S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Jan, 2021

By Evan Fallor

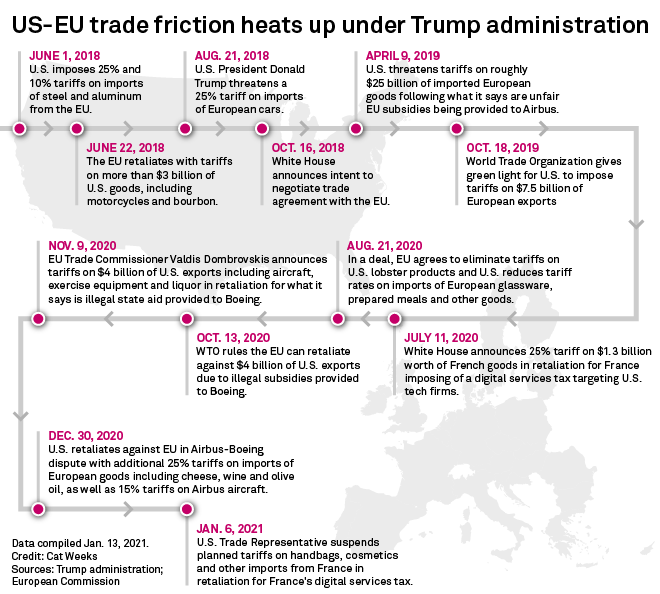

The last-minute decision by the outgoing Trump administration to hold off on retaliating against France for its digital services tax is good news for U.S. importers and consumers but could also mean that the incoming Biden administration will have to act not only on this outstanding tax but also on others across the globe.

The Office of the U.S. Trade Representative on Jan. 6 announced that it would not impose 25% tariffs on a group of $1.3 billion of French goods, including handbags, Champagne, cheese and cosmetics. The administration had been slated to do so following a Section 301 investigation into Paris' decision to impose a digital services tax, or DST, on American tech giants like Facebook Inc. and Apple Inc. Several European countries have already imposed taxes of 1.5% to 7.5% on digital services like ad sales, which these American firms say will cost them tens of millions of dollars in annual revenue.

The decision to reverse course on the retaliatory tariffs helps the Biden administration "a bit," said Simon Lester, associate director of the Stiefel Center for Trade Policy Studies at the Cato Institute in Washington.

"Undoing tariffs that are in effect can be difficult because there will be an interest group or two who wants to keep them in place," Lester said in an interview. "So it's probably better for the Biden administration not to have to deal with that and to start with a cleaner slate."

The Biden administration will inherit a frayed U.S.-EU relationship, one that was strained under President Donald Trump due to a number of battles including the DSTs. However, despite the tariff backtracking, there still remains a handful of Section 301 investigations into digital services taxes completed by the Trump administration, and Lester said the incoming Biden administration will feel pressure to act.

The USTR has released findings of its DST investigations for Italy, India and Turkey and said this month that ongoing DSTs in 10 other areas have progressed "significantly" but not concluded. Holding off on French tariffs will "promote a coordinated response" among all of the ongoing DST investigations, the agency said.

OECD blueprint

France pushed ahead with its DST in 2020 after the U.S. pulled out of talks on a global corporate tax revamp based on a blueprint from the Organisation for Economic Co-operation and Development, or OECD, which would allow countries to tax sales in their jurisdiction and not only where they register their subsidiaries. The proposals, backed by Germany, France, the U.K., Spain and Italy, also call for a minimum corporate tax rate to avoid a race to the bottom by nations trying to lure companies to their shores.

If implemented, the new regime could raise an extra $100 billion of tax for countries globally.

"I think the postponement of the 301 remedies does offer an opportunity for Biden, especially if the OECD can come to at least a preliminary resolution in the coming months," Julia Friedlander, a senior fellow at the Atlantic Council, said in an interview. "USTR understands that it wasn't going anywhere, especially because conversations behind the scenes remain productive and technocratic, and they have always been that way despite Trump's bluster."

Friedlander said she is optimistic about a resolution. Companies know they have to pay, but just want to know what it will be, and everyone involved understands the unilateral taxation creates sector distortions that blow back on economic growth and small technology businesses, especially amid the coronavirus pandemic.

"If even a preliminary agreement is reached, the Biden administration can dispatch with the 301s," Friedlander said.

US company 'discrimination'

The tariffs stem from the Trump administration's investigation into France's digital services tax approved in 2019, which the trade representative argued in its findings disadvantaged U.S. companies and restricted American commerce. According to Panjiva, a business line of S&P Global that covers international trade, DST proposals from other countries have typically targeted 2% to 7.5% of revenues earned within the relevant country. Panjiva found that the U.S. accounted for roughly 56.8% of 20 top web-focused companies in 2019, with an average ratio of taxes to revenues of 2.2%.

The OECD proposal would not only apply to tech companies but also allow the U.S. and others to tax European luxury goods companies.

On the same day as the determination not to impose tariffs on French goods, the U.S. trade representative ruled in a separate Section 301 review that digital services taxes implemented by India, Italy and Turkey "discriminate against U.S. companies, are inconsistent with prevailing principles of international taxation, and burden or restrict U.S. commerce."

The decision to hold off on the France-specific tariffs and lump the investigations into one large group "dumps the problem in their lap," said Bill Reinsch, senior adviser for the Center for Strategic and International Studies in Washington. However, he said the Biden administration is not automatically locked into treating all the investigations as one.

"That's probably better for them," Reinsch said in an interview. "They don't have to decide whether they want to unwind something Trump did and they can just focus on what they want to do."

Biden is already inheriting a number of issues with the EU besides the digital services tax spats. Tariffs on metals from the EU imposed by Trump in 2018 remain, as does the carbon border tax being considered by the European Commission. The U.S. also recently widened its tariffs in the decades-old Boeing Co.-Airbus SE dispute.

"There is lots of talk about U.S.-EU cooperation, but that won't be easy with disputes like this one festering," Lester said.