Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Jul, 2021

By Zack Hale

| The GE-Alstom Block Island Wind Farm, three miles off of Block Island, R.I., became the first operating commercial offshore wind facility in the U.S in December 2016. Source: Scott Eisen/Getty Editorial via Getty Images |

Planned offshore wind facilities off the U.S. East Coast are effectively blocked from participating in the PJM Interconnection's multibillion-dollar capacity market under Trump-era rules promulgated by a Republican majority at the Federal Energy Regulatory Commission.

But now that is set to change. With Democrats poised to gain a 3-2 majority at FERC, PJM is set to file changes to its mandatory capacity market that would enable clean energy resources, like offshore wind farms built pursuant to existing state clean energy policies, to fully participate, giving the fledgling industry access to the grid operator's all-important capacity auctions.

Similar efforts are also underway to reform capacity market constructs in the ISO New England and the New York ISO to better accommodate state-level climate and energy legislation that mandates thousands of megawatts of new offshore wind generation.

Trump-era rules

The offshore wind industry's capacity market dilemma dates back to 2016 when a coalition of merchant power generators filed a complaint with FERC claiming that proposed state subsidies for at-risk nuclear- and coal-fired power plants in Ohio would artificially suppress PJM's capacity auction clearing prices, threatening the viability of a three-year-forward market construct designed to ensure sufficient power supplies.

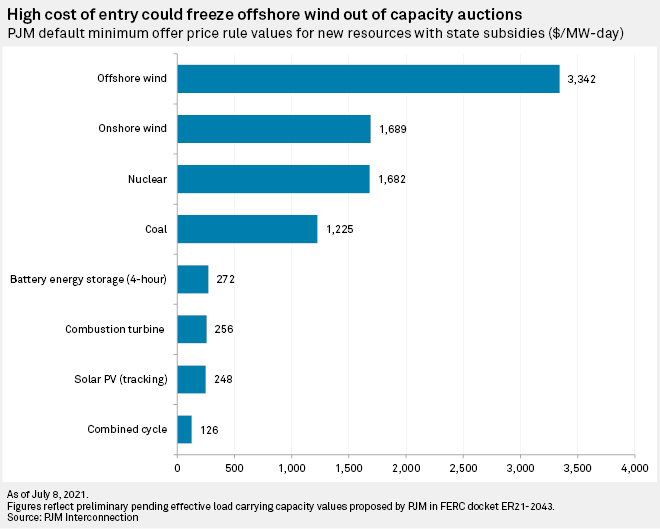

After years of debate and multiple capacity auction delays, FERC's Republican majority issued a final rule in December 2019 that directed PJM to expand its minimum offer price rule, or MOPR, to all new and some existing resources receiving material state subsidies. The market mitigation rule was originally designed to prevent the exercise of market power, but critics have argued its recent application in wholesale capacity markets targets resources with no ability to influence prices.

FERC's order was blasted by clean energy advocates and Richard Glick, the commission's lone Democrat at the time, who argued it was a thinly veiled attempt to prop up thermal generators at the expense of state-sponsored clean energy resources.

When Glick was given the chairman's gavel shortly after U.S. President Joe Biden's inauguration, one of his first actions was to convene a series of technical conferences on how the PJM, ISO-NE and NYISO capacity market constructs can be reformed to better accommodate state-level climate and energy legislation.

