Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 3 Feb, 2021

Introduction

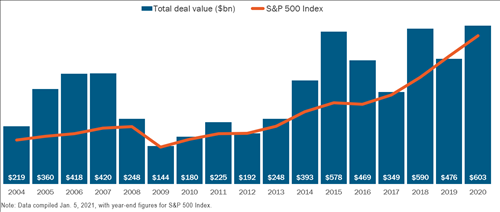

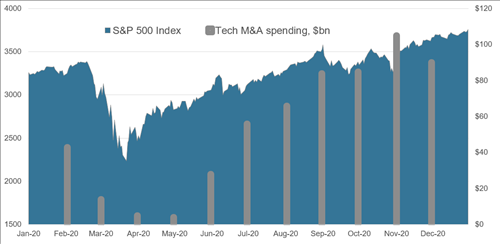

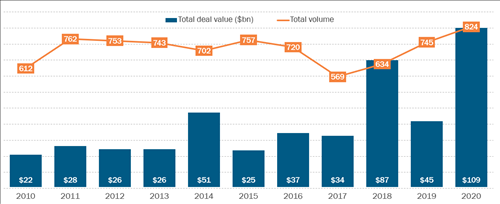

In a year dominated by a global health disaster that no one saw coming, 2020 also notched a record that virtually no one could have predicted: Tech M&A spending last year soared to its highest level since the dot-com collapse. Astonishingly, almost impossibly, the total value of tech and telecom transactions announced around the plague-ravaged world in 2020 topped $600bn, according to 451 Research's M&A KnowledgeBase.

Annual Tech M&A Spending vs. S&P 500 Performance, 2004-20

Source: 451 Research's M&A KnowledgeBase; S&P Global Market Intelligence

Last year's record spending came in more than 25% higher than we recorded for the 'before times' year of 2019 and more than four times the amount spent in the similarly recession-scarred year of 2009, our data shows. Even more, the unprecedented activity played in a historically abrupt boom-bust cycle.

Typically, a recession that triples the US unemployment rate and erases trillions of dollars of economic activity – like we saw in the dark, early days of the pandemic – would linger for years. For example, the M&A KnowledgeBase shows that during the Great Financial Crisis of 2008-09, tech M&A spending didn't regain prerecession levels until 2015.

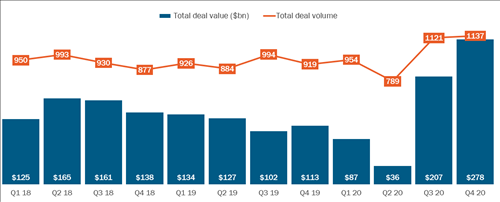

In the case of COVID-19, the slowdown was measured in mere months, rather than years. Already by summer, acquirers' pent-up demand – combined with Wall Street's confidence in the tech sector to thrive, not just survive, during the lockdown – flooded into the tech M&A market:

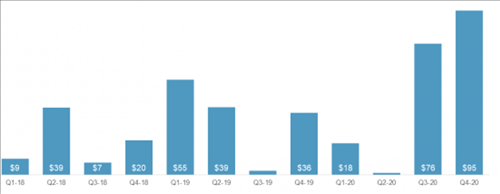

Recent Quarterly Global Tech/Telecom M&A

Source: 451 Research's M&A KnowledgeBase

The against-the-odds recovery in tech M&A even outpaced the stunning bull market rebound on Wall Street. (On a total return basis, the S&P 500 climbed 18% in 2020, led by a 44% gain by the tech names in the benchmark index, according to S&P Global Market Intelligence.) Tech acquirers and investors enjoyed one of the few true 'V-shaped' recoveries in last year's otherwise ruinous pandemic.

