Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Jun, 2021

The security of longer-term supply contracts signed between U.S. utilities and coal producers is becoming increasingly rare in an industry struggling with declining demand.

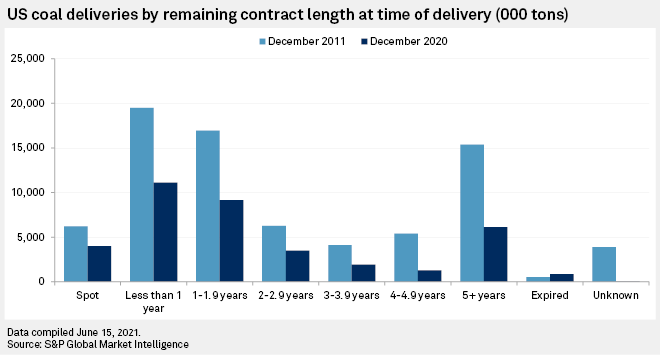

Longer-term contracts offer coal companies the certainty of incoming revenue needed to make investments in future infrastructure. They can also help convince investors of future profitability. An S&P Global Market Intelligence analysis found a growing share of the monthly coal delivered to power plants is arriving with fewer than three years remaining on the contract term. Meanwhile, the percentage of coal provided with over three years remaining in the agreed period is trending downward over the last several years.

"In my opinion, it's no surprise because the utilities don't really know how much coal-fired power they're going to need," said John Hanou, president of Hanou Energy Consulting LLC. "I think they just don't want to commit to any kind of term because it's possible that the plant may shut down or get out-dispatched by other energy sources, namely, natural gas."

Hanou said that, historically, coal companies have used spikes in coal prices — when utilities are most in need of coal — to lock in longer-term coal contracts. However, over the past few years, coal prices have generally been depressed, even to the point of driving many U.S. coal mining companies to bankruptcy.

In an annual report, Peabody Energy Corp., the largest coal producer in the U.S., said that most of its sales are under agreements of a year or more but also pointed to a trend of customers under long-term agreements seeking shorter-term contracts. Peabody noted its largest customer accounted for approximately 9% of total revenues from coal supply agreements and has contracts expiring at various times between 2021 and 2023.

Peabody attempts to enter into new, long-term supply agreements when the prices and terms and conditions are favorable but the company said customers could be less likely to do so.

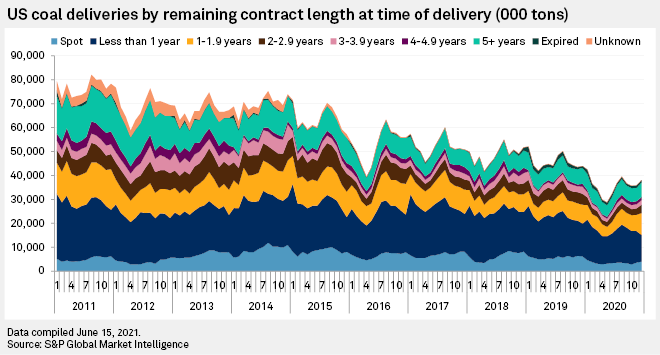

Across the country in 2020, about 48.1% of coal deliveries arrived at U.S. power plants on spot contracts or on contracts with less than a year remaining on the term. Depending on the month in 2020, between 69.5% and 74.1% of coal delivered to U.S. power plants arrived through spot deals or contracts with less than three years remaining in the term. That compares to between 62.3% and 67.3% of coal deliveries across the months of 2011.

As recently as February 2012, 21.3% of coal arrived on contracts with more than five years remaining in the term. While that figure dropped to as low as 11.5% in April 2017 and has generally trended lower since 2021, the share of coal delivered on contracts of greater than five years remaining increased slightly through 2020.

Robert Godby, an energy economist at the University of Wyoming, said shorter-term contracts give power plants more flexibility with fuel and operating costs and reduces uncertainty.

"They don't want to be on the hook for a long-term take or pay contract where they don't need the coal," Godby said. "In some cases, it may be a question of an early retirement, but regardless, capacity factors are falling, and falling quickly."

