S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

1 Aug, 2022

By Siri Hedreen

| A feeder pipe transports CO2 at Shell's Quest Carbon Capture project in Alberta. Source: Shell Canada |

The Inflation Reduction Act, if passed, is poised to become a boon for carbon capture technology, according to policy analysts.

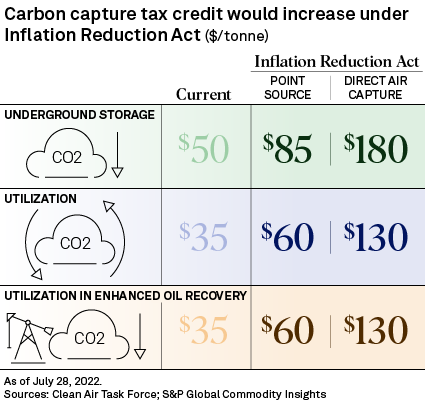

Carbon capture groups cheered the budget reconciliation deal announced July 27 by U.S. Senate Majority Leader Chuck Schumer, D-N.Y., and Sen. Joe Manchin, D-W.V. The agreement would increase subsidies by up to 70% for facilities that capture their emissions.

"All of a sudden, it's like giving steroids to the industry," said Matt Bright, carbon capture policy manager at Clean Air Task Force. "Some of these projects that are in planning and saying 'OK, we're going to break ground' — I have a feeling you're going to have many more of those announced very quickly over the next year or two, if this [deal] could be inked."

The Democrats' $369 billion climate and energy deal would increase those tax credits to up to $85 per tonne for point source emitters, such as industrial facilities or power plants. Direct air capture facilities would be eligible for an even greater subsidy of up to $180 per tonne.

According to the Carbon Capture Coalition, the 45Q expansion, coupled with bipartisan infrastructure law spending, could spur a 13-fold increase in the deployment of carbon capture tools by 2035. Spokesperson Madelyn Morrison called the package "the most transformative and far-reaching policy support in the world for the economywide deployment of carbon management technologies" in a July 28 statement.

Direct air capture gains credibility

The proposed tax credit expansion would be a particular game-changer for direct air capture, according to policy experts. Direct air capture removes CO2 from ambient air, resulting in a net reduction in atmospheric emissions. Point-source carbon capture, by contrast, installed to offset industrial emissions, is net-zero at best. But direct air capture is less efficient, with little profit motive.

Experts said the budget reconciliation bill would go a long way in making that technology more worthwhile.

"It's absolutely changing the dynamics of the economics," Bright said of the proposed credits. "I mean, you're going from $50 to $180 [per tonne] — more than a threefold increase."

Tax credits alone are not enough to recover the cost of direct air capture, which is still more than $200 per tonne at best, according to Bright. But the credit would send a market signal, bringing direct air capture "in the imagination of a much bigger sphere of dollars" that spurs innovation and, in turn, reduces costs, Bright added.

The bill would also lower the capture threshold that makes a facility eligible for tax credits to 1,000 tonnes per year for direct air capture plants and to 18,750 t/y for electric generating facilities. Capture equipment installed at power plants must be capable of capturing at least 75% of CO2 emissions.

All other facilities must have a capture rate of 12,500 tonnes per year.

Critics rip 'false solutions'

Carbon capture is divisive among climate activists, with opponents calling it an expensive distraction at best, and an excuse to keep emitting at worst.

Environmental group 350.org slammed the reconciliation bill for its 45Q tax credits, among other provisions. "The bill props up false solutions, like the technological carbon capture scam industry, which will only contribute to the further pollution of the planet by providing more giveaways to the fossil fuel industry," J.L. Andrepont, the group's senior policy campaigner and policy analyst, said in a statement.

Others say the decarbonization tool is the world's best shot for hard-to-abate sectors, such as steel- or cement-making — a stance backed by the latest Intergovernmental Panel on Climate Change report, which said carbon capture may be necessary to reach net-zero emissions by 2050.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.