Banking on a normalized 2021

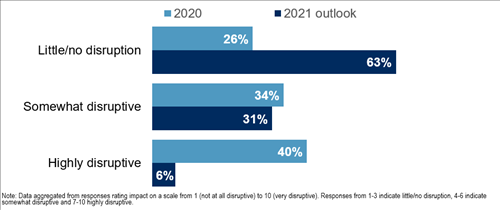

Even as the number of COVID-19 cases spiked late last year, many dealmakers were already putting the pandemic behind them. That certainly came through in the consensus forecast from a special mid-December 451 Research Flash Survey: Coronavirus Impact on Tech Banking, which collected views from some of the industry's busiest bankers. Nearly two-thirds of our survey respondents expect little to no impact from the outbreak on dealmaking this year.

How Disruptive Was COVID-19 to Your Firm's M&A Work in 2020? How Disruptive Will It Be in 2021?

Source: 451 Research Flash Survey: Coronavirus Impact on Tech Banking, December 2020

As they looked ahead, just one in 20 senior investment bankers (6%) said coronavirus would be significantly disruptive to M&A in the coming year. That represents a sharp drop from the 40% who said the outbreak hit their business hard in 2020. (To be clear, the percentages are aggregations of those bankers who rated the disruption at 7 or higher on a scale of 1 (not at all disruptive) to 10 (very disruptive). For the most part, bankers say they see a way to work their way out of the pandemic.

The strongly bullish forecast that bankers gave in our mid-December survey could not have been more at odds with the outlook they gave eight months earlier. In the first edition of our Flash Survey in mid-April, so many transactions had been tabled and pipelines had been hollowed out so much that a bear market for banking for M&A looked inevitable.

Back in April, nearly two-thirds of respondents (63%) to the 451 Research Flash Survey: Technology Investment Banking Outlook said they had less work in their pipeline than they did a year ago. By far, that was the most pessimistic assessment of the tech banking business we've ever received in our 15 years of surveys. In fact, it was pretty much the exact opposite of the view they typically give us, when the vast majority of respondents say they have more deals in the works.

Discretionary purchases

In order to transact, buyers need two things: confidence and cash. (Or, more colloquially, they need the will and the means to do a deal.) Both of those indispensable commodities, much like toilet paper and bleach, were nearly impossible to find in March and April.

As the pandemic ripped around the globe last spring, the modern workaday world went into lockdown. Businesses shuttered, restaurants emptied and travel ceased. The COVID-19 crisis broadened and deepened as the opening months of the new decade went along, infecting hundreds of thousands of people and stifling trillions of dollars of economic activity around the globe.

Coronavirus, which first emerged in China in late December but only really got recognized in the West in February, started as an alarming public health concern and has subsequently metastasized into a dire threat to economic health. The outbreak ended Wall Street's longest-running bull market, plunged the credit market into a quarantine of its own, and basically wiped out a decade's worth of growth in the tech M&A market.

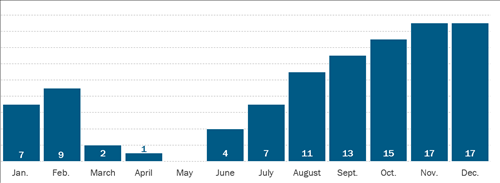

Yet, almost as quickly as COVID-19 swept in and decimated dealmaking last spring, buyers got back to work. (Doing so over Zoom, forgoing the travel and in-person meetings that were once considered an indispensable part of transactions.) After Q2's 'corona-quarter,' the substantial M&A backlog flooded into the market in the back half of the year, pushing acquisition spending to the highest-ever level in the M&A KnowledgeBase for back-to-back quarters. Starting in summer, tech acquirers shopped as if the pandemic were over.

Number of Monthly Tech Transactions Valued at $1bn+, 2020

Source: 451 Research's M&A KnowledgeBase

Our data shows a staggering $485bn worth of spending on tech and telecom acquisitions in aggregate for the final two quarters of 2020. That shopping spree pushed the value of deals announced in just the final half of last year higher than the full-year totals for every year except two since 2002, according to the M&A KnowledgeBase. Astonishingly, the tech M&A market exited the plague-ravaged year of 2020 at a trillion-dollar run rate.

