Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Jun, 2022

By Garrett Hering and Anna Duquiatan

| Vistra Corp.'s 260-MW/260-MWh DeCordova energy storage station in Granbury, Texas, built at a gas plant, is one of the newest U.S. battery assets. |

Fighting through ongoing supply chain and trade policy challenges that are delaying many new U.S. energy storage additions, project developers still managed a strong start to 2022.

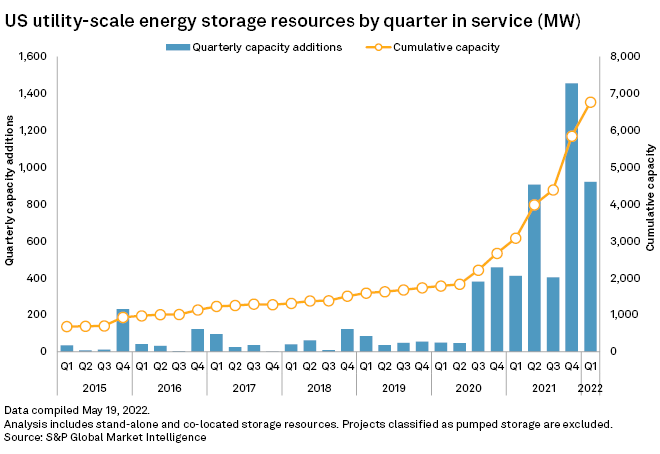

New energy storage resources, mostly one- to four-hour lithium-ion battery systems, totaled 921 MW of installed power capacity in the first three months of the year, more than doubling from the first quarter of 2021, according to S&P Global Market Intelligence data.

While down nearly 37% from last year's fourth quarter, it marked the second-best quarter yet for electrochemical energy storage.

The biggest new assets entering operation in the quarter were Goldman Sachs Renewable Power LLC's 140.3-MW/561.2-MWh Slate Solar Project, a battery-backed photovoltaic facility in Kings County, Calif., and Terra-Gen LLC's 140-MW/560-MWh Valley Center Battery Storage Project, a stand-alone storage facility in San Diego County, Calif.

Also in the first quarter, Jupiter Power LLC completed its approximately 100-MW/200-MWh Flower Valley II Battery Storage Project in Reeves County, Texas, while NextEra Energy Inc. subsidiary NextEra Energy Resources LLC completed a pair of solar-plus-storage projects in Nevada, the Dodge Flat Solar Energy Center and the Fish Springs Ranch Solar Farm, with a combined 300 MW of photovoltaic and 75 MW of four-hour battery storage.

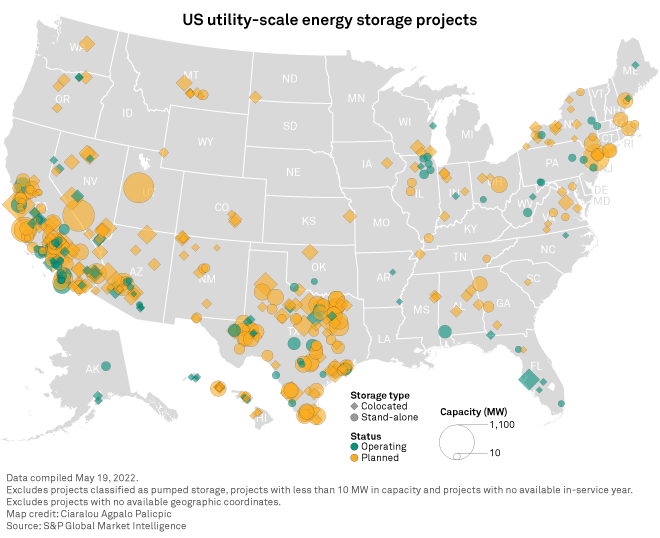

The first-quarter performance pushed total operating nonhydroelectric power storage capacity in the U.S. to nearly 6,800 MW, with the Southwest and Texas together accounting for about 75% of that.

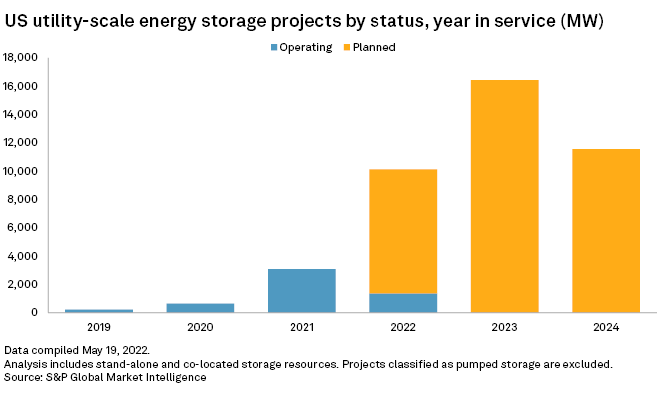

If near-term developer plans come to fruition, up to 10.1 GW could be completed in 2022. While delays may push a significant portion of that into future years, many large-scale projects are advancing. In the second quarter, Vistra Corp. announced the completion of a 260-MW, one-hour system at its Decordova CT natural gas plant in Hood County, Texas, currently the state's biggest battery asset.

Another 16.4 GW is planned to enter service in 2023, followed by almost 12 GW in 2024, for a total of 38.1 GW of planned power storage additions from 2022 to the end of 2024, Market Intelligence data shows.

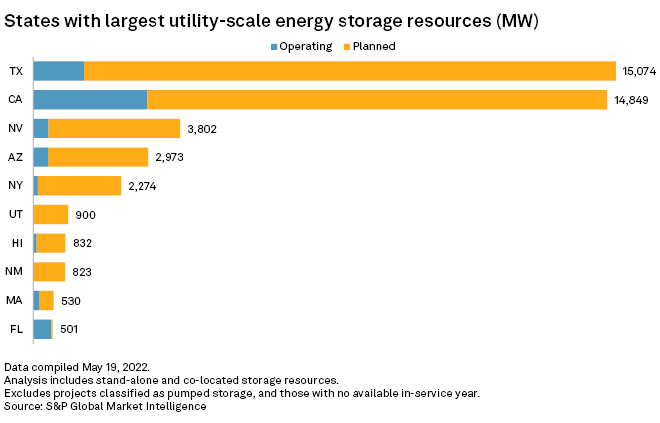

As of May 19, California led the country with roughly 3 GW of operating battery storage capacity — mostly four-hour resources. But Texas has overtaken the Golden State in the near-term pipeline, with 13.8 GW planned capacity compared with California's 11.9 GW. Developers plan to bring online most of that over the next three years.

Significant additional volumes are planned in Arizona, Nevada, New Mexico and Utah, combining for 7.7 GW. Developer interest is especially strong in Nevada, where plans for large-scale battery storage stations have been rapidly accumulating in response to a transmission buildout coupled with in-state demand from Berkshire Hathaway Energy's NV Energy Inc. and utilities in California.

More than 2.1 GW is also planned in New York through 2025, in addition to 115 MW in operation. The state has goals of reaching 1.5 GW of energy storage by 2025 and 3 GW by 2030, though Gov. Kathy Hochul in January called for boosting the 2030 target to 6 GW. In Hawaii, which is experiencing widespread delays of solar and battery projects, 748 MW is planned, according to Market Intelligence.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.