S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Apr, 2021

By Jon Rees

British high street banks' planned branch closures for 2021 already outstrip total closures for 2020, as lenders focus on boosting their provision of digital services to customers.

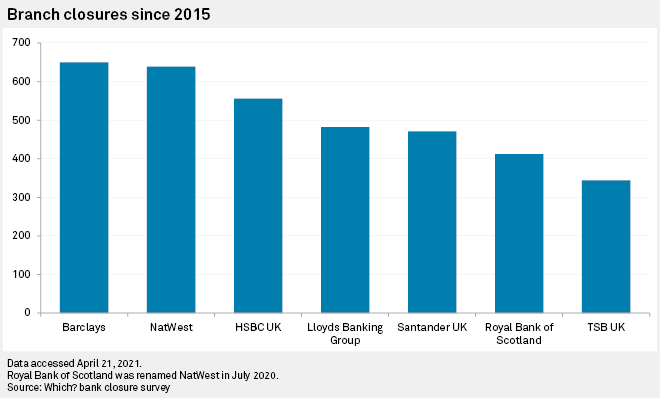

More than 4,000 bank and building society branches have closed in the U.K. over the past six years, according to a report from consumer group Which, at a rate of about 50 a month.

"It's a question of viability," said John Lyons, banking specialist and partner at PWC.

There has been a huge pivot to digital over the last 18 months, particularly with COVID-19, he told S&P Global Market Intelligence, with many lenders investing heavily.

"They see the percentage of transactions being completed digitally constantly rising [and they] simply have to think about how many branches they have," Lyons said.

Banks are looking to balance their operations, because of the low-interest rate environment which has seen net interest margins squeezed, so they have to balance their operations to bring them in line with the realities of the economic environment, he said. This trend is being seen around Europe.

Branch closures

In 2020, as a result of a pause in closures during the pandemic, there was a slowdown in branch closures with 368 branches shutting — Barclays PLC topped the list by closing 105.

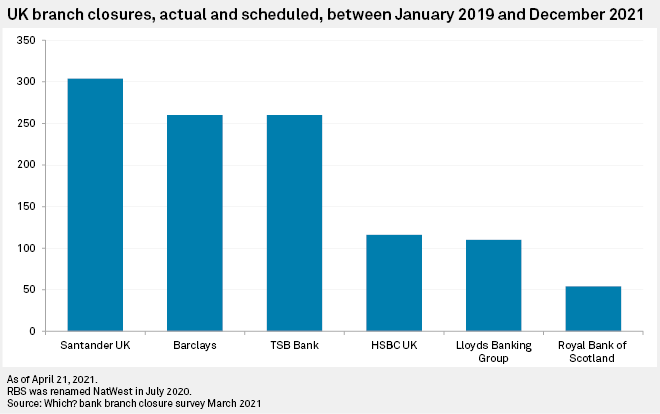

The scheduled branch closures so far this year, however, already outstrip the closures from last year with TSB Bank PLC set to close 155 branches, Banco Santander SA subsidiary Santander UK 111, HSBC Holdings PLC 82 and Barclays 63, while Marks & Spencer Group PLC's M&S Bank will close all its instore branches by the end of the summer.

The growth in digital banking has clearly been a key driver for banks looking to reduce costs through branch closures. Indeed, the Financial Conduct Authority said the average cost of running a bank branch is £590,000 a year and some banks, according to the branch closure assessments which banks provide, have only a handful of regular customers.

Even before the pandemic struck, accessing banking services online had risen fast, particularly among younger account holders. UK Finance, an organization that represents banks, said nearly 10 million people, or 18% of the adult population, registered for mobile payments in 2019, with 79% of these registered users recording a payment.

"Growing numbers of customers are opting to use new technologies to pay and manage their money at a time and place that's convenient to them, particularly during the pandemic," a UK Finance spokesman told S&P Global Market Intelligence.

"But technology is not for everyone and banks are committed to ensuring customers can continue to access the important services they need, including access to cash. Branches play a key role in the life of local communities, meaning decisions to close them are never taken lightly."

Digital engagement

In 2020, NatWest Group PLC, Lloyds Banking Group PLC and HSBC were among the top five rated finance apps for time spent in-app, according to app research company App Annie. However, for average monthly session per user, fintech apps outstripped mainstream banking apps with 3x as many sessions for users than their high street rivals.

The main high street banks claim varying degrees of digital engagement with their customers.

Lloyds said it has 17.4 million active digital customers, with 12.5 million mobile app users. Barclays said more than 11.5 million of its customers are digitally active, and NatWest said it had 9.4 million digitally active customers with 7.7 million mobile users.

HSBC said 90% of all customer contact now took place over the phone, internet or smartphone with over 60% of HSBC UK's personal customers digitally active. Taking account of the impact of the pandemic, HSBC UK said the number of customers using branches has fallen by a third in the past five years.

It is a similar picture at TSB, which said 91% of all customer transactions are completed digitally.

"The decision to close a branch is never taken lightly, but our customers are banking differently — with a marked shift to digital banking," a TSB spokesman told S&P Global Market Intelligence.

Though there has been a steady increase in the number of customers who access high street banking services digitally, there is concern that banks may be leaving less digitally aware customers without access to services.

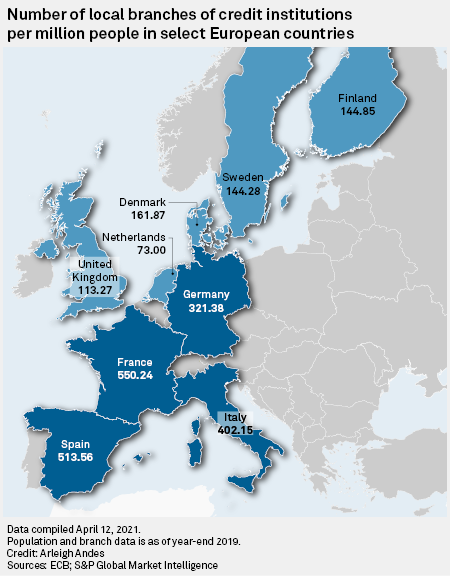

The U.K. now has fewer branches than most major European countries. According to S&P Global Market Intelligence data, it has 113.27 bank branches per million people, compared to 513.56 per million in Spain and 550.24 per million in France.

PWC's Lyons said that straight comparisons are not easy, though. For instance, France has a lot of regional banks that serve their local area, "so French banks are coming at this from a slightly different heritage than the U.K.," he said.

Members of Parliament's Treasury Select Committee have warned that banks risk leaving customers behind in their rapid embrace of digital technology, noting that visits to branches fell by a quarter from 2012 to 2019.

"There are still large sections of society who rely on bank branches to carry out their banking needs. A bank branch network, or at the least, a face-to-face banking solution, is still a vital component of the financial services sector, and must be preserved," they said.