Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 28 Jan, 2022

By Guillermo Ruiz-Rico

The first month of 2022 registered violent swings for most securities in the US and showed a continuation of a downward trajectory that was initiated upon reaching new highs in various indices – Nasdaq 100 (mid-November 2021), (S&P 500, early January 2022). These were likely caused by the general public’s perception on increased inflationary pressures no longer being transitory, and the ramifications of such a shift in matters of monetary policy.

The Alpha Factor Library (AFL), allows users to easily identify market shifts leveraging a factor-based approach. At the very top of this approach, there are 8 different factor styles: Price Momentum, Historical Growth, Analyst Expectations, Earnings Quality, Valuation, Capital Efficiency, Size, Volatility. (These links are accessible by clients only. If you are not a current client and would like to request a demo, please click here.) These factors are then utilized to rank equities based on each of their score to then bucket them into 5 equally weighted/market capitalization weighted quintiles.

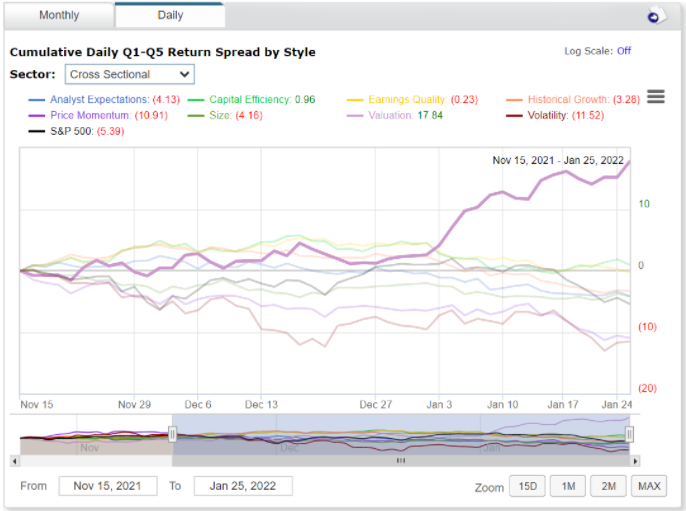

Upon examination of the daily returns for the S&P 500 (since mid-November 2021 which coincided with Nasdaq's 100 peak), it can be clearly observed the outperformance of the Valuation style at a sector neutral, equally weighted, long-short basis in the last months.

Source: S&P Global Market Intelligence as of January 26th, 2022. Charts are for illustrative purposes only.

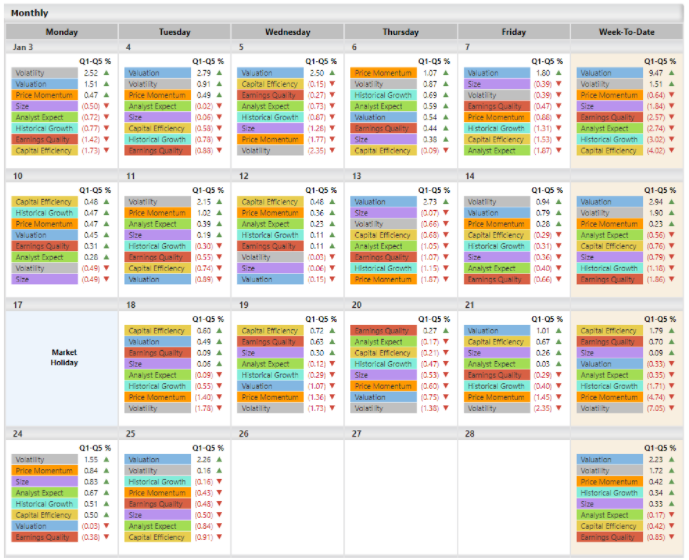

Said outperformance is also quite apparent when inspecting the top ranked return spreads for the latest monthly quant calendar for the S&P 500 – Valuation often showing at the top.

Source: S&P Global Market Intelligence as of January 26th, 2022. Charts are for illustrative purposes only.

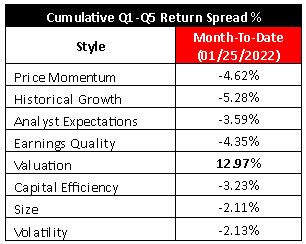

Moreover, while the Valuation style factor has recorded high positive cumulative returns in the month-to-date calculations, all other factor styles have showed negative ones. This is easily visible in the Market Snapshot section.

