Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Nov, 2021

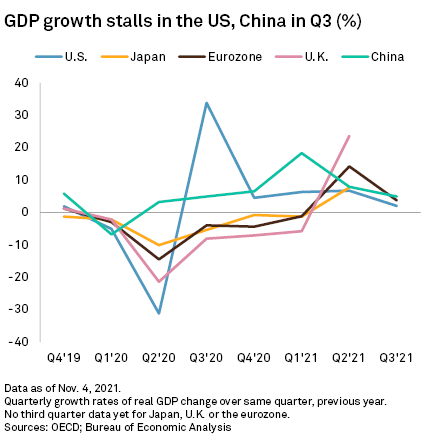

The U.S. will likely bounce back quicker than other major economies from a global slowdown caused by continued COVID-19 woes, supply chain bottlenecks and rising inflation.

GDP growth in the U.S. and China fell in the third quarter and economists have cut their expectations for future growth. Consumer-led economies — including the U.S. and many countries in Europe — will eventually rebound as inflation and COVID-19 pressures alleviate. Meanwhile, China is grappling with a struggling real estate sector and broader corporate debt concerns that will hinder its growth longer term, economists said.

|

"Global post-COVID growth has peaked and we expect it to moderate in 2022," Louis Kuijs, head of Asia economics at Oxford Economics, said in an email. "But China's current slowdown seems more pronounced than what we see elsewhere."

Developed economies in the eurozone enjoyed a stronger third quarter. France achieved better-than-expected growth in the third quarter while the eurozone achieved annualized growth of 3.7%. Economists expect private consumption to moderate in Europe, while labor shortages hamper production in the important automotive sector.

In Japan, industrial activity is suffering due to supply chain disruptions and the economic slowdown in China reducing demand for Japanese goods.

Slowing growth

Economists believe turmoil in supply chains, labor shortages and the recent wave in coronavirus infections contributed to real GDP growth in the U.S. slowing from an annual pace of 6.7% in the second three months of 2021 to 2% in the July-September quarter. This was lower than the consensus expectation of 2.6%.

S&P Global Ratings said in an Oct. 29 report that it now believes its 2021 GDP forecast for the U.S. of 5.7% is "too high," while Morgan Stanley cut its fourth-quarter forecast to 3.8%, down from 6.7% in September.

In China, third-quarter growth slowed to 4.9% from 7.9% in the previous three-month period as a downturn in the residential real estate sector and COVID-19 outbreaks weighed on activity. Early October indicators suggest weakness in China's economy is persisting, with both the official manufacturing and non-manufacturing monthly Purchasing Managers' Indexes — measures of business activity — dropping from September to October. Economists at HSBC expect annualized Chinese growth to slow to 4.6% in the fourth quarter.

"The best of the global recovery is now in the rear-view mirror," Neil Shearing, group chief economist at Capital Economics, said in an email. "Growth is likely to be weaker than most expect over the next year."

Consumer confidence takes a hit

|

The U.S. and Europe jump-started the global economy as lockdown measures were reversed. A sharp — albeit incomplete — recovery in the U.S. jobs market, government stimulus checks and savings built up during lockdowns enabled household spending to recover quickly. Manufacturers in emerging economies — most notably in Asia — were then able to supply those goods and the world economy began to recover the output lost as a result of COVID-19.

Inflation has eaten into paychecks, reducing consumer spending power, while disruption to supply chains limits the availability of goods. Consumption of goods fell by 9.2% in the third quarter, including a slump in expenditure on autos.

High COVID-19 case totals also impacted spending in the service sector. Annualized growth slowed to 7.9% from 11.5% in the second quarter. Overall, consumption fell from nearly 8 percentage points of GDP in the second quarter to 1 percentage point in the third quarter, according to BCA Research.

Consumer sentiment has also fallen. The preliminary release of the closely watched University of Michigan Consumer Sentiment Index fell to 71.7 in October from 72.8 in September, lower than the level in April 2020 when the pandemic first hit.

Yet, U.S. retail spending remains strong, with monthly sales rising to new highs.

Rising COVID-19 cases that discouraged spending are now falling in the U.S. The seven-day rolling average of daily cases climbed from 12,000 in July to a peak of over 172,000 in September, according to an Our World in Data analysis of data from the Centers for Disease Control and Prevention. This has since fallen to 72,000 as of Nov. 3.

|

"We're expecting a pickup in [U.S.] economic activity now that delta [wave] is partially over," said Dana Peterson, chief economist at the Conference Board in a Nov. 3 briefing. "We anticipate no new major variant disruption."

Inflation remains a concern. Consumer prices in the U.S. have climbed by 5.4% year over year on average every month since June. That is a faster pace than other economies.

U.S. consumers also expect inflation to stay near that level well into 2022, according to the latest data from the Federal Reserve Bank of New York's Survey of Consumer Expectations.

Still, economists expect two pressures on inflation, supply chain distortions and elevated energy prices, to ease in 2022. That unwinding will support household spending and give the U.S. economy a further boost. Tiffany Wilding, chief U.S. economist at PIMCO, expects U.S. inflation to return to the Fed's long-term target of 2% by the end of 2022.

PIMCO notes that low stocks of natural gas and coal and a lack of wind have contributed to higher utilities prices across the globe. This has caused power rationing in China and shuttered production at European manufacturers, further disrupting supply chains. Yet these impacts are likely temporary, Wilding said.

Industrial production in Germany fell 1.1% month over month in September, missing the consensus expectation of a 1% rise. Car production achieved a small gain of 2.1% month over month, but that came after an 18.9% decline in August. Eurozone retail sales also unexpectedly fell in September, following weakness in the prior two months, according to data firm Econoday.

|

China's problems mount

China's decline in growth is a more structural downward shift. This is a problem for other Asian countries that depend on exports to China for demand for their goods.

Oxford Economics anticipates China's industrial and GDP growth will slow further on an annualized basis in the fourth quarter, while the high-profile debt crisis at China Evergrande Group and other leading Chinese real estate groups has dented consumer confidence.

"Headwinds will likely persist in the last quarter of the year, as the situation of the property market has remained fragile, while the gas crisis has also emerged as a new drag," Kuijs said. "Policy support is likely to be measured and targeted going forward as authorities are aiming for more balanced economic growth."