The second half of 2020 marked a record level of spending as increasingly confident acquirers started signing off on ever-larger tech purchases. Tech vendors announced multibillion-dollar deals that would have been unimaginable just a few months earlier. Among the highlights: Salesforce nearly doubled the size of its largest acquisition, chipmakers AMD and NVIDIA both announced transactions valued at over $30bn, and Teledoc shattered records in the suddenly relevant e-healthcare market. (See section below for more on the shift in M&A strategies at many of the biggest-name tech companies.)

Change accelerated

One of the favorite observations that echoed around the tech industry in 2020 was that the pandemic accelerated changes that companies had been considering, pulling forward years of transformation into mere months. That sunny-sided assessment was typically used by tech titans when talking about the 'digital transformation' programs among their customers. But these executives could have just as well been speaking about M&A programs at their own companies.

As we have noted, once the initial shock of the outbreak passed, tech acquirers more than made up for lost time. They doled out almost a full year's worth of M&A consideration in just the final six months of 2020. But why? What made tech vendors shop at a record rate even as the economy around them plummeted to its lowest level since the Great Depression?

Much of the answer lies in the tech industry itself – both in terms of its irrepressibly up-and-to-the-right mindset as well as its self-assured place in the broader economy. This idea of 'tech-ceptionalism' was reinforced by soaring stock prices for a large number of Silicon Valley standouts. (According to S&P Global Market Intelligence, tech stock in the S&P 500 Index last year gained more than any other sector, soaring twice as high as the benchmark index's overall return.)

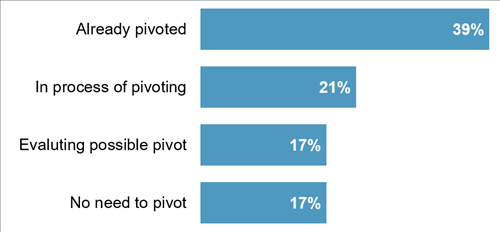

Changes in Business Strategy Due To COVID-19

Source: 451 Research Voice of Customer; Macroeconomic Outlook, Impact of COVID-19, August 2020

To stay open – even a little bit – during the pandemic, pretty much every company had to change the way they went about their business. Restaurants built al fresco dining areas, retailers moved their stores online, and movie studios bypassed closed theaters to take releases straight to homes. It was a Darwinian event for most participants in the global economy.

And yet, coronavirus didn't hit the tech industry nearly as hard as other industries, where unemployment rates tripled or quadrupled from prerecession levels. Bits and bytes lend themselves to the distributed production and consumption in a way that boxes and burritos don't. Or put another way: Doing business digitally brings a huge advantage when much of the physical world can't do business at all.

In addition, philosophically, the tech industry tends to view disruption as, if not a desirable state, at least a potentially profitable one. Whether adapting to a new computing architecture (mainframe to client-server to cloud) or rewriting code to get into new markets, many in Silicon Valley tend to view disruption as an opportunity rather than a threat in their own internal SWOT analysis. And, by many measures, COVID-19 stands as the single largest economic disruption in a century.

All that is to say, the tech industry had the overwhelming good fortune to make it through the painful pandemic largely unscathed. The few adaptations that were required of digital businesses could mostly be addressed in-house (or, more accurately, at home, as tech workers moved their offices to basements, living rooms or even second houses as they picked back up the work during lockdown).

Once those smaller 'organic' changes addressed the immediate challenges brought about by the outbreak, tech vendors shifted their thinking to larger 'inorganic' changes. Strategies evolved from not just making it through the pandemic but coming out ahead. Increasingly, for the tech industry – a very small and incredibly lucky segment of the economy that had both the will and the means to do deals – that meant going shopping.

