Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Oct, 2022

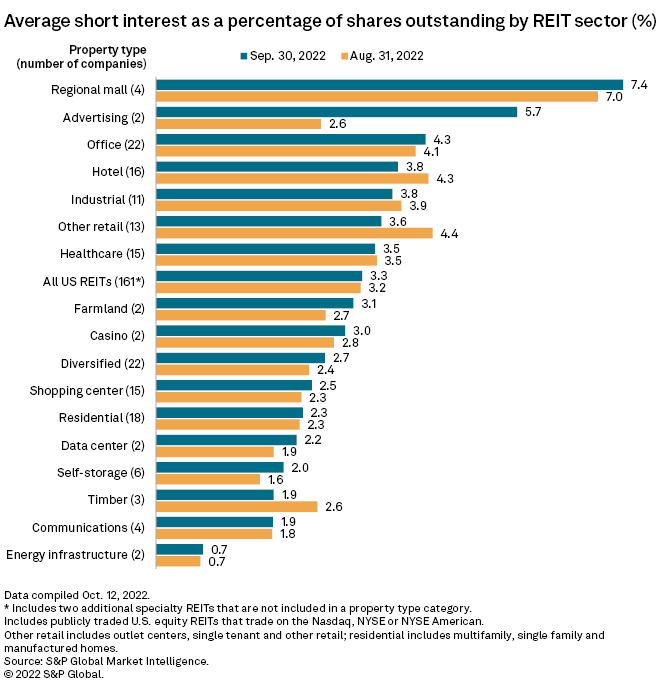

U.S. equity real estate investment trusts posted a modest gain in average short interest in September, up 2 basis points to 3.3% of shares outstanding as of month-end, according to S&P Global Market Intelligence data.

Outfront Media significantly lifts advertising sector's average short interest

The advertising REIT segment had the biggest gain in average short interest across all property types, posting a 3.1-percentage-point hike from the preceding month to 5.7% of shares outstanding as of Sept. 30.

The hike was solely attributed to the jump in OUTFRONT Media Inc.'s short interest relative to shares outstanding by 6.3 percentage points to 9.5% as of September-end, the biggest increase in short interest across all U.S. REITs.

Lamar Advertising Co., on the other hand, had a 9-basis-point drop in short interest over the same period to 2.0% of shares outstanding.

Following the advertising sector, farmland REITs grew their average short interest by 44 basis points to 3.1% of shares outstanding. The regional mall segment nabbed the third-highest gain with a 40-basis-point increase to 7.4% of its shares outstanding.

* Click here to set email alerts for future Data Dispatch articles.

* Click here to download data featured in this story in Excel format.

* Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

By contrast, the "other retail" sector, which includes outlet center, single-tenant and other retail REITs, had the biggest fall in average short interest across all property types, losing 82 basis points over the preceding month to 3.6% of shares outstanding as of Sept. 30.

Single-tenant retail landlord Agree Realty Corp.'s short interest relative to shares outstanding dropped 9.1 percentage points to 3.8% as of September-end, the largest decline across all U.S. REITs for the month.

Top REITs by change in short interest

Healthcare REIT Medical Properties Trust Inc. had the second-largest increase in short interest in September, next to Outfront Media, with a 2.7-percentage-point hike to 11.0% of its shares outstanding.

After Agree Realty, hotel REIT Sunstone Hotel Investors Inc. had the second-biggest drop in short interest for the month, down 4.5 percentage points to 6.8% of its shares outstanding.

Most shorted US REITs

Regional mall REIT Pennsylvania REIT was the most shorted U.S. REIT stock, with 872,210 shares sold short as of Sept. 30, or 16.2% of its shares outstanding. Single-tenant retail REIT NETSTREIT Corp. and office landlord SL Green Realty Corp. followed, with short interests at 15.0% and 11.1% of shares outstanding, respectively.