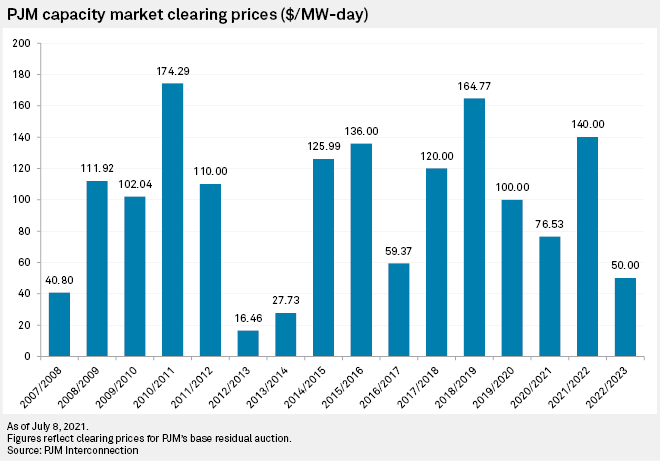

Following a March technical conference focused on PJM, clean energy advocates maintained that under the expanded MOPR, new offshore wind facilities would not clear the grid operator's capacity auctions for years to come. This is because new resources receiving state subsidies are subject to very high default offer floor prices, which led to no offshore wind resources clearing in PJM's long-delayed capacity auction held in May covering the 2022/2023 delivery year.

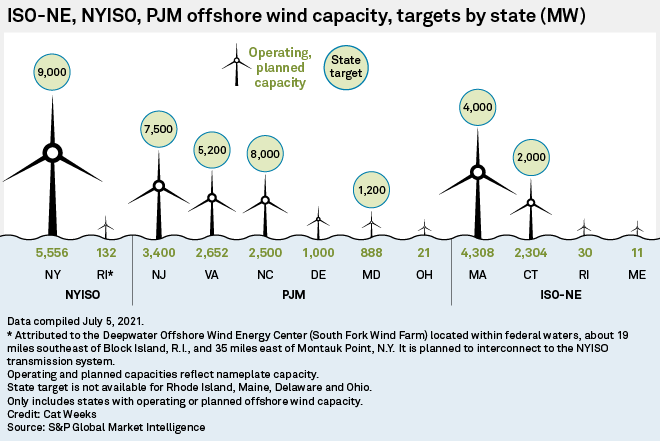

East Coast states are now targeting nearly 37,000 MW of installed offshore wind capacity in the decades ahead, and the Biden administration in March announced its own goal to add 30 GW of installed U.S. offshore wind capacity by 2030.

"Obviously, it places them at a competitive disadvantage if other facilities are able to get capacity market revenues and they're not," Tabak said. "It's also important that they be able to build that into their expected revenues because that's going to affect their financing."

Public Service Enterprise Group Inc. President and CEO Ralph Izzo also warned in February of a "double-payment" problem looming in 2025 in which New Jersey ratepayers could be forced to procure extra capacity that could have otherwise been provided by offshore wind facilities expected to come online around that time.

