Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 26 Dec, 2022

Electric Vehicle (EV) sales have seen considerable growth in recent years, reaching 9.4% of global passenger vehicle penetration in 2021, and expected to triple by 2026. S&P Global Commodities Insights estimate EV sales to grow by a compounded growth rate of over 28% over this period. A consequence of this, battery materials have quickly become critical to the automotive supply chain with major companies establishing partnerships with both battery cell manufacturers and miners of the raw material. Examples of this include Tesla, the world’s largest Electric Vehicle manufacturer reporting partnerships with: BHP for nickel sulphate; Albermarle for lithium hydroxide; Glencore for Cobalt; and Syrah Resources for graphite flake.

Source: S&P Global Market Intelligence, Northern Graphite

Data as of Dec 20, 2022

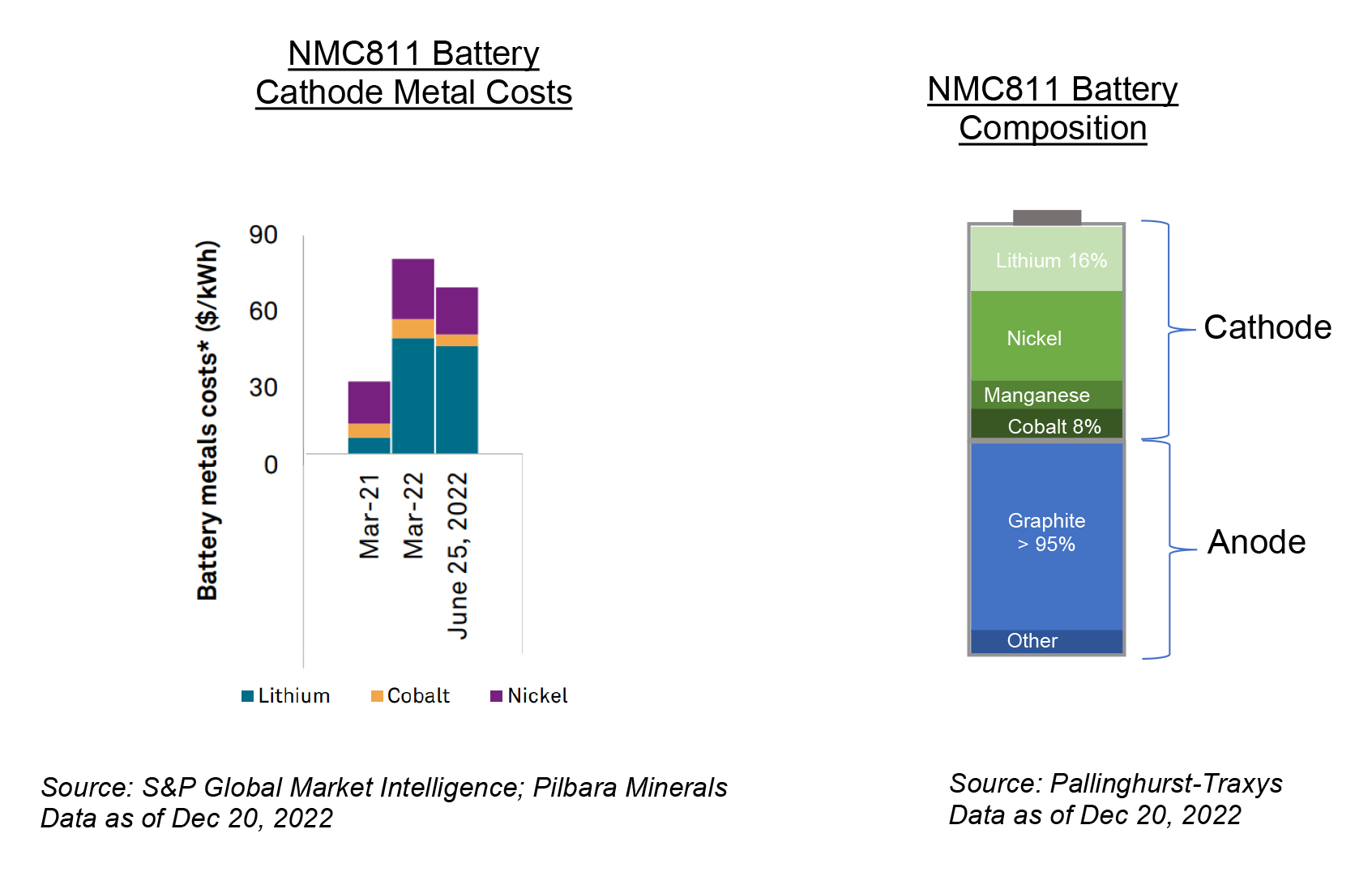

Cathode building metals (Cobalt, Lithium & Nickel) have been the priority for car manufactures in 2022 as all three markets struggle with supply challenges. Cathode chemistry utilized in long range EVs have seen a shift to higher nickel composition cathodes at the expense of cobalt and manganese to achieve the longest range possible with current technology. NMC811 cathode chemistry (meaning 8 Nickel to 1 Manganese and 1 Cobalt) is forecast to capture significant battery market share in the coming years. LFP Cathodes (Lithium-Iron-Phosphate) will continue their dominance of the battery sector but have lower energy density making them more suitable for city-vehicles and energy storage.

Battery grade metal costs for all chemistry types have escalated in 2022, due to the impact of supply challenges on raw material availability. NMC811 cathode specifically doubled over 2021 levels (based on Chinese Spot assessments), as seen the in chart below. Lithium has been the primary driver of this trend and remains over 6x 2021 levels, while nickel and cobalt both peaked in March 2022 before subsiding. The cost breakdown for NMC811 in July 2022 was estimated for Lithium at 40.8$/kWh vs Cobalt at 3.5$/kWh and Nickel at 15.9$/kWh.

A material not hitting the headlines as often is graphite despite being the only commercially proven anode material and having similarly constrained supply chain. Only silicon shows promise as an alternative future anode material, exhibiting 10x higher energy density properties comparing with graphite; however commercial application in the short term remains limited due to technological hurdles. Long range car batteries require high performance graphite anode material from a few leading technology firms including LG, Hitachi and Samsung. With an average battery grade graphite input requirement of 1.2kt/GWh and cost reported up to 12,000 USD $/tonne (reported by Northern Graphite), this represents an estimated high-end cost of 14.4$/kWh. Comparing with cathode metal costs for NMC811 in June 2022, graphite is close behind nickel and 4x the cost of cobalt.

