Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Oct, 2021

By Matt Smith

Turkey's banking regulator could further restrict consumer borrowing as it tries to control high levels of inflation, potentially squeezing margins at the country's privately owned banks.

Lower limits on credit cards and personal loans are possibilities, as are increased risk-weighted asset requirements for general purpose loans and auto loans, according to Sevgi Onur, vice president and banking analyst at investment company Seker Invest. The Banking Regulation and Supervision Authority cut the maximum tenor for personal loans of more than 50,000 lira in late September.

"It's highly likely we'll see some of these measures," Onur said. "Worries about inflation, which is stubbornly high, and the current account deficit could force the regulator to act."

The central bank has more than doubled interest rates since May 2020 to 18% as it unwinds pandemic support measures and grapples with inflation that hit 19.58% in September. The country's target rate is just 5%.

Consumer loan exposure

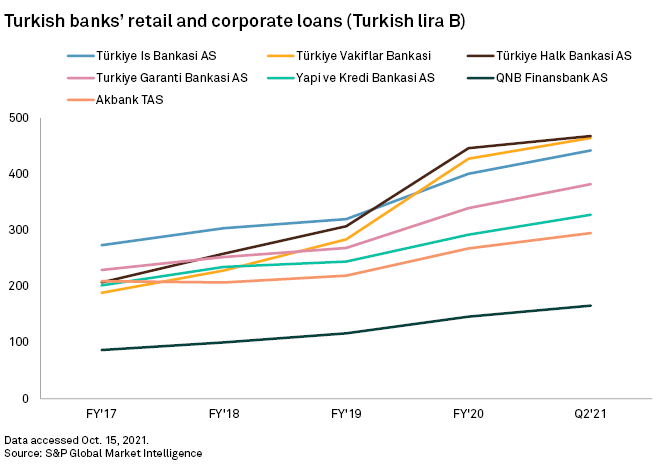

Turkey's privately owned banks have greater exposure to consumer lending than their government-controlled rivals, S&P Global Market Intelligence figures show. Roughly 30% of loans extended by QNB Finansbank A.S., Turkiye Garanti Bankasi A.S. and Yapi ve Kredi Bankasi A.S. as of the end of the second quarter were to retail borrowers, compared to about 20% at Türkiye Halk Bankasi A.S., or Halkbank.

"Private and foreign banks will be more affected should the regulator impose the mooted curbs on consumer lending," Onur said. Onur believes the regulator could lower limits on consumer credit cards and personal loans based on income. Currently, the credit card limit is 5x a person's monthly salary, while monthly repayments on general purpose loans should be no more than 60% of monthly income.

The regulator declined to comment on potential further lending restrictions when contacted by Market Intelligence. It may limit the size of retail loans and impose additional reserve requirements for extending retail loans above a certain level, Bloomberg News reported last month.

Banks' required reserves to back loans were used extensively as an adjustment tool by the regulator to facilitate and boost lending growth during last year's extraordinary pandemic conditions.

It it only likely to use this tool again if retail loan growth continues at a brisk pace with clear repercussions on inflation, the current account deficit and Turkey's macro balances, according to Serhan Gok, head of equity research at brokerage Yatırım Finansman in Istanbul.

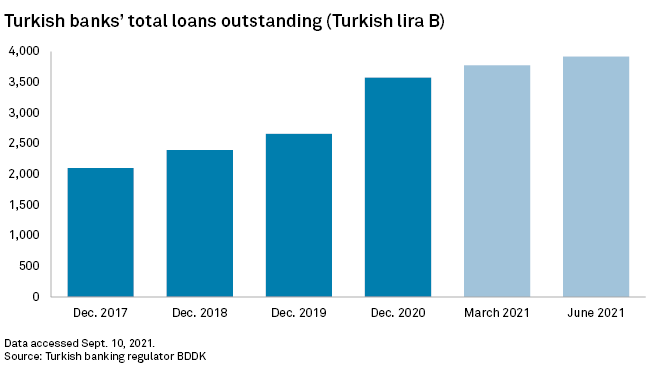

Total outstanding retail loans at Turkish banks grew by 42% in 2020, according to data from Yatırım Finansman. In 2021, up to Sept. 10, the growth rate was 11%. Gok said a temporary increase in retail lending growth was to be expected given one-off factors such as the reopening of the economy.

Total retail and corporate loans at Turkey's biggest banks — state-controlled Halkbank and Türkiye Vakiflar Bankasi, and privately held Garanti Bank; Türkiye Is Bankasi A.S., or Isbank; Yapi Kredi; QNB Finansbank; and Akbank TAS — increased by 10% in the first six months of 2021, according to Market Intelligence figures. This followed a 32% increase in 2020 spurred especially by big jumps at Halkbank and Vakiflar.

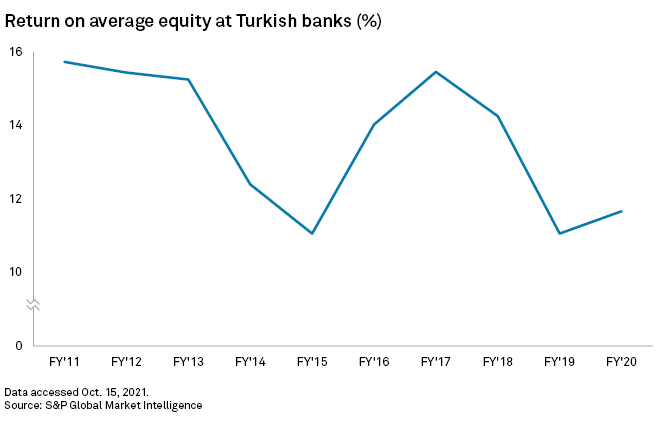

Profitability at Turkish banks in 2020 rebounded from a low in 2019. Aggregate return on average equity increased to 11.67% from 11.06%, but this was down from 15.46% in 2015.

As of Oct. 18, US$1 was equivalent to 9.31 Turkish lira.