S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Jan, 2022

By Darren Sweeney and Allison Good

The heightened pace of U.S. power and utilities M&A during the second half of 2021 should continue into 2022, as industry experts expect deal-making will continue to be a strategic avenue for growing renewable energy investment and strengthening environmental, social and governance profiles.

"The interesting thing is the activity picked up [in 2021], but the deals look a lot different than they have in the past," Jeremy Fago, U.S. power and utilities deals leader at PwC, said in an interview.

"I don't think that we're going to see the megadeals that we saw in [2016, 2017 and 2018] over the next year or two," Fago continued. "We may see a couple of those, but I think the interesting thing about the ESG piece of this is although it may be driving some reshuffling of capital and some shuffling of portfolios, it may actually cause some challenges on the regulatory front."

Fago pointed out that regulators will likely question how a certain portfolio or acquisition target is aligned with a company's ESG and net-zero goals and that he expects federal legislation, especially the Build Back Better Act bill, to drive deal activity.

PwC's 2022 power and utilities deals outlook cited "additional clarity" on federal policies as an M&A driver as well, but the $2 trillion bill took a major hit after West Virginia Sen. Joe Manchin, a crucial vote in the evenly divided chamber, said he could not support it. Senate Majority Leader Chuck Schumer, D-N.Y., said the Senate will vote on a revised version of the House-passed Build Back Better Act "very early in the new year" and "will keep voting on it until we get something done."

Still, financial and legal advisers are counting on a busy 2022 for power and utility sector deal-making.

"There's no magic to Dec. 31, so I think you see the law firms continuing to staff up on the M&A side ... as the market continues to grow," Keith Martin, co-head of projects at the law firm Norton Rose Fulbright US LLP, said in an interview.

Private equity deploys capital

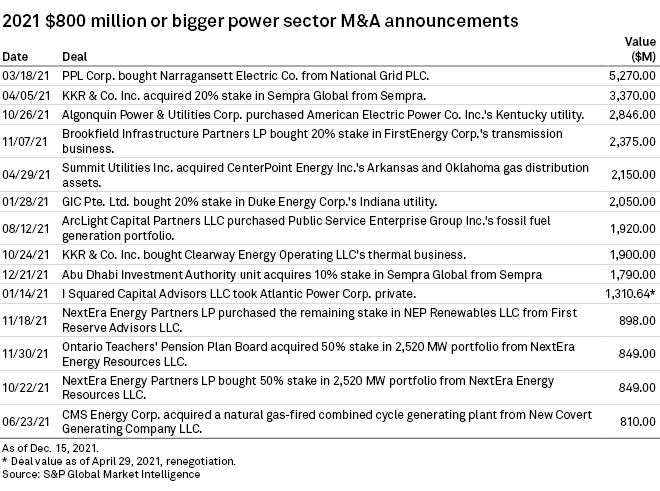

Several of the biggest U.S. power and utilities sector deals in 2021 involved private equity buyers, including fossil fuel generation portfolio sales.

Alan Wink, managing director of capital markets at accounting firm EisnerAmper, said in an interview that about 60% of the deals in electric utility in 2021 involved financial partners.

"[Y]ou would have to assume because of the value in the electric utility space ... that 2022 will probably be a pretty frothy year for M&A activity," Wink added, though he does expect a "tipping point at some point" given that asset managers "get paid for investing [capital] in companies and generating above-market returns."

Jonathan Dickman-Wilkes, JP Morgan Securities Inc. managing director, noted Oct. 20 that thermal portfolio deals are now almost exclusively driven by private equity. They also result in more conservative valuations, such as Public Service Enterprise Group Inc.'s $1.92 billion announced fossil fuel portfolio sale in August to ArcLight Capital Partners LLC due to terminal value concerns, Dickman-Wilkes added.

Minority stake acquisitions like GIC Pte. Ltd.'s purchase of a nearly 20% interest in Duke Energy Corp. subsidiary Duke Energy Indiana LLC are also attractive propositions for private capital, according to PwC's Fago.

"When you look at all the dry powder that is out there globally, going in a minority fashion at some of these businesses where you're really able to rely on the owner/operator that has owned those for long periods of time to basically generate those cash flows for you, I think that's a model we'll continue to see," Fago said.

The industry even saw a leveraged buyout when I Squared Capital Advisors LLC agreed to take Atlantic Power Corp. private in January and renegotiated the $1.31 billion deal in April. The independent power producer owns facilities that use coal and natural gas in addition to renewable fuels like biomass.

"We've had a lot of strategic deals over the last several years, and we're starting to see financials really start to play in the space," Fago added. "If you're privately held and you're cash flow-focused, there's still tons of opportunity in the non-renewable space."

KKR & Co. Inc., for example, agreed to purchase thermal assets from both Sempra and Clearway Energy Inc. in 2021.

FirstEnergy's cash infusion

In another deal involving private equity, FirstEnergy Corp. on Nov. 7 announced it will sell a 19.9% stake in FirstEnergy Transmission LLC to Brookfield Infrastructure Partners LP for $2.4 billion in an all-cash transaction.

FirstEnergy plans to use proceeds to boost its balance sheet, eliminate near-term equity needs and support the company's investment plans.

"At this point, I really feel as though we are certainly built to last from a strategic view," FirstEnergy President and CEO Steven Strah told S&P Global Market Intelligence. "We feel very, very good about our future moving ahead."

The CEO said the pure-play transmission and distribution utility will likely sit on the sidelines of the M&A market for now and focus on organic investments to improve and modernize the grid, especially as it evolves to accommodate renewable energy.

"The integration of renewable power ... we are very well-positioned to help facilitate that in terms of making the necessary investments to be a different company in that regard," Strah said. "So, I don't view any new, large strategic shifts coming. But what we do want to do is we want to embrace the renewable opportunities that are being introduced to our system."