Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Feb, 2023

By Garrett Hering and Anna Duquiatan

U.S. imports of lithium-ion batteries, especially those made in China, are booming as demand for electric vehicles and energy storage stations continues to rise.

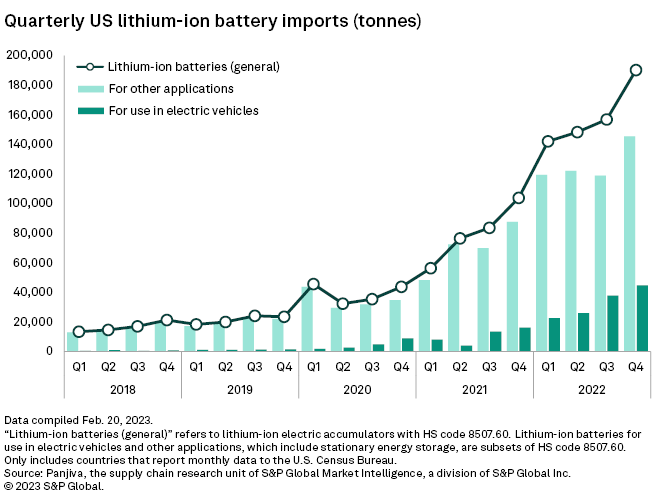

Lithium-ion battery imports climbed to a record 637,396 tonnes in 2022, jumping 99% from 2021, according to data from Panjiva. That marked the third consecutive year in which U.S. battery imports roughly doubled.

The fourth quarter of 2022 also saw the 10th consecutive quarterly increase, with 190,219 tonnes of imported batteries. That was up 83% from a year ago and 21% from the third quarter of 2022.

The skyrocketing shipments come as a wave of recently announced multibillion-dollar battery factories advanced across the U.S., some with financial assistance from the U.S. Energy Department and in partnership with foreign manufacturers. But most remain in the planning or early construction phases, and many will take years to complete.

China-sourced imports expand

Tesla Inc., for instance, plans to build a new 100-GWh lithium-ion battery cell plant and electric heavy-duty truck manufacturing facility in Nevada. The planned $3.6 billion undertaking is an expansion of Tesla's Gigafactory Nevada, which includes a joint venture cell factory with Japan's Panasonic Holdings Corp. that has approximately 37 GWh of existing capacity.

Tesla has not said when the new factory will come online, however, and the battery, EV and storage company continues to rely on batteries from other manufacturers to fuel its growth.

"We feel we can scale a lot faster using both suppliers and internally produced cells," Tesla CEO Elon Musk said on an earnings call in January.

Among Tesla's suppliers is China's Contemporary Amperex Technology Co. Ltd., the world's largest battery-cell maker. The company, known as CATL, also supplies batteries to U.S. energy storage technology and development companies, including Fluence Energy Inc., NextEra Energy Inc., FlexGen Power Systems Inc. and Ameresco Inc., Panjiva data shows.

In addition, CATL is providing technology for Ford Motor Co.'s recently announced $3.5 billion battery factory in Marshall, Mich.

Overall, CATL, BYD Co. Ltd. and other Chinese manufacturers accounted for nearly 87% of U.S. battery imports in the fourth quarter of 2022, up from about 80% the year before.

South Korea, home of battery-makers LG Energy Solution Ltd., Samsung SDI Co. Ltd. and SK Innovation Co. Ltd., made up 5.6% of U.S. battery imports, down from almost 9% in the final quarter of 2021. All three producers are working with automakers to scale up or start U.S.-based battery manufacturing.

Poland, Japan and Germany each accounted for between 1% and 2% of U.S. lithium-ion battery imports in the 2022 fourth quarter.

Panjiva is the supply chain research unit of S&P Global Market Intelligence, a division of S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.