Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 15 May, 2023

By Tim Zawacki

The increased use of reinsurance by US life insurers and annuity providers seeking enhanced capital efficiency continued unabated in 2022, even as volatile financial markets changed the economics associated with the kinds of arrangements that dominated the landscape in prior years.

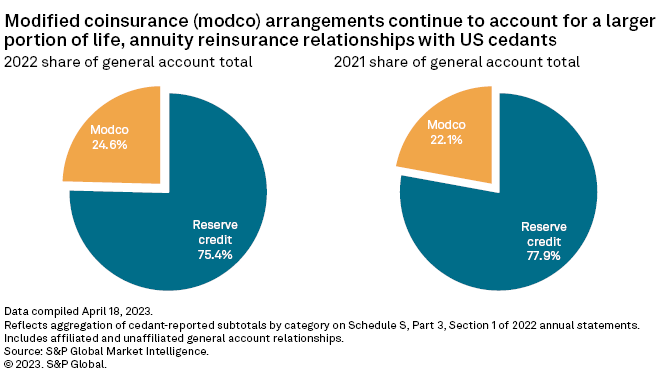

Amid a convergence of supply and demand for capital solutions for in-force life and annuity business, the ratio of ceded to gross life and annuity reserves increased to a new high of 28.8% at the end of 2022. This ratio is a measure of the prevalence of relationships between US-domiciled cedants that file annual statements with the National Association of Insurance Commissioners and the various captive and offshore reinsurers that do not. It has more than tripled over the past 20 years, up from a previous peak of just about 27.0% on a year-over-year basis.

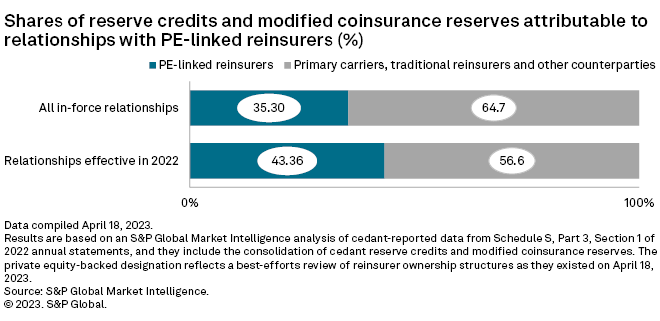

Private equity-backed reinsurers continued to make their mark in the business, accounting for 43.3% of the aggregate reserve credits and modified coinsurance reserves on life and annuity business associated with relationships that took effect in 2022, according to an S&P Global Market Intelligence analysis of individual relationships. These reinsurers accounted for 35.3% of all of the cedant life and annuity reserve credits and modified coinsurance reserves associated with reinsurance arrangements that were in effect at year's end. This occurred even as higher interest rates led to a change in the economics associated with forming new relationships.

Primary carriers increased their use of affiliated offshore reinsurers and, in select cases, entered sizable new relationships with traditional reinsurers. Even though higher interest rates and resulting improvements in yields on fixed-income securities and other investments may reduce some carriers' urgency to enter new reinsurance relationships, the nature of activity during the second half of 2022 suggests they remain motivated to reduce certain balance sheet risks and boost capital efficiency under the right circumstances with a range of counterparties.

Key unaffiliated reinsurance deals

Some of the largest unaffiliated reinsurance relationships that took effect in 2022 show the diversity of counterparties, structures and underlying liabilities that have fueled the industry's overall utilization of risk-transfer solutions. They also highlight life reinsurance's many purposes, including increased capital efficiency, a means of executing acquisitions and reducing risks from interest rates and equity markets.

With little fanfare, Great-West Lifeco Inc.'s Empower subsidiaries engaged in a series of large reinsurance transactions with Hannover Re at the end of 2022. The transactions, which encompassed a range of liabilities that include certain reserves Empower amassed through its April 2022 acquisition of Prudential Financial Inc.'s full-service retirement business, involved total cedant reserve credits of $6.12 billion and modified coinsurance reserves of $20.17 billion.

