S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Jun, 2023

By Mark Anthony Gubagaras

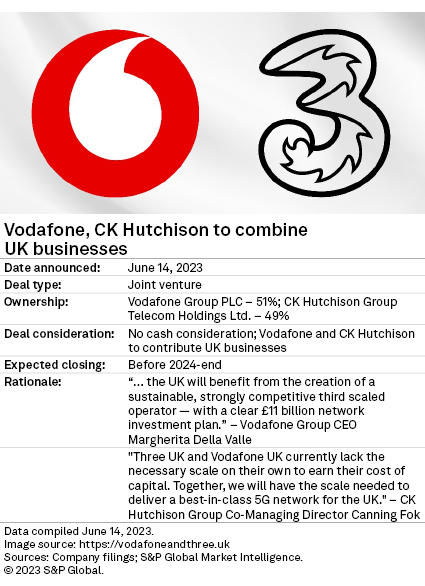

After over a year of talks, Vodafone Group PLC and CK Hutchison Holdings Ltd. finally agreed to combine their mobile telecom businesses in the United Kingdom. But delays in reaching a deal likely signal a tough road ahead.

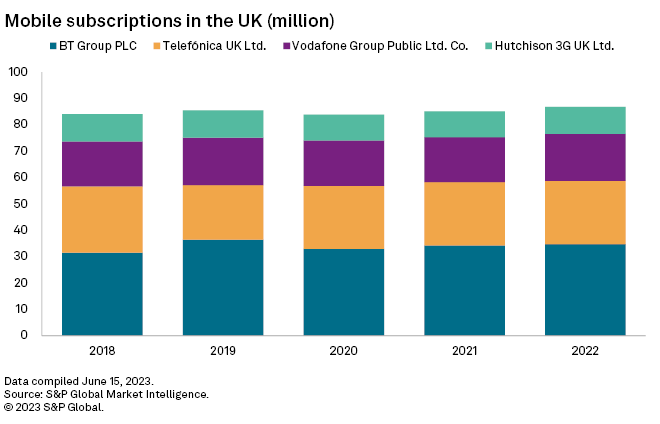

Vodafone's Vodafone UK Ltd. and CK Hutchison Group Telecom Holdings Ltd.'s Three UK are currently the No. 3 and No. 4 mobile operators in the United Kingdom with 18.6% and 10.8% market share, respectively, according to Kagan, a media research group within S&P Global Market Intelligence.

The companies will contribute their respective UK units via a joint venture, which will be 51% owned by Vodafone. CK Hutchison Group Telecom Holdings Ltd., owner of Three UK, will own the remaining 49%. The deal structure will be locked up for three years, after which Vodafone can exercise a put/call option to acquire CK Hutchison Group Telecom's stake in the merged entity.

Such a strategic partnership is not new for Vodafone and CK Hutchison — the pair already operate a 50/50 joint venture in Australia. The entity, Vodafone Hutchison Australia (VHA), later combined with TPG Telecom Ltd. in 2020 but only after facing a significant regulatory battle. The Australian Competition and Consumer Commission initially rejected the VHA–TPG merger over concerns that it would lessen competition in the local telecom market. A court eventually overturned the ruling.

Vodafone and CK Hutchison may now see a similar challenge in seeking to merge their British subsidiaries.

Back in 2016, the European Commission rejected Three UK's planned acquisition of O2, saying the deal could lead to price increases or narrow consumer choices. The decision echoed concerns raised by British telecom and media watchdog Ofcom, as well as the UK Competition and Markets Authority (CMA).

Following the UK's exit from the EU, all eyes are now on what the CMA and Ofcom will say about the new proposed merger.

While CMA approved O2's merger with Virgin Media in 2021, it recently made headlines for blocking Microsoft Corp.'s proposed $75 billion purchase of Activision Blizzard Inc.

Ofcom has softened its stance on mergers involving UK mobile operators. In 2022, the watchdog said it does not have a fixed position on the sector's consolidation and that it would assess any future transactions on a case-by-case basis.

|

Executives at CK Hutchison and Vodafone say the combination is needed to make them more competitive against the current market leaders

"This has long been a challenge for Three UK's ability to invest and compete," said Canning Fok, CK Hutchison's group co-managing director.

Vodafone UK in 2022 had 17.8 million mobile subscriptions, while Three UK counted 10.3 million, Kagan data shows. By comparison, BT Group PLC unit EE Ltd. had 34.7 million subscriptions, while Virgin Media O2 placed second with 24.1 million subscriptions. Virgin Media O2 is jointly held by Telefónica SA and Liberty Global Inc.

A merger between Vodafone UK and Three UK would provide the necessary scale to improve mobile services while still earning the cost of capital, Fok said. The merged company committed to investing £11 billion over 10 years to deploy a stand-alone 5G network that would reach more than 99% of the UK population.

The investment pledge seems aimed at winning over the UK government, which is eyeing stand-alone 5G coverage across all populated areas in the country by 2030 under its wireless infrastructure strategy.

Even if the companies win over regulators, they are also facing opposition from unions. British trade union Unite warned the deal would lead to higher prices and further job cuts. It also claimed Hong Kong-based CK Hutchison has links to Chinese state authorities, thus potentially compromising the privacy of customer data and sensitive public contracts.

However, Vodafone CEO Margherita Della Valle maintained that the UK "will benefit from the creation of a sustainable, strongly competitive third-scaled operator."

Assuming the deal can make it past regulators, it is expected to close before year-end 2024.