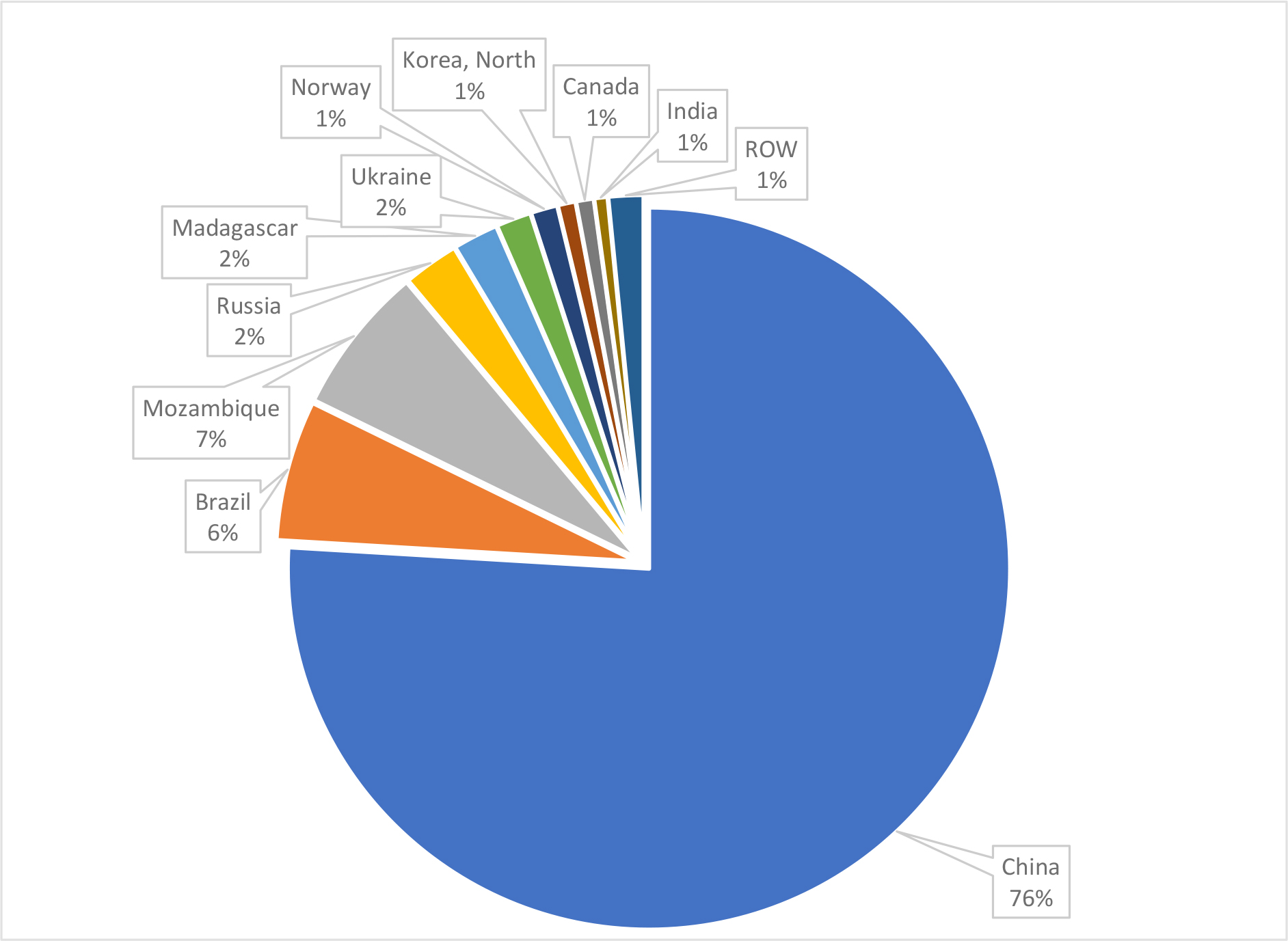

Graphite supply will need to be addressed to meet the demands of the battery sector and the growing trend for diversification of supply chains to mitigate risk, will strengthen investments outside of China (producer of over 3/4 of the world’s graphite in 2021). African projects are capturing interest from investors and downstream consumers alike. Success of these projects is highly dependent on unique resource attributes, some of which reduce processing costs, but others will define the end-product performance. In this report, I will look at the resource properties that define the success of these projects.

