Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Oct, 2021

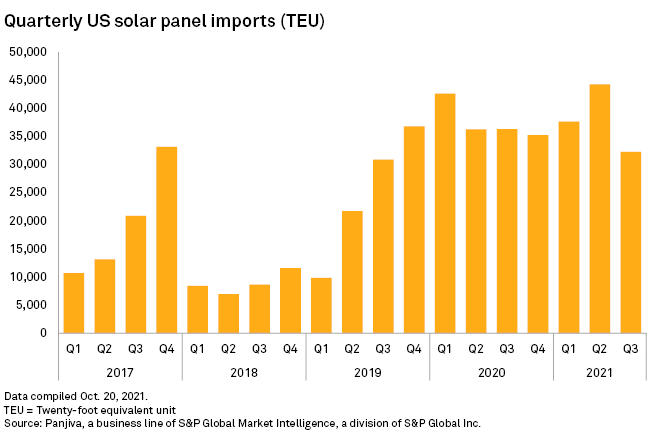

U.S. solar panel imports plunged during the third quarter as the industry grappled with equipment shortages that project developers blamed on a proposed expansion of tariffs.

The number of shipping containers delivering solar panels to American ports between July and September was down 27% from the prior quarter and 11% from a year earlier, according to research firm Panjiva. The decline marks the biggest quarterly drop since the start of 2018, when project developers were fresh off a buying spree to stockpile equipment ahead of a new round of import tariffs ordered by former President Donald Trump.

Executives at U.S. solar companies have said in recent weeks that a request to the U.S. Commerce Department to extend tariffs on Chinese solar cells and panels to some factories in Southeast Asia is stalling projects as developers struggle to obtain panels. The proposed tariffs would target America's top solar panel suppliers and could be applied retroactively to past shipments.

Those disruptions have compounded supply chain problems caused by snarled trade routes, soaring raw-material costs and the detention of solar panels that U.S. Customs and Border Protection suspects of being linked to alleged labor abuses. The jump in material and shipping costs could threaten 56% of the utility-scale solar projects planned globally for 2022, Rystad Energy, a consulting firm, said Oct. 26.

It "isn't at all surprising" that solar panel imports declined in the third quarter, "given what our companies are telling us about the difficulty they are having getting product," said Jen Bristol, communications director for the Solar Energy Industries Association, or SEIA, a trade group that opposes the requested tariffs.

The challenges facing the solar industry, which pose a test to President Joe Biden's ability to accelerate the country's shift to carbon-free power, are mounting as world leader prepare for the U.N. Climate Change Conference in Scotland in early November.

"Demand for renewable energy continues to soar, driven by an increase in corporate sustainability commitments" in the U.S., Edison Energy LLC said in an Oct. 22 market report. However, higher commodity and constructions costs are causing headwinds for the sector, the company said, with the solar industry facing "even more setbacks with regard to trade-related regulations."

That echoes an assessment by research firm LevelTen Energy Inc., which recently said solar project developers are "navigating through a host of headwinds that threaten their success on a daily basis."

The petition to impose tariffs on solar cells and panels shipped to the U.S. from Malaysia, Vietnam and Thailand is particularly concerning for project developers. The taxes were requested by a group of unnamed companies that accused Chinese manufacturers of moving some operations to Southeast Asia to evade U.S. import duties.

SEIA said in a letter Oct. 25 to Commerce Secretary Gina Raimondo that the requested duties would jeopardize 18 GW of solar installations and "make it impossible to meet President Biden's climate goals."

"It is our understanding from developer partners and clients across the country that the potential risk exposure from these duties has already frozen imports into the United States, effectively grinding the industry to a halt," George Hershman, president of Swinerton Renewable Energy and SEIA's chair, wrote in a separate letter to Raimondo earlier this month.

Timothy Brightbill, a partner at Wiley Rein LLP who represents the anonymous petitioners, has said his clients' interests are aligned with the Biden administration's goal to boost domestic manufacturing. Brightbill has said there is enough supply of solar cells and panels from elsewhere to meet U.S. demand if the Commerce Department imposes the requested tariffs.

Of the 109.6 GW of renewable energy and energy storage projects that are under construction and in advanced development in the U.S., more than half of the capacity is solar, according to the American Clean Power Association.

The threat of further trade disruptions is being felt unevenly across the U.S. solar market.

NextEra Energy Inc., the top owner of planned solar capacity in the U.S., told Raimondo on Oct. 25 that applying antidumping and countervailing duties to cells and panels from Thailand, Vietnam and Malaysia would cause "substantial harm" to America's solar industry. So far, though, the company has not experienced the sorts of disruptions that have hit competitors with less spending power, executives said.

Other leading solar developers either declined to comment or did not immediately respond to messages seeking comment.

"It's good to be us," NextEra CFO Rebecca Kujawa said on an earnings call Oct. 20. "Having significant capital dollars to put to work enables us to have strong relationships and extensive relationships with those in the supply chain to help navigate these uncertainties."

Panjiva is a business line of S&P Global Market Intelligence, a division of S&P Global Inc.