Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Mar, 2021

| A tugboat pushes coal barges down the Monongahela River in southwestern Pennsylvania. Source: Zach Frailey/Moment via Getty Images |

After a challenging 2020, U.S. coal companies now generally face a lower probability of default but are still grappling with substantial obstacles to accessing capital.

U.S. coal consumption is in a yearslong structural decline but took a further hit in 2020 as the COVID-19 pandemic drove a decrease in electricity demand. While 2021 appears to hold lower default risk across many sectors, some U.S. coal businesses remain in a precarious financial state.

"The access to capital hasn't changed for U.S.-based coal companies. It's still very limited and very constrained," S&P Global Ratings analyst Vania Dimova said. "It's still difficult to raise capital. It's still difficult to make a profit because we're facing continued thermal [coal] decline. That trend hasn't reversed, and we don't expect it to reverse."

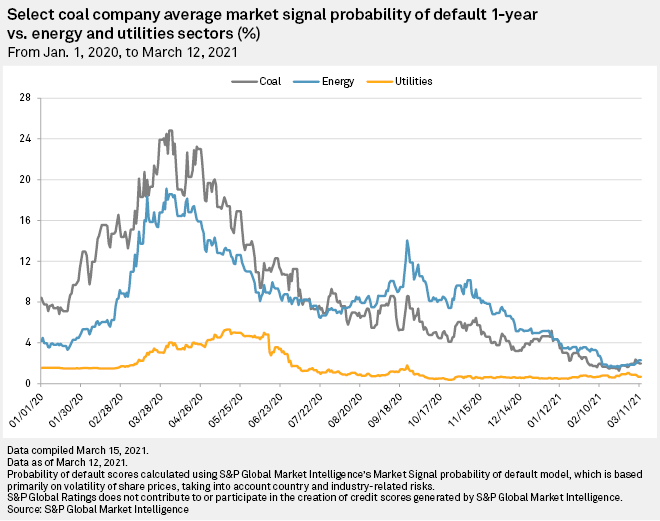

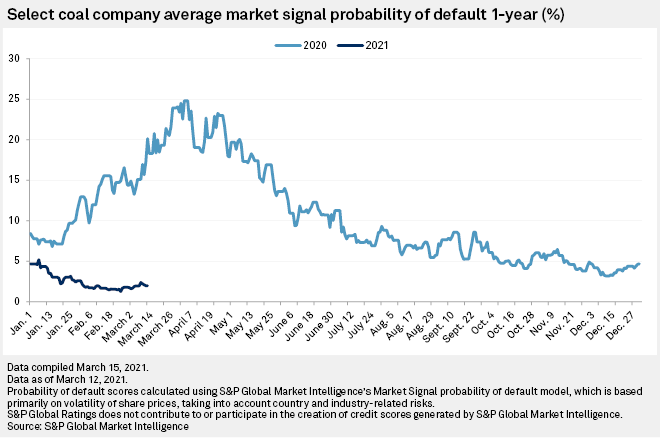

The U.S. coal sector's probability of default spiked much higher than the broader energy sector in the early days of the pandemic, reaching a score above 20% in March 2020. However, the measure has since settled to lower levels — less than 3% as of March 12 — for both energy and coal companies in the U.S. The probability of default across the utility sector has remained relatively low, spiking just above 4% in the first half of 2020 before settling below 1% in early March.

The figures are based on a model devised by the Credit Analytics branch of S&P Global Market Intelligence and represent the average of the one-year probability of default scores for U.S. public companies within each sector that trade on the NYSE, Nasdaq or AMEX. The scores are based primarily on share price volatility and take into account country- and industry-related risks.

Shares of most U.S. coal companies declined sharply in the first quarter of 2020 as the impacts of the pandemic began. By the end of 2020 and through the start of 2021, share prices for several coal companies, particularly those focused on metallurgical coal, had steadily climbed away from the lows seen in early 2020.