Global Graphite Flake Production 2021

Synthetic Vs Natural Graphite

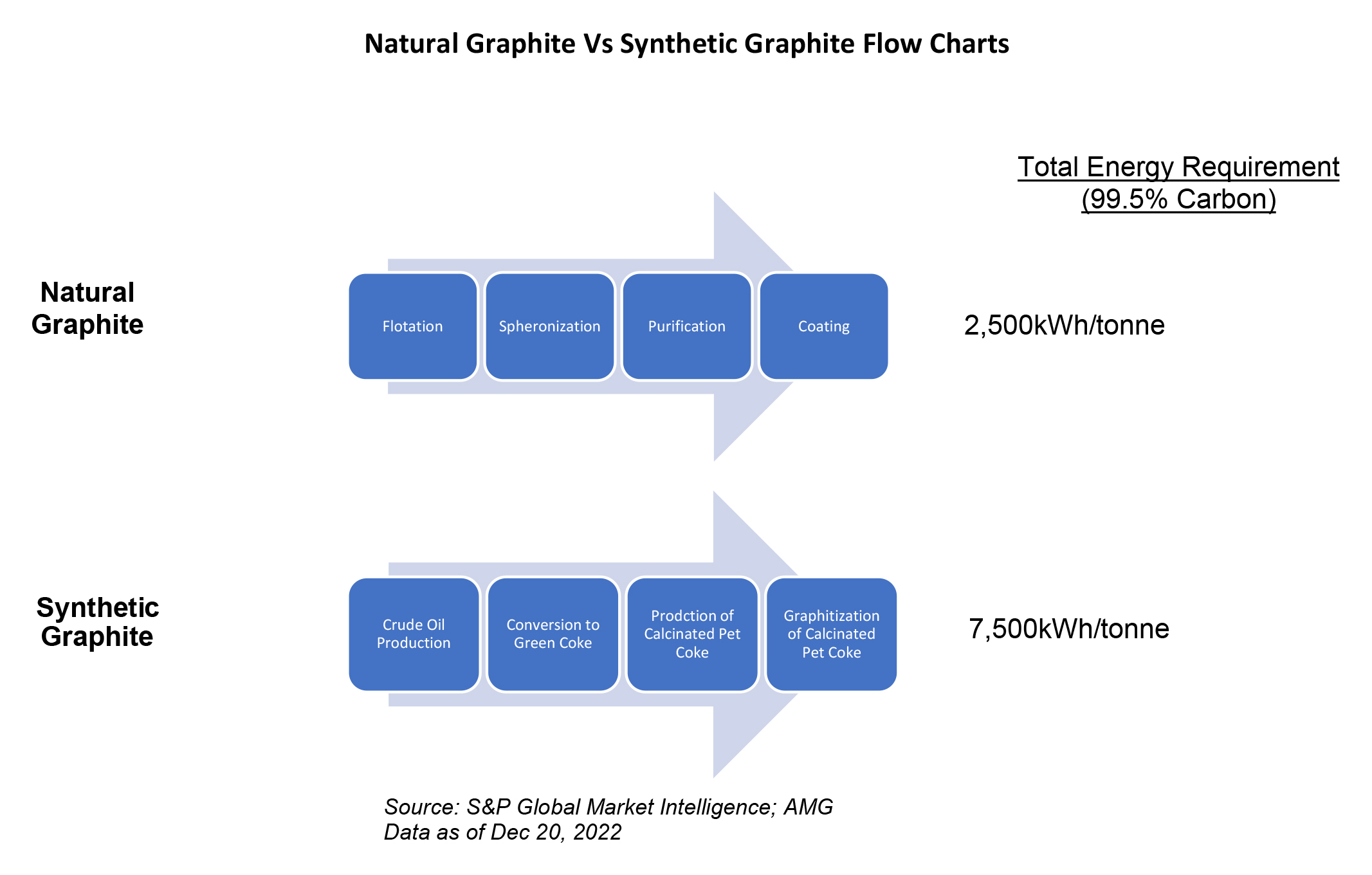

Graphite anodes can be sourced by mining of the raw material, known as natural graphite, or from synthetic graphite, which is produced from crude oil. Synthetic graphite still dominates the market, but performance benefits of natural graphite and new production will likely see it take over by 2025.

The process of manufacturing synthetic graphite is energy intensive, involving carbon enrichment (Coking) at 450⁰C and purification into a solid state (Calcination) at 13,000⁰C. In comparison to the preparation from natural graphite, a synthetic anode requires 3x the energy per tonne of 99.5% graphite material comparing with natural graphite and, if not powered by renewables, can emit over 3x the carbon dioxide. Synthetic graphite has some advantages, like faster charge and longer life, but cost and poorer energy storage capacity makes it less sought after by car manufacturers who prioritize driving range and low carbon emissions.

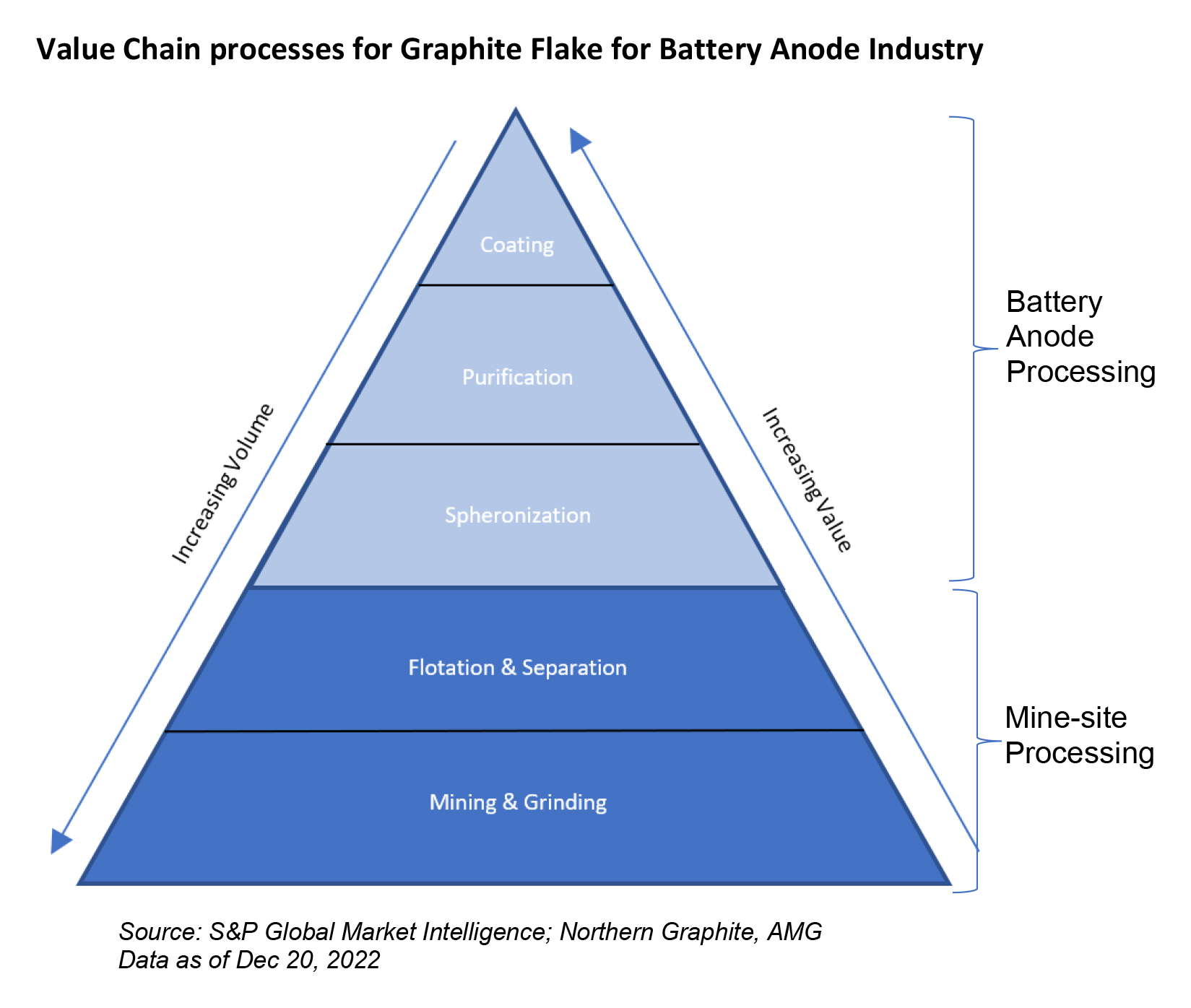

Mined graphite will go through several processes before it can be considered anode material. At mine site, graphite flakes are first ground and separated via flotation into flake sizes, which then dictates what industry the graphite is destined for. The most important battery related value-add processes are Spheronization, Purification and Coating. Flakes destined for the battery sector are rolled into spheres (Spheronization) so they can be tightly packed together later in the anode (improved carbon and energy density). Purification is achieved via acids to remove impurities that would otherwise affect battery performance, with a typical Total Graphitic Carbon (TGC) composition of 94-95%TGC rising to a battery grade of over 99.95%TGC. Finally, coating of the spheres with a layer of resin and baked at 1,200⁰C giving a hard carbon shell that protects the sphere from degradation during expansions/contractions when charged/discharged and prevents the electrolyte reacting with the active graphite.