A new way to do business

None of that is to minimize the devastating impact that coronavirus had in 2020 and continues to have around the world. Not even the lightly roughed-up tech industry had fully made it to 'after times' by the start of 2021 (both economists and epidemiologists would remind us that 'recovery' does not equal 'recovered').

Even as coronavirus vaccines are distributed more widely and the broader economy edges back into health, the lockdown is still forcing companies to change how they do business. It's a bit like the virus itself. Although the immune system may have dealt with the immediate infection, there are often lingering symptoms that can deeply affect the underlying body. The same phenomenon is starting to be seen in the bodies of tech providers, particularly as it relates to their lifeblood: sales.

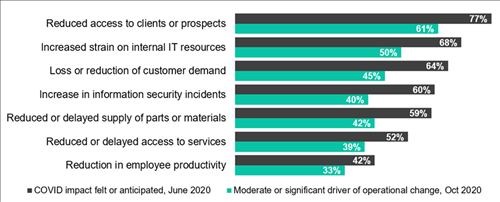

In a 451 Research survey in October, several hundred IT professionals indicated that two of the three most significant changes they have felt at their organizations from COVID-19 concerned sales. Respondents ranked sales ahead of other crucial areas of their business that have also been reshaped by the pandemic, such as more security incidents, supply chain snags, or even drops in employee productivity.

COVID-19 Impacts and Drivers of Organizational Change

Source: 451 Research's Voice of the Enterprise: Digital Pulse, Coronavirus Flash Survey June & October 2020

Specifically, when asked what operational changes their company had made due to the pandemic, more than six of 10 respondents (61%) said 'reduced access to clients/prospects' has altered the way they do business. That was the top change noted in 451 Research's Voice of the Enterprise: Digital Pulse, Coronavirus Flash Survey, October 2020. Another 45% said 'loss of customer demand,' which ranked as the third-most-cited response.

Overall, our survey captures a high level of adaptability, or to use the favored term in the tech industry, the ability to pivot to get through the pandemic. There was no 'business as usual' – instead, tech vendors had to change the way they did business.

M&A fits that shift in mindset, which is one of the key reasons why so many tech firms did so many big deals in 2020. An acquisition, necessarily, brings operational change. New products, new markets, new channels and a new way of doing business – exactly what tech companies told us in our survey that COVID-19 was forcing them to do anyway.

Trouble on the top line

Expanding a bit on the key finding from the hundreds of respondents from the IT industry to our COVID-19 Flash Surveys is the fact that – more than any other single aspect of business – the outbreak disrupted sales. Whether it was trying to prospect over Zoom or close deals without a handshake, the sales process became a bit of an unknown.

As one stark indicator of this uncertainty caused by the pandemic, consider this: The word 'unprecedented' appeared in more than 515,000 presentations to Wall Street by US public companies in 2020, according to a transcript search on S&P Global Market Intelligence.

Monthly Tech M&A Spending vs. S&P 500 Performance, 2020

Source: 451 Research's M&A KnowledgeBase; S&P Global Market Intelligence

Whatever changes the suppliers in the tech industry are going through because of the 'unprecedented' outbreak, there are already signs from the other side of the sales process that demand won't necessarily be picking back up in the coming year. (And, we would note, that's despite the prevailing forecast for a sharp economic upturn in the coming year. Most economists, including the US Federal Reserve, expect the GDP in the US to increase roughly 4% in 2021.)

For instance, a December survey of about 500 technology decision-makers by 451 Research's Voice of the Customer: Macroeconomic Outlook, Corporate IT Spending indicated that IT budgets are relatively tight for the next few months. More than one in five respondents (22%) reported that they had less money to spend on technology products and services in the first half of 2021 than they spent in the back half of 2020. That slightly topped the 18% who said they had more money.

Put it all together and there's a lackluster outlook for sales in the richly valued tech industry during this once-in-a-century pandemic: Vendors are struggling to do business with customers who, in turn, aren't planning to bump up their spending in any case. That's a key concern for any business, since revenue keeps companies alive. But any top-line trouble could prove particularly acute for a vendor in the tech industry, which enjoys outsized valuations mostly because it outgrows virtually every other industry.

