Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jun, 2023

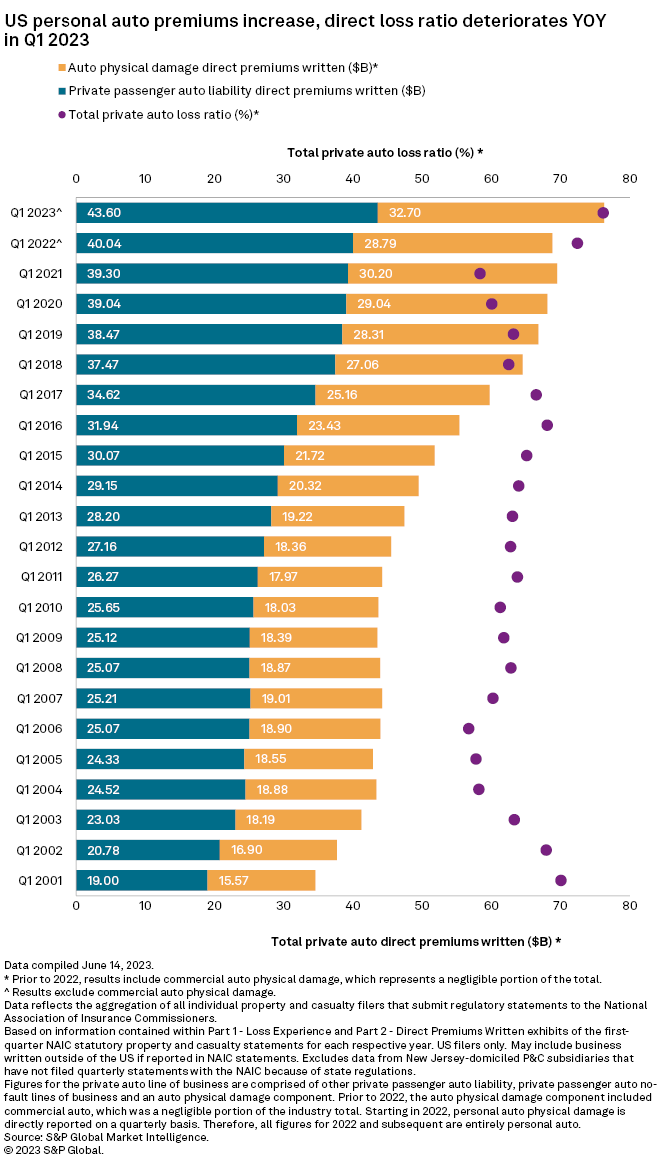

US private auto insurers wrote a record number of premiums during the first quarter of 2023 even as the business line posted its worst direct incurred loss ratio for a first quarter in over 20 years.

An S&P Global Market Intelligence analysis of quarterly premium information since 2001 shows that US private auto insurance premiums rose $7.48 billion in the first quarter of 2023 to $76.30 billion from $68.83 billion in the first quarter of 2022.

The rise in premiums can be attributed in part to carriers continuing to produce strong top-line growth as they attempt to catch up to fast-rising private auto loss costs via rate increases.

However, the overall direct loss ratio for the business line also deteriorated during the first quarter, rising from 72.4% to 76.2%.

The first quarter was an unusually active period for natural catastrophes, which, in combination with ongoing inflation-related challenges in the private auto business, led to the highest personal lines direct incurred loss ratio for a first quarter since at least 2001, according to an S&P Global Market Intelligence analysis.

The previous first-quarter high for the period from 2001 through 2022 had been 72.4% in 2022. In the 88 previous quarters for which data is available, the private auto direct incurred loss ratio had only exceeded 76.2% during the second, third and fourth quarters of 2022.

Market share shifts

Five of the 10 largest US personal auto insurers posted double-digit premium growth during the first quarter.

State Farm Mutual Automobile Insurance Co. remained the largest private auto insurer in the US as it grew its premiums by 22.2%, the second largest year-over-year increase in private auto direct premiums written among the top 10 private US auto insurers.

The insurer's net premiums written surged at their most rapid pace in any quarter in at least the last 21 years as it continued to take significant pricing actions, particularly in the private auto business.

The Progressive Corp. saw the largest year-over-year increase in direct premiums among the top 10, growing by 25.2%.

During Progressive's first quarter earnings call, CEO Susan P. Griffith said the insurer plans to take "aggressive rate increases where needed across all lines through the balance of 2023 to ensure we're pricing to deliver our target profit margin."

In its Form 10-Q, Progressive also noted that during the first quarter, it increased personal auto rates in 31 states, with an aggregate countrywide increase of about 4% while continuing to earn in the aggregate countrywide net increases of 13% taken during 2022.

The Allstate Corp., United Services Automobile Association and American Family Insurance Group were the other three to see a double-digit increase in private auto direct premiums written, growing by 10.2%, 15.6% and 12.6%, respectively.

Only GEICO Corp. and Liberty Mutual Holding Co. Inc. saw year-over-year declines in private auto direct premiums written, falling by 1.9% and 5.7%, respectively. Previously, GEICO had only seen premiums decrease after the second and third quarters of 2020, following premium rebates amid the COVID-19 pandemic.

Loss ratios worsen

Although State Farm saw the second largest year-over-year increase in direct premiums written among the top 10, the company also saw the worst loss ratio among that group at 87.9%. The deterioration is largely attributable to inflation and natural catastrophes, according to an S&P Global Market Intelligence analysis.

As first-quarter direct loss ratios hit new heights, the only top 10 insurer to see an improvement year over year was GEICO.

GEICO's loss expenses for the first quarter of 2023 decreased $552 million compared to the first quarter of 2022, according to its May Form 10-Q. The insurer attributed this improved loss ratio to higher average premiums, favorable reserve development for prior accident years, the reduction in policies-in-force and lower claims frequencies.

Severity due to inflation

In its May Form 10-Q, Progressive attributed the year-over-year increase in severity, in part, to the "impact of inflation, which continues to increase the valuation of used vehicles and total loss, repair, and medical costs."

The Travelers Cos. Inc. executive Michael F. Klein provided commentary on frequency severity trends during an April earnings call, attributing changes in severity to unpredictable weather and economic forces.

"One consistent trend we see underneath everything is parts and labor costs continuing to rise," Klein said. "That's been fairly steady for a long time."