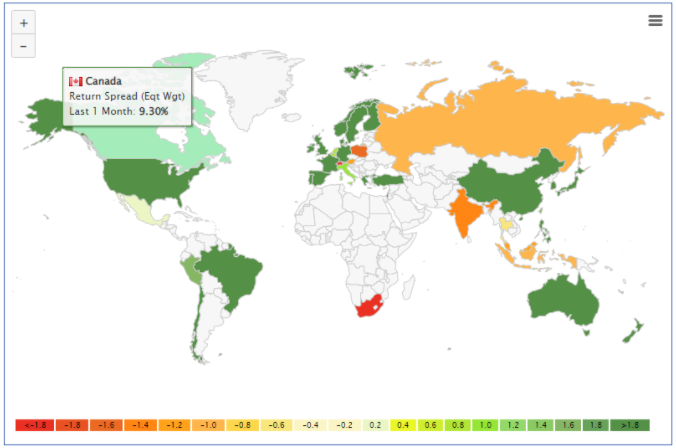

A similar trend for the Valuation factor style can also be observed in other global equity markets by leveraging the Country Monitor section for the last month, e.g. Canada’s overall equity market recorded the highest return spread for the Valuation factor of all monitored countries.

Source: S&P Global Market Intelligence as of January 26th, 2022. Charts are for illustrative purposes only.

The Valuation style factor is an equal weighted combination of six representative factors used to assess a firm’s intrinsic value based on various aspects, such as earnings (Ball and Brown 1978), assets (Fama and French 1993, 2008), cash flows (Tortoriello 2009), and others.

Out of the six factors, the one that has so far recorded the highest month-to-date return is the Dividends to Price ratio (same universe, ranking order and sector neutrality being applied).

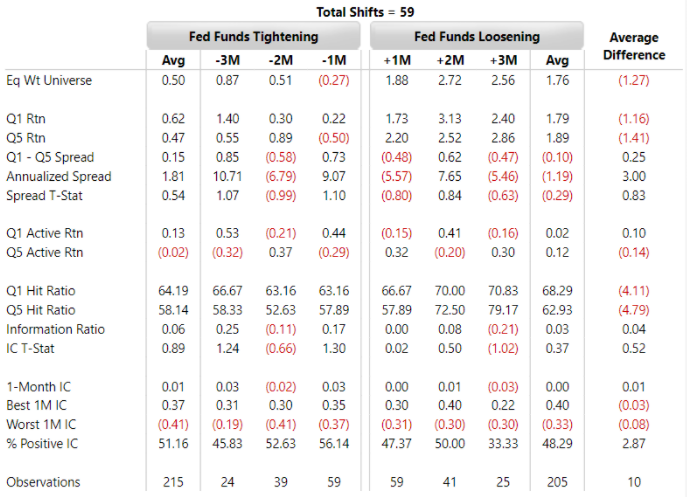

Zooming in on the dividends-to-price factor in the context of upcoming monetary policy shifts, it is of interest the behavior of this factor in the months prior to monetary policy tightening.

Source: S&P Global Market Intelligence as of January 26th, 2022. Charts are for illustrative purposes only.

While unintuitive at first, given the current context where global economies are still in recovery mode from the 2020 pandemic, it does make economic sense that this factor tends to record higher returns after loosening monetary policies are implemented, as they often take place in response to recessionary periods. During recessions, safer and more predictable investments are usually prioritized, high-dividend-yield securities being a usual destination for investors.

The fact that inflation is currently perceived as untamed by the public, coupled with over a decade of accommodating monetary policy, may explain the recent outperformance deviating from the expected behavior. Specifically, the market seems to signal a willingness to address inflation by rotating into value (anticipating much needed future dividend increases), while also exiting high growth dividendless stocks (now deteriorating due to smaller discounted cash flows) and awaiting appropriate measures by the central banks.

To actionalize these insights, readers may leverage the daily report section to obtain a daily score-ranked list of securities based on their dividends-to-price factor values for the universe of choice.

Please reach out to us if you have any questions and we can navigate you through our AFL or PA solutions specific to your region or mandate.

Summary:

Research

Research