Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Dec, 2021

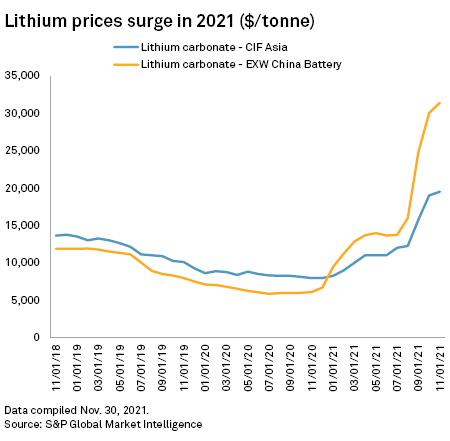

The cost of lithium-ion batteries could increase by over 16% in 2022 on the back of surging lithium carbonate prices, according to a Benchmark Mineral Intelligence analysis released Nov. 30.

The price of Chinese battery-grade lithium carbonate, a critical ingredient in most rechargeable batteries, has soared by 346% in 2021 due to high demand from electric vehicles, tight supply and shipping delays. That has strained automakers already navigating congested supply chains, according to the price reporting company's findings.

Lithium carbonate plays an important role in the lower cost lithium-iron-phosphate battery cells used in short-range EVs popular in China. But lithium-iron-phosphate batteries could soon rise in price.

"While most battery and EV manufacturers have signed long-term lithium supply agreements, which protect them from near-term price rises, those are up for negotiation at the end of this year," Benchmark Mineral Intelligence's report stated. "Future contracts with lithium producers could include more frequent 'price breaks' to reflect price increases."

Battery and EV manufacturers have also been hit with higher price tags for industrial metals, electrolytes, copper foil and binder materials. Although the cost of batteries dropped by almost two-thirds between 2014 and 2020, rising raw material costs in 2021 have reversed this trend, according to Benchmark Mineral Intelligence.

Chinese battery-producer BYD Co. Ltd. disclosed that it would increase its cell prices by 20% starting in November due to rising raw material costs, Chinese media company Caixin reported Oct. 27, citing a company letter to clients. BYD did not immediately respond to a request for comment.

The uptick in manufacturing costs is driving companies throughout the battery supply chain to stake out more control of upstream mining or strike longer-term lithium supply agreements.

On Oct. 28, the world's largest battery-maker, Contemporary Amperex Technology Co. Ltd., announced that it would establish a mining subsidiary in China's Jiangxi province to extract lithium for its batteries. Shortly before, the company failed to acquire lithium producer Millennial Lithium Corp. and its assets in Argentina after being outbid by Canadian lithium developer Lithium Americas Corp.