S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

26 Jan, 2021

By Brian Scheid

There are plenty of reasons why the U.S. Treasury has not issued a 50-year bond since 1911.

Fixed-income strategists point to limited demand, the potential to drain liquidity from other corners of the bond market, an unwanted steepening of the yield curve, and a disruption to the Treasury's long-standing "steady and predictable" bond issuance mantra.

However, after the average maturity of U.S. government debt fell dramatically in the past year amid a wave of new issuance to pay for pandemic relief, newly appointed Treasury Secretary Janet Yellen is again looking at the idea. "There is an advantage to funding the debt, especially when interest rates are very low, by issuing long-term debt," she said at her Senate Finance Committee confirmation hearing Jan. 19.

If she decides to go ahead, it would represent a victory for the Treasury, which in early March 2020 under Steven Mnuchin, decided against a 50-year bond, citing limited interest from investors as the Federal Reserve was in the process of slashing rates in response to the global pandemic. The last time the U.S. sold an ultra-long bond was to fund the building of the Panama Canal.

In Yellen's favor this time is a calmer bond market, while the impetus to act is greater thanks to a surging debt pile.

Total U.S. federal debt as a percentage of gross domestic product climbed to 98.2% in 2020 as spending spiked and economic output shriveled, up from 79.2% in 2019, according to the U.S. Congressional Budget Office. The ratio was about 34% two decades earlier. The U.S. Congressional Budget Office forecasts the ratio to climb to over 104% in 2021 and nearly double to over 195% in 2050.

If the U.S. Treasury does issue a 50-year bond, it would help get the federal government's goal of shifting borrowing toward longer-dated maturities back on track. When the pandemic first took root in the spring of 2020, the Treasury used short-term bills to help fund the unprecedented stimulus efforts approved by Congress.

That pushed the average maturity of U.S. government debt down to about 65 months after the Treasury had succeeded in pushing it up from about 52 months to 70 months between 2009 and 2019.

Longer average maturities lower the so-called rollover risk faced by issuers when they have to replace a maturing bond with a new one, which can lead to a sudden increase in borrowing costs if central bank rates have risen or there is a liquidity crunch.

However, the hurdles to issuing such an ultra-long bond are numerous, not least reluctance from the all-important dealer community, which may not be eager to keep such a long-duration asset in their trading inventories, according to Thomas Simons, a money market economist with Jefferies.

"Dealer balance sheets are already very costly due to regulation and internal controls, and most risk managers likely won't like to see lots of 50-year bonds clogging things up," Simons said. "Light dealer participation will discourage liquidity in the product and reduce investor appetite."

A 50-year bond could also steepen the yield curve, making the Treasury's other borrowing in the 10-year through 30-year space more expensive and "creating a net negative benefit to issuing that far out the curve," said Gennadiy Goldberg, senior U.S. rates strategist with TD Securities.

The Treasury yield curve has recently steepened to levels not seen in four years as investors bet on an economic recovery and rising inflation as the world emerges from the coronavirus pandemic. On Jan. 21, the gap between the five- and 30-year Treasury yields grew to 1.42 percentage points, the largest gap since February 2016. The gap stood at 1.41 percentage points at market close Jan. 22.

While Mnuchin abandoned his effort to issue a 50-year bond in March, the Treasury sold a 20-year bond in May, the first issue at that maturity since 1986. The government sold $20 billion of the issue, priced to yield 1.22%. There were $50 billion of offers for the bond, which now yields 1.61%.

While the Treasury found demand for the 50-year bond lacking, strategists said there could be growing interest from insurance companies, pension and endowment funds, and some investors looking for an instrument for multi-generational planning.

"Every time these ultra-long bonds have been discussed in the U.S., the argument has been that there is no investor demand," said Arne Lohmann Rasmussen, chief analyst with Danske Bank. "I guess that is to a certain degree correct. But the high duration and convexity in these bonds should also be attractive for some U.S. pension funds."

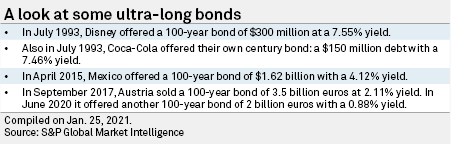

Ultra-long bonds, including 50- and 100-year issues, have been issued by other countries in recent years. The U.K. began offering 50-year bonds in 2005, most recently selling a 1.625% gilt maturing in 2071 in October 2020.

Ireland and Belgium have also issued 100-year debt but only in private placements. France and Italy have sold 50-year bonds.

Investors did very well out of a century bond sold by Austria at 2.1% in 2017, which now yields less than 1%. They accepted a meager yield of 0.88% when the country sold at that maturity again in 2020.

The Walt Disney Co. sold $300 million of 100-year bonds in 1993 at a yield of 7.55%, and was followed by The Coca-Cola Co. later that year. Ford Motor Co., Anadarko Petroleum Corp., CATERPILLAR, Motorola and Citigroup also issued 100-year bonds, later in the 1990s.

But Argentina's century bond ended less than three years after it was issued in 2017, following a default and restructuring, causing investors to lose roughly half their initial investment.

The additional challenge for the U.S. if it were to proceed with an ultra-long bond is that it would need to sell a lot more than other issuers in order to create a liquid and robust market for the instrument, said John Canavan, lead analyst with Oxford Economics.

"As the global bond benchmark, any Treasury issuance would need to be significantly larger and sold at a regular pace, which would be much more difficult," he said.

Sub-2% yield

Rasmussen said there was a "very good chance" that Treasury could issue a 50-year bond with a yield of below 2%. He estimated that, if issued, a 50-year Treasury would likely have a yield of about 1.8% to 1.9%, or just above the current yield for a 30-year Treasury.

Canavan, however, said there were too many uncertainties to forecast what yield such an issuance would garner.

"There are too many unknowns, including the hypothetical issue size, how often the auctions would be held, if there would be reopenings, the extent of the Treasury Department's long-term commitment to the new issue, etc.," he said.

The U.S. Treasury has been committed to keeping its bond issuance "regular and predictable" for decades, an effort which could be complicated by ultra-long debt, Canavan said.

"One concern is that once the current crisis passes and deficits begin to shrink again in the future, Treasury will not be able to maintain 50-year issuance in a manner that sustains liquidity in the issue," he said. "Without that liquidity, the cost would increase."