Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Apr, 2022

By Tom Jacobs and Hassan Javed

The growing threat of wildfires and reduced admitted capacity has led to a significant increase in the use of excess and surplus lines homeowners insurance coverage in California.

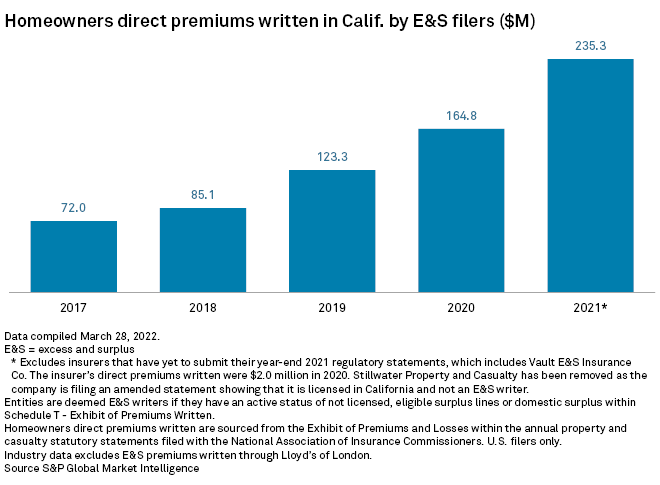

Homeowners direct premiums written in California by excess and surplus, or E&S, filers have almost tripled since 2018, rising in 2021 to $235 million, according to an S&P Global Market Intelligence analysis of regulatory statements submitted to the National Association of Insurance Commissioners. That compares to $85.1 million in 2018, $123.3 million in 2019 and $164.8 million in 2020.

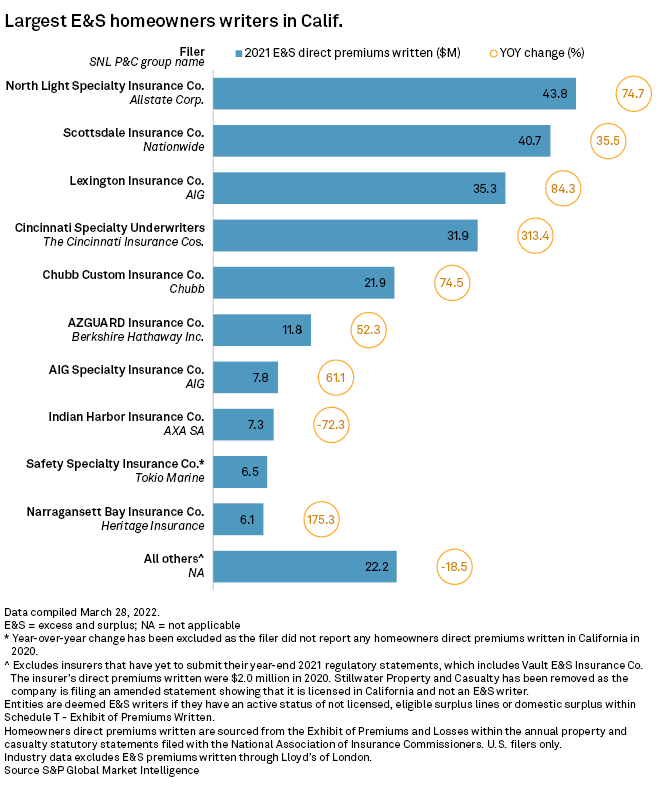

The rising use of E&S has come as insurers deal with increased wildfire damage severity in the Golden State and shrinking capacity in the admitted market through coverage denials and nonrenewal of comprehensive homeowners insurance policies, known as HO-3s. Big names like American International Group Inc. and Chubb Ltd. have roiled the market by either reducing or eliminating conventional homeowners coverage in California.

Premiums up, policies down

By law, primary homeowners insurance coverage in California via surplus lines carriers is only available for properties that have been declined by at least three admitted standard lines insurers. However, a homeowner can obtain coverage on the E&S market to augment their HO-3 policies to ensure full recovery in the event of a loss.

Data collected by the Surplus Lines Association of California shows that premiums for new, renewed and extended E&S homeowners policies totaled $342.1 million in 2021, an 83.8% increase from $185.6 million in 2018. While premiums have risen sharply, the number of policies issued annually has actually fallen by more than half to 27,296 in 2021 from 61,824 in 2018.

Homes prices, insurance costs heating up

Michael Caturegli, executive vice president at SLAC, said the state's expanding real estate market has contributed to "an imperfect storm" that has hit homeowners and landlords seeking coverage. He has seen evidence that the average home price in California has risen more than 20% within the last 12 months and an average of 36% over the last four years.

Those higher prices, coupled with the rising threat of wildfires, seem to have pushed many policies into the nonadmitted market. Caturegli said cost-prohibitive coverage or denial of coverage from the admitted market has affected people who live in the Wildland-Urban Interface areas, where the value of a home is not commensurate with the premium.

"Homeowners don't have a lot of options, except to go to the non-admitted market," Caturegli said in an interview.

The California Department of Forestry and Fire Protection reported a total of 8,835 fires in 2021, with 2.6 million acres burned. Only the 2020 wildfire season scorched more of the Golden State landscape, with 4.3 million acres burned that year.

Since 2017, there has been an average of 8,370 fires and 2.1 million acres burned in California per year, causing more than $40 billion in combined losses for the insurance industry, according to Aon PLC.