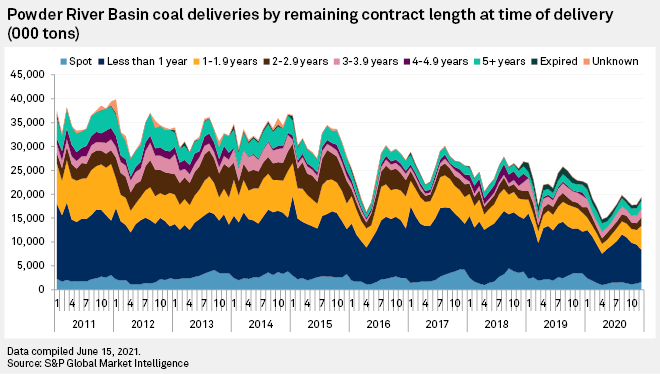

After recent bankruptcy-related disruptions in the Powder River Basin, some power plants may also be skeptical of a smaller operation's ability to fulfill a longer-term contract, Godby said. Additionally, the economist said, the declining number of contracts is a serious concern for smaller mines. Particularly in the Powder River Basin in the western U.S., mines rely on economies of scale. A reduced customer base increases uncertainty, leading to a "downward spiral effect" where mines become increasingly unviable.

"As contracts go away, uncertainty mounts," Godby said. "Costs also rise due to reduced economies of scale, and they rise if financial market access is reduced, reducing reinvestment, reducing the mines' competitiveness as costs increase, worsening uncertainty and access to capital, increasing costs and so on."

The Institute for Energy Economics and Financial Analysis, or IEEFA, recently counted 82.3 GW of announced coal plant retirements and conversions for 2021 through 2030, up more than 11 GW since March, said IEEFA data analyst Seth Feaster. The analyst said there was also a "huge rise" in coal plant retirements slated for 2031 to 2040, up to 36.1 GW from 19.4 GW in March.

Feaster said a trend toward shorter contracts reflects how quickly a transition from coal is occurring and how utilities are becoming less committed to the fuel. The analyst said utilities are "understandably reluctant" to lock in long-term contracts due to retirements combined with lower coal utilization rates, an overhang in coal stockpiles, uncertainty around gas prices and a diminishing economic case for coal-fired power.

"For miners, the short-term risks are growing significantly, imperiling capital investment decisions and planning in general with short-term contracting, compounded by the number of customers rapidly dwindling," Feaster said.

Coal supply risks are also growing for utilities, the analyst said, increasing the potential for unexpected disruptions into 2022 and beyond.

"There continues to be way too much supply chasing an ever-shrinking market," Feaster said. "Coal-market conditions may have stabilized somewhat after last year's sharp drop and the increase in gas prices, but it's only temporary before the next leg down."

The trends vary slightly by region. For example, in Central Appalachia, coal deliveries to power plants on contracts with more than two years remaining on the term are nearly nonexistent. As the region depleted much of its coal reserves, producers began to focus on higher-margin metallurgical coal, which is not part of the analysis of coal delivered to power plants. The price of the steelmaking product fluctuates and is often sold domestically abroad on shorter contract terms.

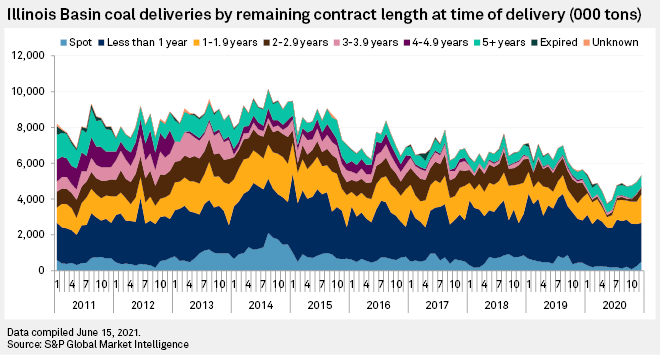

After a dip in production early in the year, both the Illinois Basin and Powder River Basin saw increases in coal deliveries in the second half of 2020, though they did not recover to 2019 levels. In both regions, deliveries predominantly arrived through contracts with two years or fewer remaining on the term.

Hallador Energy Co. CEO Brent Bilsland noted on a May 4 earnings call that a return to longer-term coal supply contracts could help alleviate a "risk premium" hanging over companies in the coal sector such as his Illinois Basin coal company.