Finally, relating that back to M&A, it's not too much of a stretch to see how any tech company might be worried that the disruption brought by COVID-19 to both the supply and demand side could weigh on their top line. And that, if they had those concerns, they might have looked to inorganic growth to make up for any possible slowdown in organic growth. M&A strategy is shaped by market reality, after all.

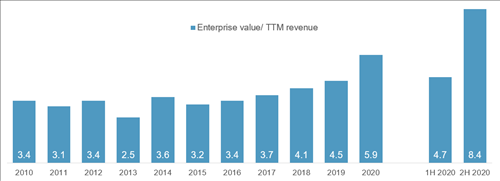

Big caps do big deals

We're devoting so much attention to the strategy shifts at corporate acquirers because that change, particularly in the second half of last year, drove tech M&A spending to record levels. Publicly traded companies – the names that had set the tone in the overall market for years – spent like never before:

Median Valuation for $1bn+ Tech Transactions, 2010-20

Source: 451 Research's M&A KnowledgeBase

At the risk of oversimplifying an M&A process that can play out over months and involve a dozen or more parties, we can nonetheless see a fairly direct link in the strategy of a tech provider between the need to change their business due to COVID-19 and the willingness to make at least some of those changes via acquisition. Consider how companies went about adapting their business in terms of sales, which they told us in our surveys was the single most important step they took to get through the lockdown.

Companies' products and processes got a top-to-bottom review, both in terms of the current pandemic and the market afterward. Perhaps inevitably, this analysis revealed inefficiencies, mismatches and outright gaps in their strategy. Their verdict: What tech vendors had would not get them where they wanted to be in the uncharted world of coronavirus. Done right, acquisitions can fill in some of the corporate shortcomings, getting companies further and faster than they would have gotten on their own.

Dealing from strength

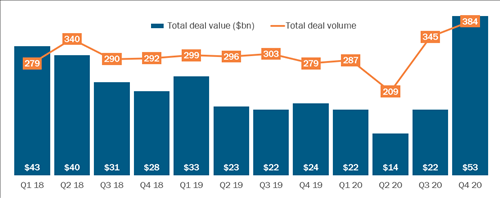

Tech providers were also aided and abetted in their M&A spree last year by Wall Street. Record stock prices for most of the big names in the industry helped move deals along by supplying both the confidence and currency to get them done. Remember, as we noted earlier, the two requisite components for successfully consummating any transaction: the will and the means. Businesses have to want to buy something and they have to be willing to pay for that something.

Annual $1bn+ Transactions, by Buyer Type

Source: 451 Research's M&A KnowledgeBase

In 2020, as tech stocks soared past other sectors during the rebound, both M&A currency and M&A confidence climbed to all-time highs. Investors shifted their money into the one area that they thought would grow through the pandemic. (That was true even as the recipients of that benevolence didn't return the favor by revealing what that growth rate would be. A record number of companies, in tech and the broader economy, withdrew their financial guidance because of, you guessed it, last year's 'unprecedented' conditions.)

Rising stock prices reinforce the idea that companies have the correct strategy in place. That positive feedback from the market makes them more ready to place big M&A bets. (We look at some of those specific wagers below.) Of course, the converse is also true:

Recently Quarterly Amount of Stock ($bn) Spent by Nasdaq- and NYSE-listed Companies on Tech Targets

Source: 451 Research's M&A KnowledgeBase

With tech stocks soaring last year, executives felt encouraged by investors to go shopping. (Tech's rampaging bull market, which carried it far higher than any other sector, is yet another source of the 'tech-ceptionalism' we noted earlier.) Executives found that Wall Street's bullishness had a more tangible impact on dealmaking, as well. Richly valued shares go a lot further as an acquisition currency. The M&A KnowledgeBase indicates that during the final two quarters of 2020, publicly traded tech buyers doled out far more shares to cover their transactions than any other quarter since 2002.