An additional stage is employed by certain high-tech firms to improve performance, involving blending with synthetic graphite to take advantage of unique properties in both products, doping with silica to improve storage capacity and heat treatment to repair defects and prevent degradation. High-end EV manufactures pay a premium for the battery storage capacity and longevity achieved through these processes.

Graphite Flake Properties

Understanding the value of a graphite resource requires more than simply grade, size and costs to mine. Unlike graphite mines, base-metal mines producing metals like copper, nickel or cobalt will achieve a concentrate product of similar concentration, and the product value is directly linked to the metal mass within the concentrate. Deleterious elements (like arsenic) found in the concentrate will incur a penalty over a certain threshold for the additional treatment and safe storage of contaminated slag. The purified products generally have the same performance no matter which mine it comes from so the initial resource properties have little impact outside of cost to reach this product. Similarly, for lithium, the mineral resource can result in one of many products including carbonates, chlorides and hydroxides but, outside of processing costs, the quality of the battery is not impacted either way. This is not the case for graphite as the resource properties can have a profound effect on the end-product performance and downstream industry it can be used for.

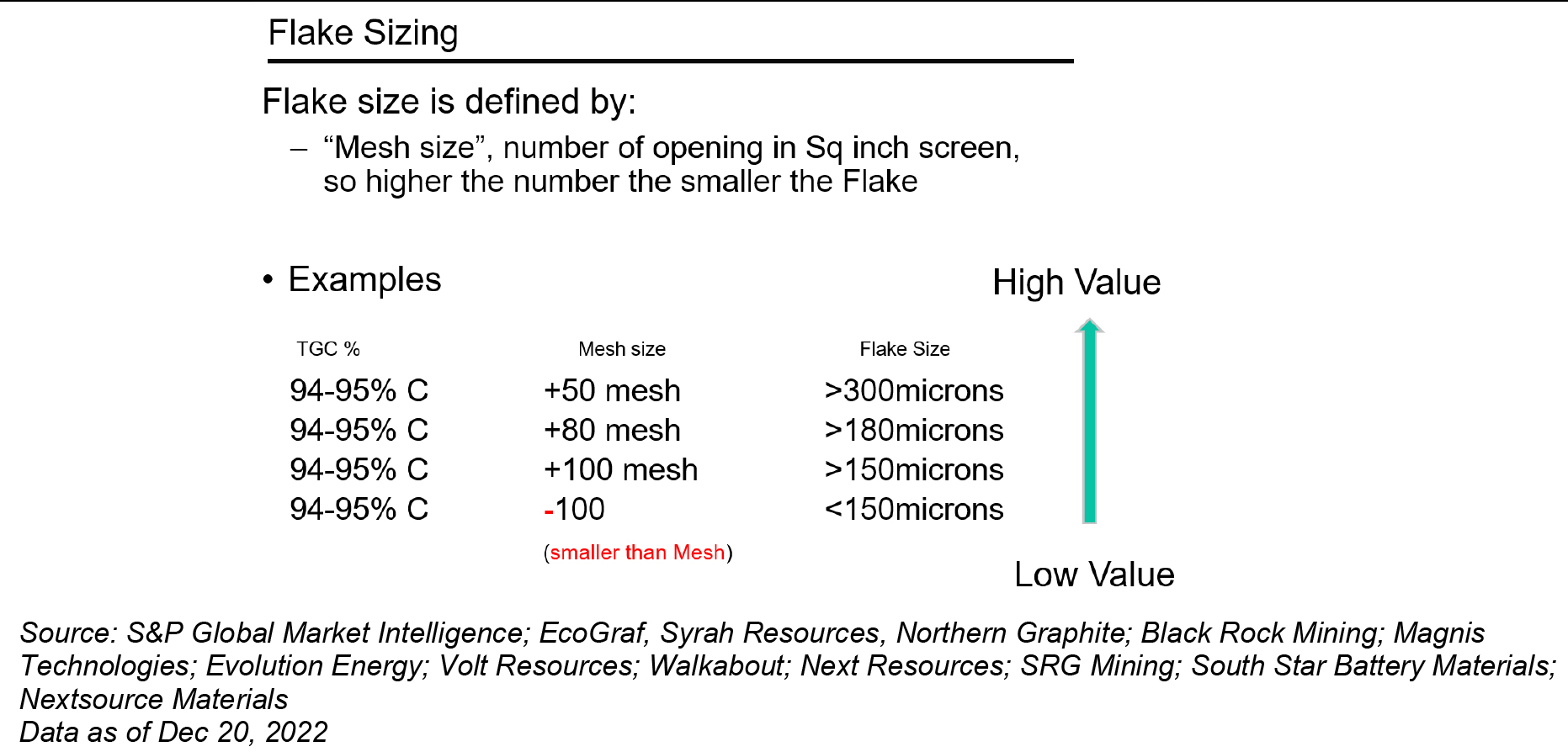

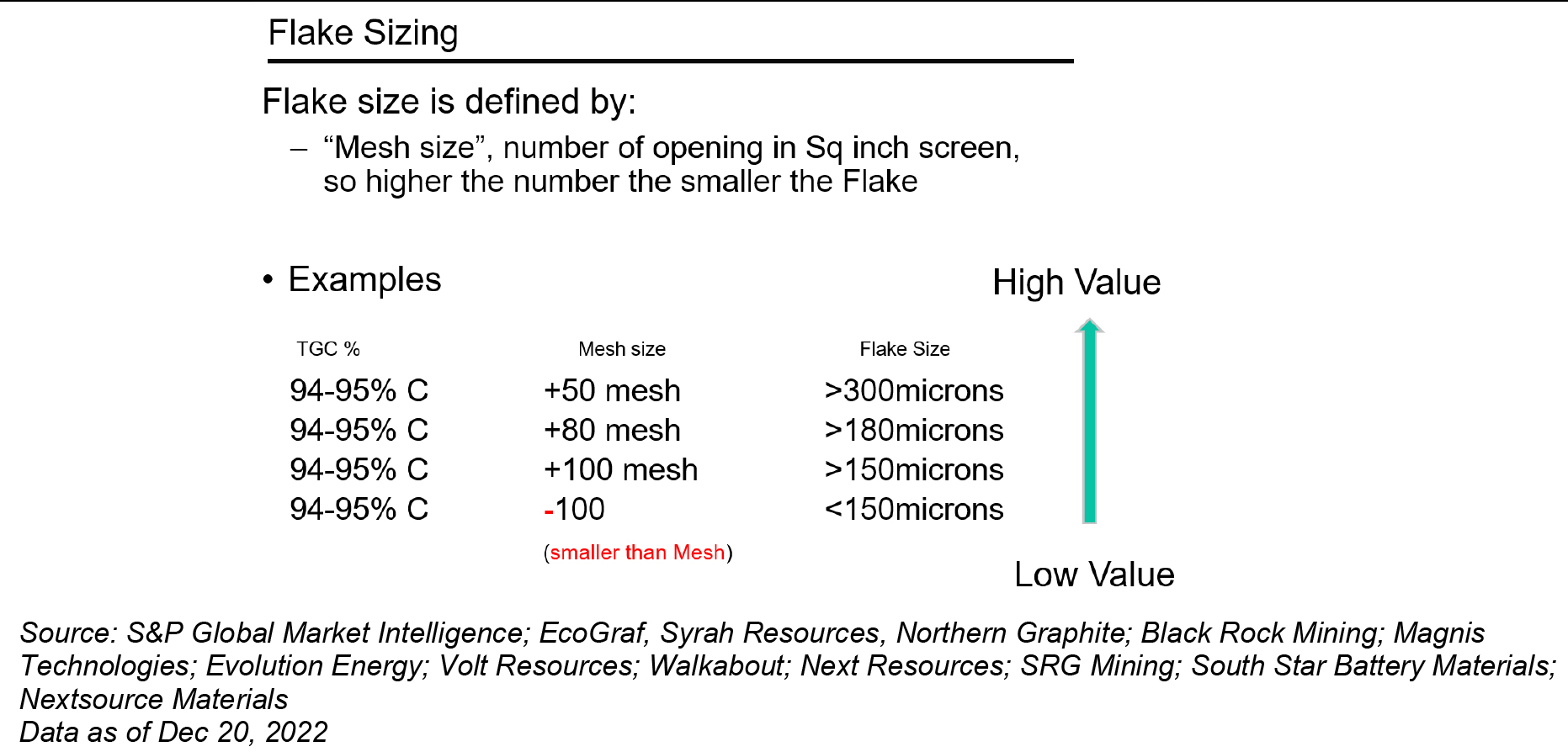

One of most important properties of a graphite resource effecting the end battery performance include flake size. Flake size is an indication of the natural size of the perfect carbon lattice, which cannot be improved through any process known today. It is the imperfections of the carbon lattice structure that prevent charge to be stored and cause weak points that initiate lattice degradation in the final coated graphite spheres that makes up the battery anode. For this reason, natural flake value produced at mine site is defined by minimum flake size of the concentrate with penalties/premiums applied for all other properties.

Flake size is measured in either microns or more commonly as a Mesh Size, meaning the number of openings that can fit in a single square inch sized screen (larger mesh number represents more smaller holes). Miners also provide descriptive words for the relative flake size including summarized below:

