S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Sep, 2018

Insurance

By Tim Zawacki

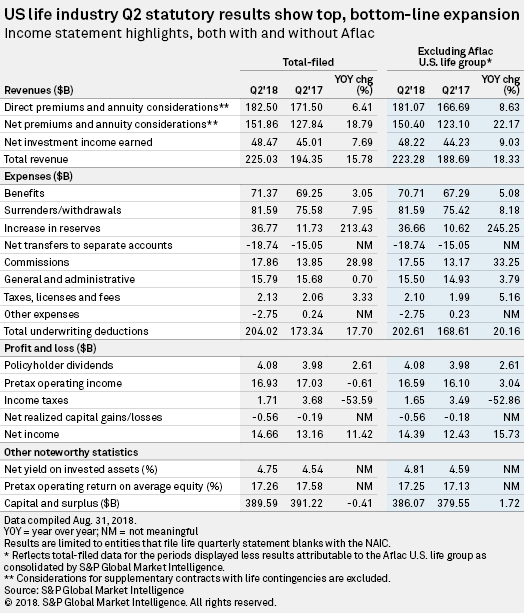

A shift of Japanese business out of a U.S. life and health company has again had a dramatic, if illusory, impact on the industry's statutory results.

Six years after MetLife Inc. transferred business from the Japan branch of American Life Insurance Co. (DE)outside of the scope of U.S. statutory data to a Japan-based affiliate, Aflac Inc. completed the conversion of the Japan branch of American Family Life Assurance Co. of Columbus (Aflac) into a Japanese corporation.

U.S. life industry capital and surplus had increased on a year-over-year basis for 35 consecutive quarters entering the three-month period ended June 30, but Aflac's accounting for the conversion puts that nearly nine-year streak under threat. American Family Life Assurance paid an extraordinary dividend to its parent of just over $11 billion. That value that reflects the statutory book value of two Aflac companies, contributing to an $8.14 billion year-over-year decline in capital and surplus for Aflac's remaining U.S. life and health subsidiaries. In addition to the Aflac Japan conversion, the predecessor of American Family Life Assurance Co. of Columbus and Aflac Reinsurance Co. merged during the second quarter.

S&P Global Market Intelligence calculated U.S. life industry capital and surplus of $389.59 billion as of June 30, down 0.4% from the same date in 2017, based on data compiled through Aug. 31 and subject to change. The exclusion of the effects of the Aflac extraordinary dividend, however, would have resulted in the sort of low-single-digit percentage increase that the industry experienced in the fourth quarter of 2017 and first quarter of 2018.

U.S. life industry net income of $14.66 billion in the second quarter marked a year-over-year increase of 11.4% and would have otherwise paved the way for higher capital and surplus. Though pretax operating income fell by 0.6% to $16.93 billion for the period, sharply lower federal and foreign income taxes in the second full quarter since the implementation of a lower U.S. corporate tax rate provided a boost. Pretax operating income and net income would have increased by 3% and 15.7%, respectively, when excluding the Aflac U.S. life group.

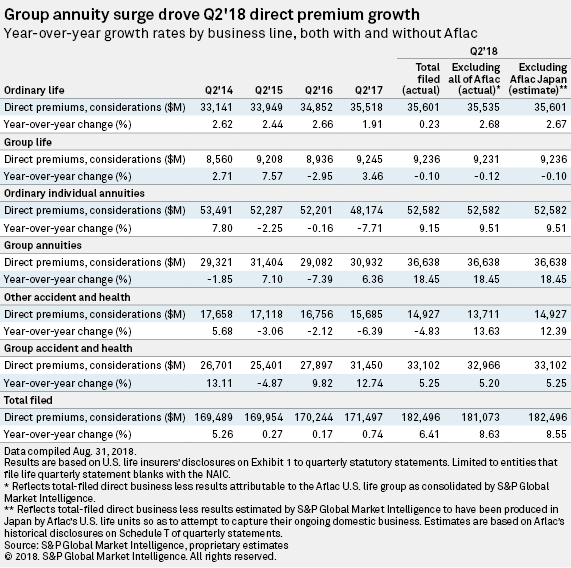

Annuity acceleration boosts direct business

The effects of the conversion extend well beyond statutory equity, among other things creating a drag for the industry in year-over-year growth in ordinary life, ordinary individual annuities and other accident and health direct premiums and considerations.

In other accident and health, which had been Aflac's largest single line of business on a pre-conversion basis, the industry's total-filed direct premiums plunged 4.8% year over year in the second quarter. But S&P Global Market Intelligence estimates that the industry would have achieved growth on a normalized basis of approximately 12.4% using Aflac's second-quarter 2018 production as a historical run-rate — a swing of 17.2 percentage points.