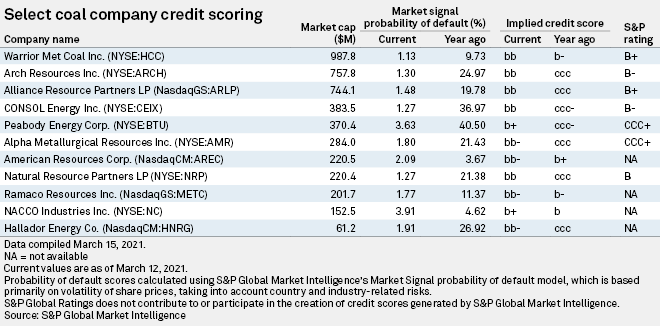

Of the publicly traded U.S. coal companies analyzed by Market Intelligence, none received higher than a B+ rating from Ratings. The rating agency defines a B-rated company as a speculative-grade entity that is "more vulnerable to adverse business, financial and economic conditions" but currently can meet financial commitments.

In the face of rising pressure from investors focused on environmental, social and governance issues, many producers are pivoting away from assets that produce coal for the power sector. That pivot has included corporate name changes and asset divestments to reflect a shift to focusing on the metallurgical coal provided to steelmakers rather than thermal coal for power customers.

Companies with more metallurgical coal exposure may have an easier time than thermal coal producers obtaining financing as long they demonstrate good management costs and solid assets, Dimova said. While there are efforts aimed at reducing coal use in the steel supply chain, many of those technologies are in the early days of development.

The No. 1 ESG investment strategy people are concerned about is climate and carbon, Stewart Glickman, a CFRA energy equity analyst, said in an interview.

"There are so many folks that don't want to contribute to the carbon problem and climate change, that they are moving away from coal," Glickman said. "It makes it very difficult I think for a lot of coal producers because they're trying to sell into a dwindling market. I think that's the biggest factor that they have working against them."

Moody's lead coal analyst Benjamin Nelson said this year the agency has more stable outlooks on the coal companies it rates, and companies generally have better liquidity and cash flow generation prospects. However, the rated portfolio of companies tends to favor coal companies with stronger balance sheets.

The sector experienced some reprieve from higher coal prices in 2018. However, Moody's previously noted that the amount of cash coal companies returned to shareholders exceeded the industry's rated debt at the end of 2019.

As a result, several coal companies entered the pandemic with a difficult financial condition.

"It's just kind of a slow decline, and the companies are going to have to catch up with their balance sheets to make sure that they can sustain the debt levels and then keep pushing maturities out, or hopefully, improving the balance sheet so they can sustain those burdens," Dimova said.

Across the economy, businesses turned to debt issuance, term loans and other measures to shore up liquidity and deal with cash burn during the pandemic, Nelson noted. However, it was more challenging for the coal sector to secure the cash it needed to deal with the economic shock of the virus.

"We saw stuff like equipment financing, convertible notes issuance, tax-exempts, and some extension of existing secured instruments, but not so much new ones," Nelson said. "We saw no coal company do an unsecured bond deal, for example."

Nelson added that the struggle to access capital means Moody's puts more emphasis on a company's ability to handle liquidity internally.

During the company's Feb. 19 earnings call, Ramaco Resources Inc. CEO and Executive Chairman Randall Atkins noted the sector's challenge to accessing coal markets. Atkins said the metallurgical coal producer is paying for new projects with working capital, small equipment credit lines and free cash flow.

"The capital markets are punishing all coal groups for ESG reasons, underperformance and certainly [having] any thermal production," Atkins said. "To make any headway, you somewhat have to go it alone."

Consol Energy Inc., a Pennsylvania-based thermal coal producer, is focusing on reducing its debt levels ahead of upcoming maturities on its debt.

"Access to capital for coal companies has been shrinking over the past several years, and we anticipate this trend will only worsen," Consol President and CEO Jimmy Brock said on a Feb. 9 earnings call.

Still, the outlook for the export market and domestic coal burn does offer a few positives for coal in 2021, Nelson said.

"I wouldn't say that cash flow generation will be wonderful," Nelson said. "We have some companies that should look pretty good from a cash flow generation perspective. We have some others that, even with an improvement in prices, it looks like it'll be modest or even breakeven."

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.