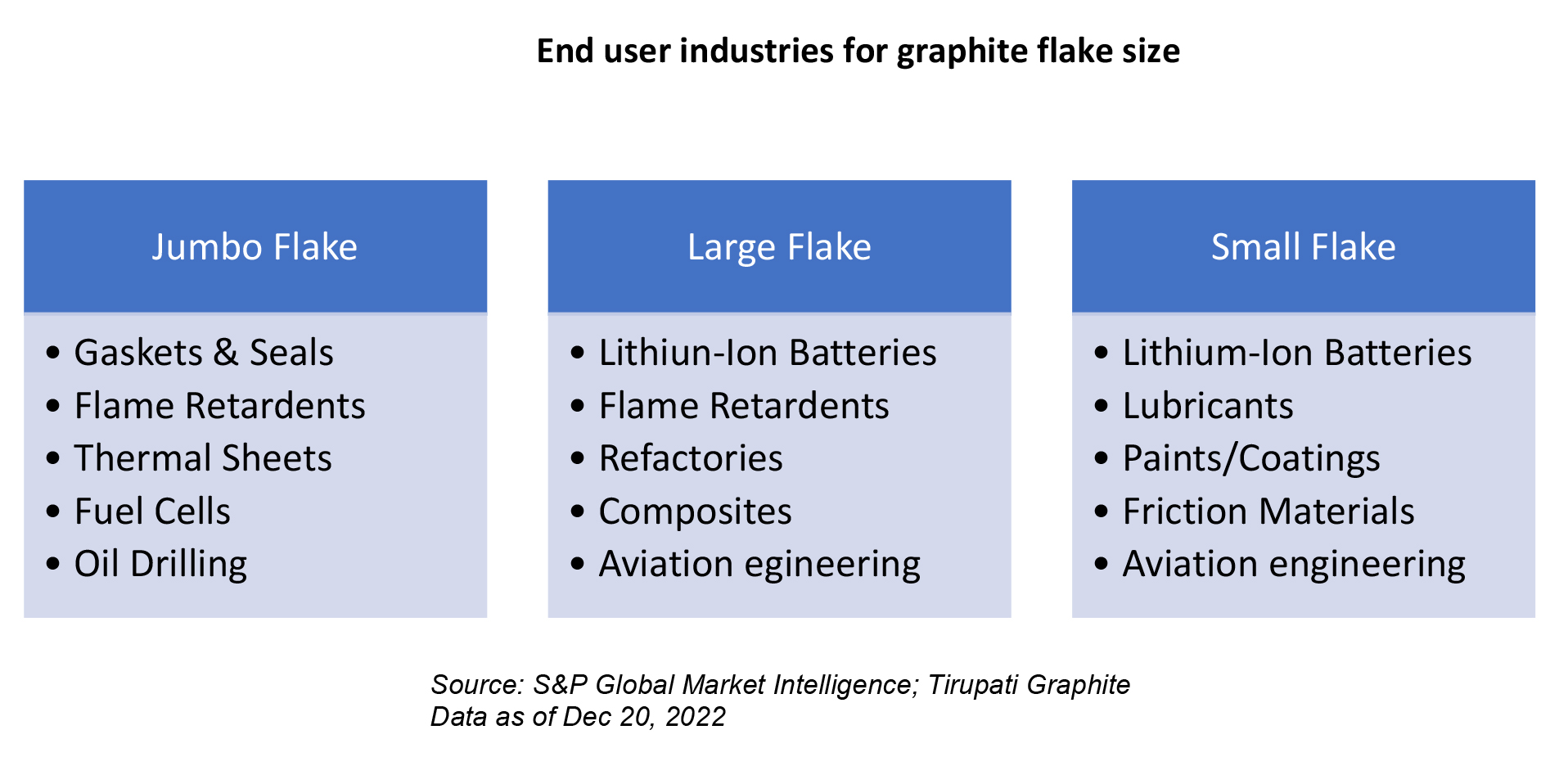

Pricing for each flake size is difficult as the market has limited independent trades and most miners look for off-take agreements with annual contracts. The end consumer industry will differ between flake size so prices can move independently as those respective market perform. Battery performance improves with size, but pricing of Jumbo Flake limits this benefit-reward ratio. Jumbo Flake has unique properties that make it ideal for high-tech applications industrial sectors as it can form “expanded graphite” when treated at a high heat (expansion of crystal lattice by over 100x). Thermal conductivity, radiation/chemical protection, elasticity and permeability all improves well beyond its closest material rivals making it ideal for gaskets/seals, flame retardants and high-speed equipment. Small or fine flake is consumed in lower value industries like lubricants, composites and coatings but still utilized in lithium-ion batteries for small electronics like phones that do not require as long a lifetime as a car.

As a general guide to price relationship between each flake size, the +100 Mesh can be used as a reference. The market for +100 Mesh (>150microns) has been on an upward trajectory since early 2020 as Covid created logistical challenges and delayed new project starts, increasing from below $500/tonne in 2019 to over $800/tonne in 2020, and now experiencing some stability at around 1,100$/t FOB China for 94-95%TGC grade (according to reports by Northern Graphite).

Estimated premium/discount for graphite flake sizes comparing with +100 Mesh (>150microns):