The pandemic's primary prints

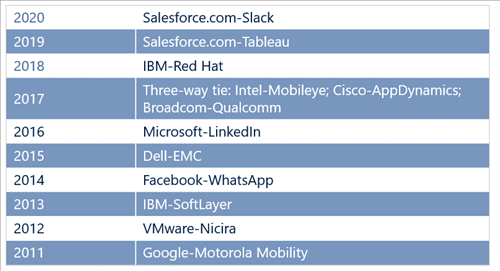

The interrelated trends of using highly valued stock to cover a big-ticket acquisition that got accelerated by coronavirus came together in last year's marquee transaction, Salesforce's $28.4bn purchase of Slack. In a 451 Research survey, senior investment bankers awarded that deal the 'Golden Tombstone' as the most-significant transaction of the year.

Top Vote-Getter for Most-Significant Tech Transaction of the Year

Source: 451 Research Tech Corporate Development Outlook Survey (2011-19); 451 Research Flash Survey: Coronavirus Impact of Tech Banking (2020)

And the voting for last year's top deal wasn't even close. Approximately two-thirds of investment bankers picked that acquisition – a 'pandemic print' that valued the employee communications and collaboration software provider at some 36x trailing sales, which is roughly four times Salesforce's own trading valuation. According to terms, Salesforce will cover roughly 40% of the cost of its largest-ever purchase with equity.

It's worth remembering that Salesforce has had an employee communications and collaboration program, called Chatter, for a decade. But again, the changes from the crisis, specifically the broadly adopted practice of working remotely, put a premium on that technology among customers. (In October's 451 Research Coronavirus Flash Survey, nearly two-thirds of the tech folks we surveyed (64%) said their organization has made a 'significant increase' in permanently working from home.)

Of course, no matter the economic conditions, sales considerations are pretty much always the top driver of M&A strategy. What was unique about 2020 is the fact that COVID-19 and the associated disruption of business brought that out abruptly and starkly. Priorities changed overnight after the outbreak, and buyers did their best to keep pace with 'pandemic prints' in a variety of suddenly booming markets:

Jump-starting the M&A machine

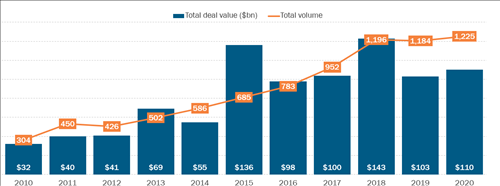

While corporate shoppers were back in the market by summer, rival financial acquirers took longer to return. As the pandemic swept through their existing portfolio companies and lenders pulled back on some of the riskier loans that private equity (PE) firms rely on to pay for their deals, buyout shops found themselves stymied by the double whammy. COVID-19 interrupted the decade-long trend of ever-increasing deals by tech-focused PE firms.

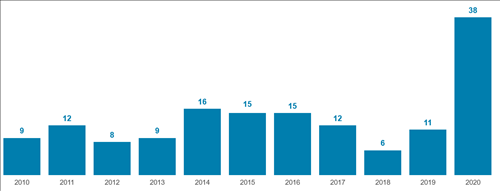

Tech/Telecom Deals by PE Firms, 2010-20

Source: 451 Research's M&A KnowledgeBase

Not that buyout shops, which are sitting on more capital than at any point in history, would stay inactive for long. They can't really afford not to do deals. (Industry tracker Preqin recently noted that North America-focused PE firms were holding $870bn of dry powder at the end of 2020, more than twice the amount they had a decade ago.) Consider the stunning turnaround in deal volume for PE firms that played out in the M&A KnowledgeBase just from last spring to winter:

To be clear, our totals include deals directly done by the firms themselves, as well as their existing portfolio companies. The latter type of transactions, typically styled as smaller vendors bolted on to larger holdings, helped power last year's trough-to-peak comeback for financial acquirers. It also reflected a bit of a shift in the M&A strategy at buyout shops from external to internal.