The impact was far less dramatic elsewhere, but still noteworthy. In ordinary life, S&P Global Market Intelligence estimates that the industry's premiums would have expanded by nearly 2.7% on a year-over-year basis in the second quarter when making similar adjustments to historical results for the effects of the Aflac conversion. On a total-filed, unadjusted basis, the rate of increase was a meager 0.2%, which marks the industry's worst result in two-and-a-half years.

Aflac-related drag did not serve to dampen enthusiasm about the quarter's ordinary individual annuity direct premiums and considerations trend. They expanded by nearly 9.2% on a total-filed basis and by an S&P Global Market Intelligence-estimated 9.5% when adjusting Aflac's historical results to account for the loss of the Japanese business. In either case, the growth rate was the strongest for the business line since the first quarter of 2016.

S&P Global Market Intelligence's 2018 U.S. life and annuity outlook anticipated favorable growth rates in ordinary individual annuity direct premiums and considerations due to greater regulatory clarity about distribution practices and easy comparisons from the depressed business volumes the industry achieved in the middle part of 2017. The industry's direct premium volume of $52.58 billion in the second quarter marked the first result exceeding $50 billion in eight quarters. On a trailing-12-month basis, ordinary individual annuity direct premiums and considerations remained down slightly year-over-year both on total-filed and estimated bases, highlighting the depths to which the industry's volumes sunk particularly in the third quarter of 2017.

Aflac had no impact on group annuity results, but direct premiums and considerations in that line were historically significant nevertheless. Growth of 18.4% marked the industry's most rapid rate of expansion since the third quarter of 2015, and it largely reflected the lift provided by a pension benefit transfer deal involving Metropolitan Life Insurance Co. The company said in May that it had been selected by FedEx Corp. to provide annuity benefits to approximately 41,000 retirees and beneficiaries, representing pension obligations of approximately $6 billion.

The MetLife unit's $7.64 billion in group annuity direct premiums and considerations exceeded its volume in the previous three quarters, combined; it was the largest amount of group annuity business reported by an individual U.S. life entity in any quarter since Prudential Financial Inc. landed mega-deals in the pension benefit transfer space with General Motors Co. and Verizon Communications Inc. in 2012.

All told, total-filed direct premiums and considerations increased across all applicable business lines by 6.4% in the second quarter. Even with the drag associated with the Aflac Japan conversion, that growth rate was the highest the industry has generated since the pension-related boost to Prudential's group annuity business triggered a 23.3% expansion rate in the fourth quarter of 2012. S&P Global Market Intelligence estimates growth of 8.6% when excluding past production attributed to Aflac Japan.

Deals impact net growth

Growth in net premiums and considerations of 18.8% for the second quarter appeared particularly impressive at first glance. But a closer look finds that a series of reinsurance transactions in the year-earlier period resulted in several large negative entries for that income statement line item, in turn creating an artificially low base off of which the expansion occurred.

Aegon NV's divestiture of its U.S. runoff payout annuities, bank-owned life insurance and corporate-owned life insurance businesses through a reinsurance deal with Wilton Re Ltd. and a reinsurance transaction involving affiliates of Global Atlantic Financial Group Ltd. resulted in the movement of large pieces of business outside of the scope of U.S. statutory data. Net premiums and considerations at the industry level would have been down by 1.6% in the quarter when excluding Aegon's Transamerica life group and Global Atlantic from the totals for the second quarters of 2017 and 2018.

A series of more recent deals resulted in even larger negative sums of net premiums and considerations for two U.S. life companies in the second quarter of 2018: Liberty Mutual Holding Co. Inc.'s sale of Liberty Life Assurance Co. of Boston and Voya Financial Inc.'s divestiture of its closed block variable annuity business to the Apollo Global Management LLC-backed Venerable Holdings Inc. The combination of Liberty Life and Voya Insurance and Annuity Co. combined to generate net premiums and considerations of a negative $29.53 billion in the second quarter as compared with a positive result of $1.19 billion in the year-earlier period.

Though Lincoln National Corp. acquired Liberty Life, the transaction involved the reinsurance of the target's individual life and annuity business to Protective Life Corp. The Protective Life group as consolidated by S&P Global Market Intelligence had net premiums and considerations of $14.45 billion in the second quarter, multiples of the $798.1 milllion the group generated in the year-earlier period.

The U.S. life units of Athene Holding Ltd., meanwhile, produced net premiums and considerations of $4.11 billion, more than 10x their result for the second quarter of 2017, in part reflecting the role of Athene Annuity & Life Assurance Co. as a reinsurer of a portion of Voya Insurance and Annuity's pre-June 1 fixed annuity business.

Reinsurance transactions involving U.S. and non-U.S. entities have had significant effects on life industry statutory results in recent years, and the aforementioned transactions suggest that 2018 will be no different. Transfers such as the one recently completed by Aflac, however, remain extraordinary in both their magnitude and frequency.

Event