The Total Graphitic Carbon Content (TGC%) is another crucial property that defines the final mine product’s value. This is not simply the grade of carbon, which can be present in many different molecular structures; this can be defined as the composition of carbon present in graphite lattice structure. Processing can improve this content, but not entirely and few graphite ore can achieve 99.999TGC% required for the nuclear industry. Industry pricing standards used in the industry tend to be quoted for 94-95%TGC; products receive a premium of around 5% for every %TGC above the threshold, and similar penalty below.

Deleterious minerals (e.g., Boron & Molybdenum) can also be present in graphite ore, which must be pre-stripped before processing and will incur a penalty for the final flake product value. Yield achieved during Spheronization is important to the battery sector as the remaining graphite has little value. This is typically very low, around 40-50%, with graphite flakes receiving a premium if this can be improved. Several factors can affect spheronization yield including bulk density; expansion ratio; ash composition; crystallinity; volatile content; and oxidation resistance.

Africa Projects

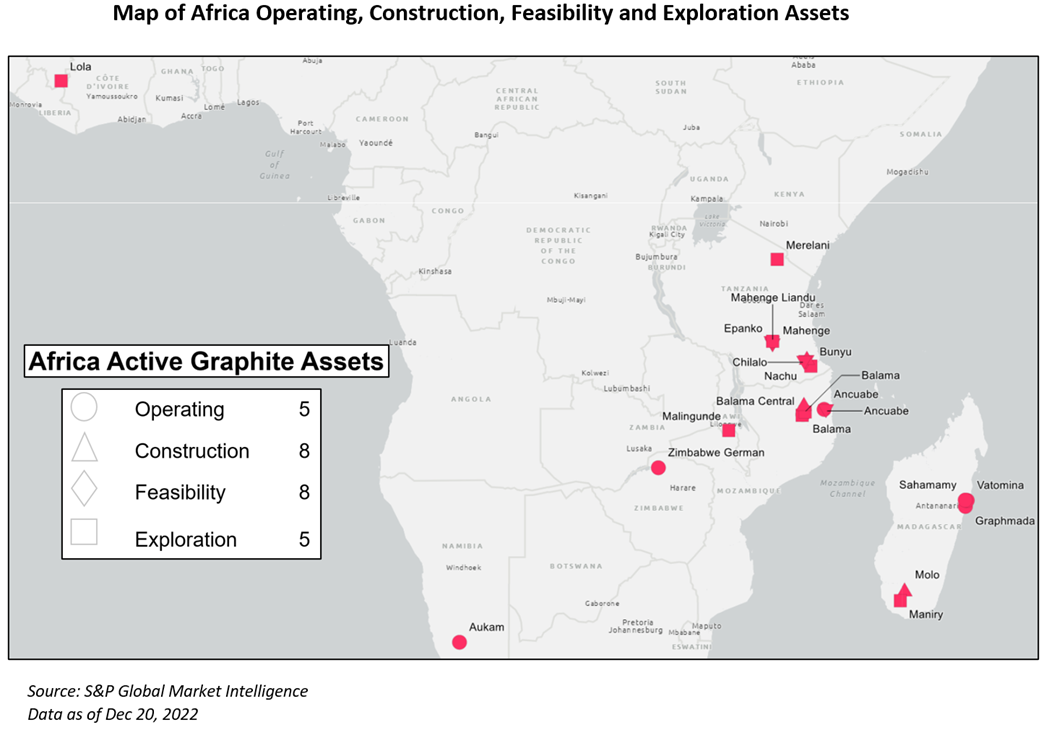

Africa produced around 9% of global graphite fake supply in 2021, with the largest mine (Balama) located in Mozambique owned by Australia based Syrah Resources. When Balama was commissioned back in 2017 the African continent had only a few small operations in Namibia and Madagascar producing less than 10kt/yr (only 1% of global supply). Balama made a big statement for being the largest in the world for graphite reserve tonnage, highest graphite grade and graphite capacity (targeting 313kt/yr). Production quickly passed 100kt in 2018 and 153kt in 2019, but since have struggled. In 2020 Covid related workforce shutdowns forced production down to 12kt. Since then both container shipping disruptions and security concerns after militia attacks in the region forced mine-shutdowns; only 72kt was achieved in 2021 and 128kt so far in the first three quarters of 2022.