When asked about the reinsurance transactions during a Feb. 9 conference call, Great-West Executive Vice President and CFO Garry MacNicholas said they were primarily a means of capital relief for his company's US subsidiaries.

Great-West executed the transaction through Prudential's sale of the legal entity now known as Empower Annuity Insurance Co. and a reinsurance relationship that encompassed a total cedant reserve credit of $8.20 billion and modified coinsurance reserves of $1.86 billion across multiple entities. Its arrangement with Massachusetts Mutual Life Insurance Co., which was how Great-West executed its January 2021 acquisition of that entity's retirement services business, ranks as the US life industry's largest unaffiliated reinsurance relationship based on the combination of a $17.27 billion reserve credit and $49.07 billion in modified coinsurance reserves, including both general and separate accounts liabilities.

Expansion of the Sixth Street Partners LLC-backed Talcott Financial Group accelerated in 2022, highlighted by arguably the most notable transaction of the year.

Principal Financial Group Inc. reported a reserve credit of $12.44 billion associated with fixed annuity business ceded to Talcott Life & Annuity Re Ltd. Another $9.91 billion in reserves for secondary guarantee universal life business were retroceded to a Talcott reinsurer through a Principal Vermont captive. Later in 2022, Talcott announced the reinsurance of legacy Guardian Insurance & Annuity Co. Inc. variable annuities in a transaction with an associated $6.68 billion in modified coinsurance reserves.

Both cedants indicated in their respective annual reports that the deals allowed them to redeploy capital to growth opportunities.

Other transactions involving $10 billion or more in cedant reserve credits and/or modified coinsurance reserves effective in 2022 included two legacy variable annuity blocks: one involving reinsurer Corporate Solutions Life Reinsurance Co., a subsidiary of the Apollo Global Management Inc.-backed Venerable Holdings Inc., and cedant John Hancock Life Insurance Co. (USA), and the other through which Standard Insurance Co. executed its acquisition of the recordkeeping business of Securian Financial Group Inc.'s Minnesota Life Insurance Co.

Offshore affiliates flourish

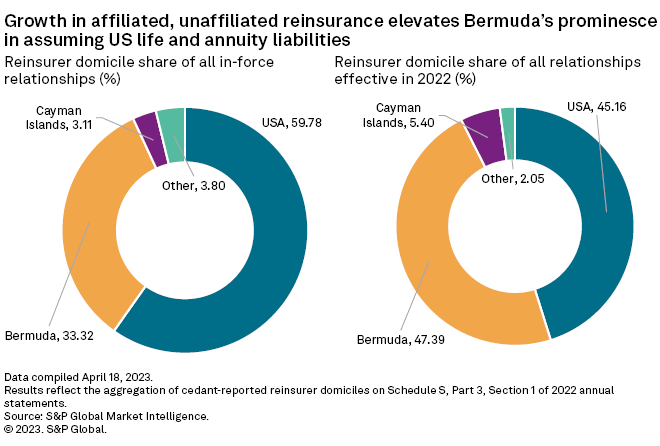

Life and annuity companies increasingly opted for offshore affiliates to assume certain blocks of business in 2022. And with life and annuity companies figuring prominently in a historically active year for new Bermuda Monetary Authority insurer and reinsurer registrations, the stage is set for a continued expansion of their use.

Our analysis of annual statement data finds that the combined amount of cedant general account reserve credits and modified coinsurance reserves associated with non-US, noncaptive affiliated reinsurance relationships surged 29.2% in 2022 to $390.88 billion. Of that amount, $86.80 billion pertained to relationships that took effect in 2022.

Most prominent among the new relationships was the launch of Martello Re Ltd. by MassMutual to assume the annuity business the insurer acquired from American Financial Group Inc. All told, MassMutual companies claimed a total reserve credit of $16.37 billion for business ceded to Martello Re. As MassMutual maintains a noncontrolling interest in Martello Re, which also attracted investment from a consortium of investors that included Centerbridge Partners LP, the company classified the relationship as affiliated.