In the early days of the outbreak, PE firms largely focused on their existing portfolio companies and how to insulate their businesses (and the all-important cash flow) against the coronavirus-induced disruption and recession. For the most part, that strategy was also born of necessity, since buyout shops had a very hard time in the spring finding any money to borrow to fund big-ticket platform purchases.

As a result, both the players and the prints in the buyout industry changed in mid-2020. For instance, midmarket acquirer Accel-KKR announced six deals in Q3, doubling its quarterly average over the past two years and matching the number of prints from July to September for longtime market leader Vista Equity Partners. Also, GI Partners inked seven tech transactions in Q3, after not having announced more than four in any quarter before 2018.

Changes in fortune

Charting the relative activity of buyout shops throughout the pandemic-scarred year of 2020 shows that PE firms did indeed get hit harder by COVID-19 than their rival corporate acquirers – and that they have rebounded higher. Buyout shops benefitted more from the pickup in overall economic activity last summer, along with expansive support and strong signaling from the US Federal Reserve.

Recent Quarterly Tech/Telecom M&A Activity by PE Firms

Source: 451 Research's M&A KnowledgeBase

A look at their quarterly M&A run rate helps highlight that outperformance as the year went along. In both of the two years leading into the pandemic, PE firms accounted for just slightly less than one of every three tech transactions we recorded in the M&A KnowledgeBase.

Heading into 2021, signs are pointing toward continued momentum in the buyout world. For instance, in December's 451 Research Tech M&A Leaders' Survey, more than six of 10 respondents (61%) indicated that they expect PE spending to tick higher this year. That was almost twice the percentage that gave a bullish forecast for buyout activity in our previous survey before coronavirus had emerged.

Additionally, the market that provides the all-important financing for PE deals appears relatively open after a tumultuous 2020. Overall, the volume of M&A-related leveraged loans last year plunged to its lowest level since 2012, according to Leveraged Commentary and Data. (LCD, like 451 Research, is a division of S&P Global Market Intelligence.) Financing activity picked up as the economy opened up, however, with LCD noting that M&A-related leveraged loan volume hit a record in December.

PE pays up

It's almost impossible to imagine that during the sharpest and most severe recession in a century, financial acquirers, who are more sensitive to the credit market than strategic buyers, could have done much business at all in 2020. Yet, paradoxically, with last year's late buyout bonanza, PE firms exited 2020 in a more competitive position against their rival shoppers than they entered the year. Both their increasing market share and the fact that they started to stretch on valuations show the remarkable transformation.

A single transaction represents this turnaround in the overall industry: Thoma Bravo's $10.2bn take-private of RealPage in late December, the largest leveraged buyout (LBO) of a public company in 2020. For all the world, that deal looked like a 2018 print, when the trend of vertical software LBOs probably peaked. Among other transactions that year, the M&A KnowledgeBase lists take-privates of software providers in industries such as travel (Travelport), education (Cambium Learning Group), healthcare (athenahealth) and even leisure (MINDBODY).

However, there was a crucial difference between RealPage and the earlier vintage. At 9.4x trailing sales and 65x EBITDA, the take-private was significantly more expensive than anything done in 2018. Not that RealPage's rich valuation looked off the charts for PE firms, at least not in the back half of 2020.