Summarizing other notable Africa graphite mines. Aukam in Namibia is one of the oldest, operating in 1940-74 and now owned by Canadian based Gratomic, who anticipate production to re-start in 2023 (22kt/yr capacity). Graphmada in Madagascar is owned by Australia based Greenwing Resources who have the mine on Care & Maintenance for expansion work to complete (40kt/yr capacity). UK based Tirupati Graphite acquired two assets in Madagascar and commissioned their first 3kt/yr plant in 2019, Sahamamy (84kt/yr capacity) & Votamina (60kt/yr capacity).

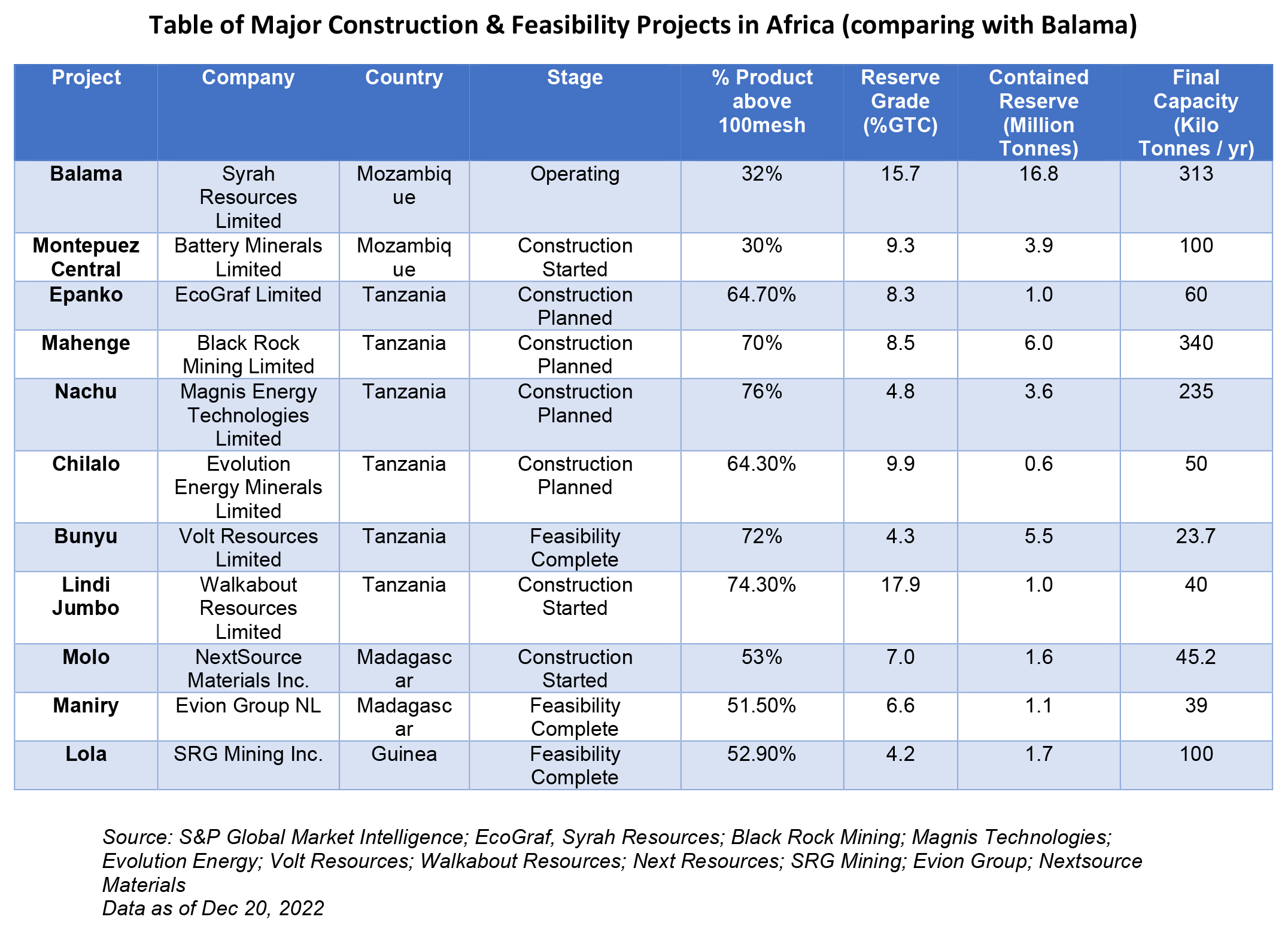

Several projects are going through construction or late-stage feasibility studies and have the potential to lift Africa to pass 26% of global supply by 2026, including six in Tanzania with a total capacity over 450kt/yr. Production cost data is limited but product quality analysis is frequently reported.

