report, we explore container adoption and revenue generation in terms of customer company size and vertical market based on 451 Research's Market Monitor: Application Container Ecosystem analysis. We are also tracking other aspects of container revenue generation, including by infrastructure, delivery model and use case. The granular market forecasts presented in this report were generated using a combination of end-user feedback from our survey research and analysis as well as conversations with vendors, end users and investors.

From emergent tool to broad enterprise adoption

When containers arrived in the industry 10 years ago, they were used primarily by larger, technology-oriented companies such as Google LLC, which pioneered Kubernetes based on containers, and Amazon.com Inc.'s Amazon Web Services Inc., which established a market for serverless capabilities via Lamda based on containers. Today, our analysis shows container usage has broadened to include larger enterprises, which still account for most container adoption, and small and medium-sized businesses.

Given the most common hurdles to container adoption — cost, complexity and lack of skills — can hinder deployment at smaller organizations to a far greater degree, it is no surprise that larger customers currently account for the lion's share of container spending. Large organizations are more likely to be the ones that allocate budget to deploy technology such as containers and Kubernetes and to have existing staff and skills, as well as the ability to attract and retain them.

While these hurdles will not dissipate in the short term, we do expect the distribution of spending on containers to begin to level out in terms of customer size over the coming years, thanks in large part to broader adoption of cloud and software-as-a-service container services by companies of all sizes. With more smaller organizations adopting containers, there will be increased opportunity to support these companies as their spending grows to rival their larger counterparts.

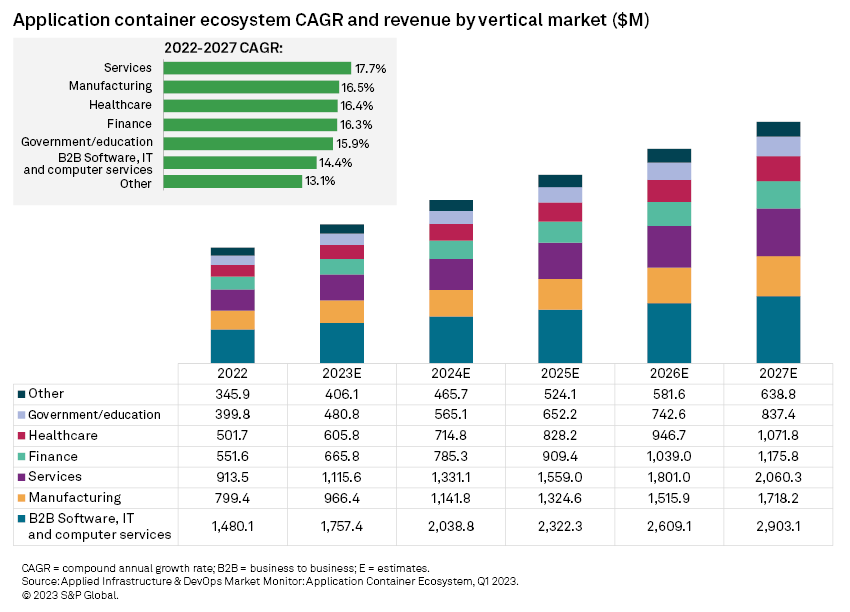

Risk and security key determinants for vertical market adoption

Not surprisingly, the leading verticals for container adoption include business-to-business, software and computer services. We expect these technology-centric verticals to continue to generate the largest percentage of container revenue through the forecast period, similar to what we have seen with other technology trends, such as development and operations, whereby developers and IT operations teams collaborate for faster releases, more efficient IT management and other benefits.

Still, a decade of containers in the enterprise has also meant a broadening of verticals using them beyond technology and cutting-edge companies, to include significant representation of manufacturing, financial services, healthcare and the public sectors. All of these verticals are poised for increased container adoption, while the tech sector remains the biggest adopter through several years of our forecast.

Cost and expertise represent primary determinants of container adoption when looking at organization/company size; however, risk and security concerns have a similar impact on adoption by vertical market. Typically at the forefront of emerging tech adoption, financial services is not as large in container adoption as one would expect, due primarily to security and compliance concerns.

Relatively more risk-averse and regulated verticals, such as healthcare and government/education, are also lagging behind other industries in terms of container adoption. While we expect security concerns to dissipate as container use and the market mature, we are not forecasting a material upswing in share allocated to these verticals because these security and compliance issues are likely to persist. This typically means more deployment via virtual machines and on-premises without containers, behind the firewall.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is part of S&P Global Market Intelligence. For more about 451 Research, please contact 451ClientServices@spglobal.com.