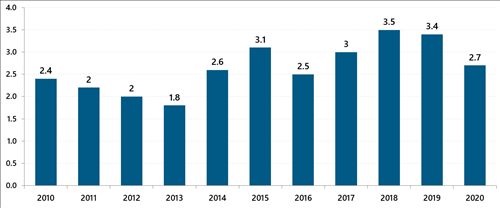

Median Price/Sales Multiple for Acquisitions by PE Firms, 2010-20

Source: 451 Research's M&A KnowledgeBase

However, unlike overall deal volume, where a late surge pushed the total number of prints to a record level, the valuation inflation of the past few months didn't overcome spring's slump. For full-year 2020, buyout shops paid a median 2.7x trailing revenue in their tech purchases, the lowest since 2016, according to the M&A KnowledgeBase. Looking ahead, respondents to our M&A Leaders' Survey forecast that multiple will rise this year. Nearly four in 10 (39%) expect PE firms to pay higher valuations in the next 12 months, compared with 28% anticipating a drop.

Getting into the SPAC act

One of the most unexpected contributors to last year's unforeseen record M&A spending came from a historically unlikely group of buyers: special-purpose acquisition companies, or SPACs. The so-called blank-check companies have amassed billions of dollars of collective buying power and, as of last year, are starting to expand the exit options for tech startups. The M&A KnowledgeBase indicates that SPACs bought more tech vendors in 2020 than they did in the previous four years combined.

Number of Tech Targets Purchased by Blank-Check Companies, 2010-20

Source: 451 Research's M&A KnowledgeBase

These acquisition vehicles, which are all the rage among investors right now despite mostly unproven results, moved from the outer fringes to the mainstream in 2020. In terms of fundraising, it seemed everyone was getting in on the SPAC act: Silicon Valley figures, buyout shops, and even Shaquille O'Neal. Altogether, some 319 blank-check companies listed on US public exchanges in 2020, according to S&P Capital IQ. (Although to be clear, only a portion of those listings are focused on the technology industry.)

As a reminder, a SPAC operates through a two-step process. Think of it as a sort of hybrid between IPOs and M&A, where a tech vendor can effectively sell itself public. In the IPO part, an individual or group of investors raise money, typically a couple of hundred million dollars, by selling shares of a shell company to public investors. The shell company has no ongoing operations. Its sole purpose is to buy some other business.

After the capital raise, the next step is M&A. The SPAC has a specified amount of time, usually in the neighborhood of two years, to put that money to use in an acquisition. In the transaction, the acquired business gets rolled into the shell company. And, as the M&A KnowledgeBase shows, purchases by SPACs had a lot of zeros in the prices last year:

Writing more blank checks

Overall, SPACs announced tech transactions last year valued at a record-shattering $58bn, according to our data. That was five times higher than the previous record, which came the year before. As stunning as the growth was in 2020 and appears almost certain to continue in 2021, it is important to remember that transacting with a SPAC isn't for everyone.

Companies need to have the operations and financials that support being a publicly traded company, which is the end result of a reverse merger. That is still a relatively tiny portion of Silicon Valley. For context, our data shows that almost 800 VC-backed vendors sold in 2020 to non-SPAC acquirers. The overwhelming exit from a venture portfolio is still to sell to a tech provider with its own ongoing business.

Acquisitions of VC-Backed Startups, 2010-20

Source: 451 Research's M&A KnowledgeBase

But for an admittedly small group, SPACs do offer an additional option. And it's an option that more companies are at least going to consider in the coming year. Remember that a record number of blank-check companies in 2020 raised capital, which has to be spent in the next year or two. Since very few investors – of any stripe – ever willingly give back money, the demand for blank-check deals is higher than ever. Supply typically finds a way to meet demand.

Already, in just the first three weeks of January, reverse mergers are off to a record start. Our numbers, which indicate a current pace of more than one per week, put 2021 on track for a roughly 50% uptick from last year's high-water mark for SPAC acquisition volume. (The usual caveat: It is still early days, and annualizing run rates isn't an exact prediction.)

Nonetheless, 2021 is shaping up to be a 'SPAC-tacular' year for these investment vehicles, which have come seemingly out of nowhere. Two-thirds of the respondents to our M&A Leaders' Survey in December forecast an increase in the number of tech vendors acquired by blank-check companies. That was three times higher than those predicting a cooling of this trend in the coming year.

WEBINAR