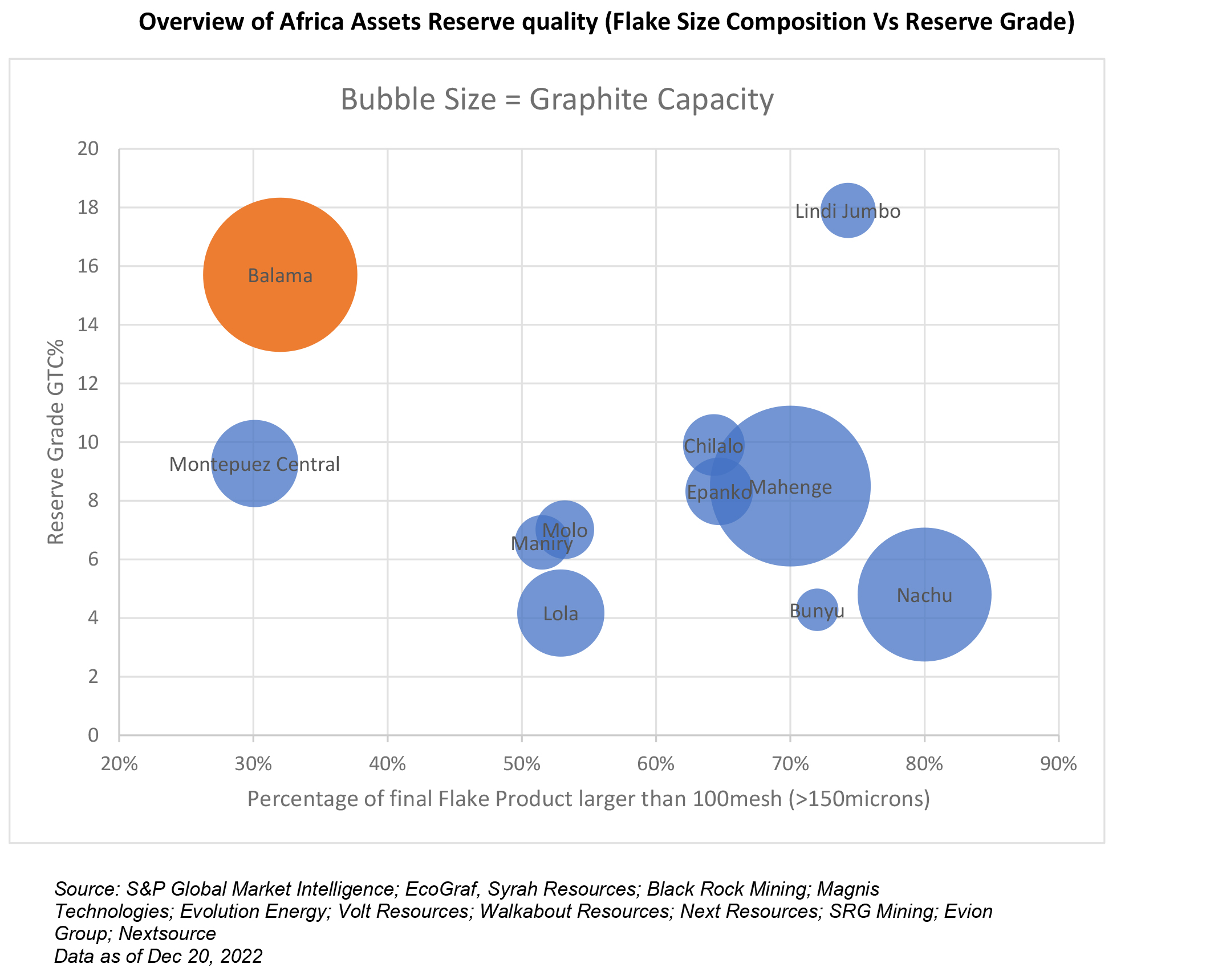

What makes the Tanzanian assets interesting is the percentage of their graphite product over 150microns (+100 Mesh) achieving 70-76%, comparing with 51-53% for most other Africa based projects in this stage, and notably high for the industry. Though this is not the only property to consider, it does indicate these operations should have more success in securing consumers in the high-tech industrial and battery space and command a higher price for a larger volume of production.

Balama has one of the highest Total Graphitic Carbon Reserve Grade than most new Africa projects, achieving over 15%TGC (Africa average: 4.2-9.9%TGC). However, Balama can only achieve 32% of its product over 150microns (+100 Mesh) Flake Size. The high-grade ore helps to keep operating costs low (cash costs reported at 286$/t in their 2015 technical study), however less production volume benefit from the premiums paid for larger graphite flake sizes comparing with most new Africa based projects. Only the Lindi Jumbo project owned by Walkabout exhibit higher Graphitic Carbon Reserve Grade than Balama (17.9%TGC) and an impressive percentage of graphite product over +100 Mesh (over 74%), but with only 40kt/yr capacity it is one of the smaller Africa new projects.

Balama outshines all in terms of Reserve Contained Graphite at 16Mt, with the closest rivals Mahenge owned by Black Rock Mining at 6Mt and Bunyu at 5.5Mt. From a capacity perspective Mahenge planned capacity will surpass Balama, with 340kt/yr. Mahenge also has impressive percentage of graphite product over +100 Mesh (70%). Nachu, owned by Magnis Energy Technologies, has the 2nd largest production capacity in the region, with over 235kt/yr and exhibits the highest percentage of graphite product over +100 Mesh (76%).

The Speronization Yield for each asset’s graphite flake product is not directly compared between projects, nor are the presence of deleterious minerals. Few projects have completed the necessary studies or failed to report publicly. This data is crucial to understand the potential value each asset can generate and comments on reporting projects is summarized in the following section (projects with reporting include: Nachu, Chilalo and Epanko).

Success Beyond Resource Quality

The success of these projects takes more than a quality resource, with proven success for delivering a start-up into production; access to capital through debt/equity; support from strategic investors or partnerships; off-take security and successful proof of anode product quality all needing to align. Debt funding has proven difficult in the past as banks struggle with risk valuation and mitigation of the opaque market, but this is starting to change with critical materials to the battery supply chain identified as key to carbon neutral economies. Managing Director, Andrew Spinks of Kibaran (Ecograf) stated back in 2018 "largely due to the opaqueness of the pricing, and we're very fortunate to have debt financing. In fact, we're the only group to have commercial development bank debt financing avenues available to us." Managing Director, David Christensen of Renascor Resources pointed out in 2019 that financial hurdles were particularly difficult for graphite producers and innovative solutions are needed: "The best of both worlds option is by building one train [plant] then another, getting capital costs down to a more manageable level, but keeping the OPEX advantage,"

Syrah Resources started the Balama project back in 2017 and had already developed a pilot plant the year before, securing off-take agreements for over 50% of their total production with several major players. The world’s largest re-factory producer, Chalieco, signed a 3yr expanding agreement for 80k/yr along with 23-35kt/yr with Hill Carbon and 50kt/yr with Marubeni. Major financial investors included Credit Suisse, Merril Lynch and Macquarie, which helped to raise equity funding needed for pilot plant Capex in 2015/16. The modular expansion approach to production allowed for a lower up-front capital cost to manage the lack of debt funding and achieve expansion with operational cashflows.

Most of the Africa based projects are using a similar blueprint for success with several securing off-take partners. Below summarizes only four of the projects based in Tanzania:

Engineering work at these four Tanzanian projects have also seen heavy investment to demonstrate their product quality for end-user markets, and many have strategic engineering partners well placed to support financing of the projects going forward.

Closing Statement

The above analysis leverages data and analytics from the S&P Global Capital IQ Pro Metals & Mining solution. By using the tools and research available in the platform, we uncover the less well reported battery material, Graphite. Car manufactures rely on a rapid global production growth of Natural Graphite to achieve their aggressive long range EV growth targets. Africa will be the fastest growing region for supply outside of China with several projects with unique resource properties that can deliver high quality graphite to both battery and high-technology industries. A lack of market transparency and supply chain complexity creates considerable risk that inhibit funding for project developers who already struggle with regional risk factors. These barriers must be overcome in order to deliver sufficient production to meet the growing sustainable global economy.

Successful criteria for graphite projects sought by investors that developers must address:

Campaign