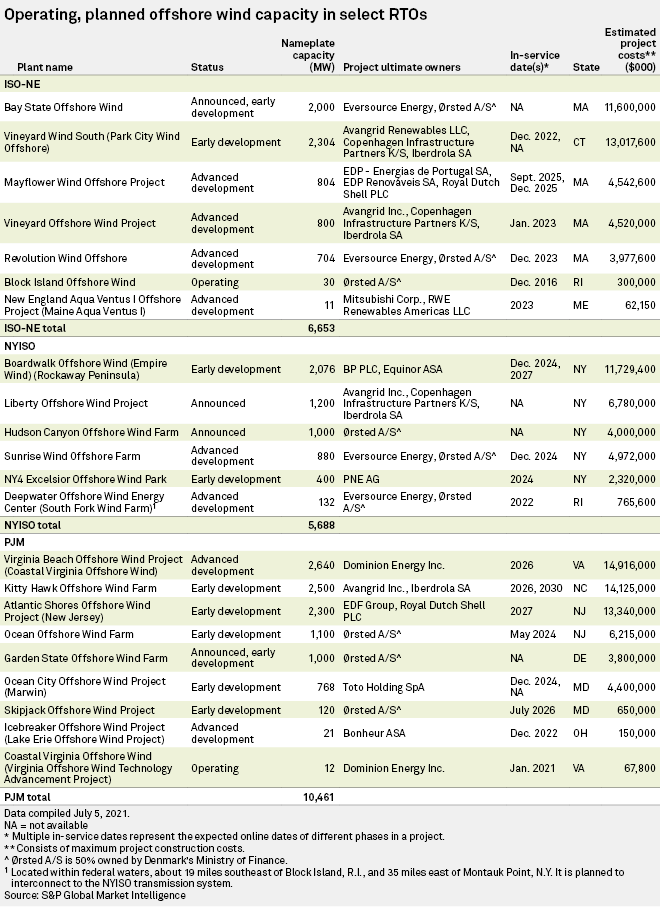

But facilities like the planned 1,100-MW Ocean Offshore Wind Farm off the coast of New Jersey are expected to clear in future PJM capacity auctions if the grid operator's proposed MOPR replacement is approved by FERC.

With 6,000 MW of state-mandated offshore wind in its footprint, the ISO-NE is currently in the midst of a stakeholder process focused on how to eliminate market mitigation rules for state-sponsored resources and plans to file a proposal with FERC in early 2022.

"It's one of our highest priorities, and it's one of the region's highest priorities," Anne George, ISO-NE's vice president of external affairs and corporate communications, said in an interview. "We're now understanding that minimum offer price rules can be a barrier to large amounts of offshore wind coming in."

George noted that the 7.1-MW Block Island Wind Farm — the nation's first commercial offshore wind facility — was also the first such generator to secure a capacity supply obligation under ISO-NE rules that enable a limited amount of renewable energy resources to avoid MOPR-type mitigation.

The 800-MW Vineyard Offshore Wind Project, expected to come online in 2023, also secured a partial 50-MW capacity supply obligation in 2018 under the grid operator's two-step capacity market construct, which enables new state-sponsored resources to purchase capacity obligations from existing generators that wish to retire. However, trading activity in the ISO-NE's last capacity auction under that construct was nonexistent.

The NYISO is engaged in a similar stakeholder process after a divided FERC in 2020 directed the single-state grid operator to expand its market mitigation rules for new generation entering the installed capacity markets in New York City and the Lower Hudson Valley.

New York is aiming to have 9,000 MW of offshore wind installed by 2035 as part of a legislative mandate to decarbonize the state's power grid by 2040. The state already has more than 5,500 MW of planned capacity in the development pipeline, according to S&P Global Market Intelligence data.

"The NYISO expects offshore wind and other clean energy technologies to play an important part of reliable grid operations in the future and is working to ensure these resources will have the opportunity to participate in our competitive markets, including the capacity market," NYISO spokesman Zachary Hutchins said in an email.

Hutchins said the NYISO expects to file related changes to its capacity market rules with FERC later this year.

Lower energy, capacity market prices expected

However, market mitigation rules are not the only obstacles frustrating East Coast states' offshore wind aspirations, said Theodore Paradise, executive vice president of transmission strategy and counsel for Anbaric Development Partners LLC, a leader in offshore transmission development.

Paradise observed in an interview that much of the debate surrounding capacity market clearing prices and the need to keep fossil fuel-fired generators online is centered on grid reliability. But planning a network of meshed offshore wind transmission serving multiple generators can also maintain grid reliability as emitting resources with higher marginal fuel costs retire, Paradise said.

"Two things are going to happen with a lot of wind," Paradise said. Energy market prices will fall as offshore wind farms with zero marginal fuel costs participate as price takers. And the Anbaric executive also foresees lower capacity market prices with more market participants saying, "you know, I'm okay with a low capacity price, that's fine with me."

"You're going to see those retirements, and you have to be positioned for it, or you do end up just probably keeping cost-of-service contracts for backend resources if you can't really use the wind to replace them," Paradise said. Cost-of-service contracts are typically used to keep older generators that would otherwise seek to retire online.

The American Clean Power Association's Tabak also pointed to a broader question beyond the long-running debate over market mitigation rules for state-sponsored resources such as offshore wind.

"Is a capacity market with the worst mitigation rules thrown out still a good construct?" Tabak said. "There's a wider discussion about what the right framework looks like and whether capacity markets are it."