An even larger series of affiliated transactions involved the domestic life subsidiaries of Prudential Financial Inc. and Lotus Reinsurance Co. Ltd., a Class E Bermuda reinsurer established in 2021. Prudential companies reported a combination of reserve credits and modified coinsurance reserves of $24.40 billion, mostly associated with variable life business.

Kemper Corp. and Symetra Financial Corp. launched new Bermuda subsidiaries in 2022, which subsequently reinsured billions of dollars worth of business from their domestic affiliates. Other domestic cedants, particularly subsidiaries of Sammons Enterprises Inc., Protective Life Corp. and The Ohio National Life Insurance Co., reported substantial growth in the size of existing relationships with their Bermuda affiliates.

Outlook

Bermuda reinsurers may be poised for further expansion in 2023 after accounting for 47.4% of the life and annuity reserve credits and modified coinsurance reserves for US cedants in relationships that took effect in 2022.

Growth of existing relationships, the entry of new arrangements and the launch of new market participants may all contribute. In March, for example, MetLife Reinsurance Co. of Hamilton Ltd. registered with the Bermuda Monetary Authority as a Class E reinsurer. MetLife, Inc.'s existing Bermuda-domiciled reinsurance subsidiary assumes certain variable annuity business that had been issued by a former affiliate.

Bermuda reinsurers are poised to expand their role on the global stage through multiple block-and-flow transactions with life insurers in Japan and other Asian domiciles, reflecting the combination of opportunities that exist in those markets and the dwindling supply of the most desired types of liabilities in the US. The Carlyle Group Inc.'s Fortitude Group Holdings Parent LP, as well as Kuvare Holdings and KKR & Co. Inc.'s Global Atlantic Financial Group LLC, are among the Bermuda-focused names with recent Asian transactions to their credit.

New private investments in the Bermuda life and annuity reinsurance market continued to emerge in 2022 and could facilitate deal flow in 2023 and beyond. Blackstone Inc. unveiled what it described as a strategic partnership with Resolution Life Group Holdings LP, highlighted by a recently completed $3 billion equity capital raise that included participation from a Blackstone-managed fund and Nippon Life Insurance Co. Aquarian Holdings LLC agreed to take a controlling interest in Somerset Reinsurance Ltd. in a transaction that closed in January. Ares Management Corp. confirmed during an April 28 call that the alternative asset manager continues to raise third-party capital to further scale its affiliated Aspida Holdings Ltd. platform, which includes the Bermuda-based Aspida Life Re Ltd.

Athene Holding Ltd., a leading private equity-backed insurer and reinsurer, said in an April presentation that its Bermuda operations provide an efficient means for raising third-party capital, particularly from non-US investors given the island's lack of a corporate income tax.

Reinsurers may also broaden their product appetite to pursue liabilities such as secondary guarantee universal life business. The continued proliferation of flow agreements could aid in the production of new business. But the deal volumes achieved in each of the last three years set a very high bar that may be difficult to reach under current market conditions.

Methodology

We analyzed life and annuity cedant disclosures on Schedule S, Part 3, Section 1 to generate the relationship and industry aggregates referenced in this article using both as-reported data and relationship mapping conducted by S&P Global Market Intelligence. With the latter approach, we consolidate relationships involving like counterparties where there may be multiple types of insurance being reinsured with distinct effective dates.

Our definition of private equity-backed reinsurers includes entities that are controlled by alternative asset managers and/or funds managed by alternative asset managers. The NAIC and individual state regulators have been considering an expansion of what constitutes control to go beyond a minimum threshold for ownership to include things like board representation and material contractual relationships, but we generally based our selections on the established methodology. Additionally, our selections are based on the reinsurers' current controlling parties and include relationships they entered at earlier dates when under different ownership structures. Most notably, we included Resolution Life as a private equity-linked reinsurer based on its new relationship with Blackstone. The company previously sought to distinguish its structure with private equity-backed competitors.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.