Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Dec, 2024

By Iuri Struta

The new year is poised for a resurgence in tech IPOs as lower interest rates and an investor shift to small- and mid-cap companies combine to create a more welcoming market for debuts.

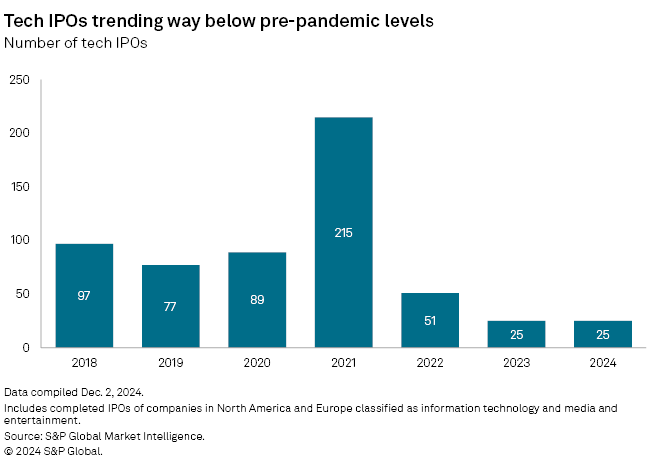

A pandemic-fueled demand for digital transformation drove tech and media IPOs for companies based in North America and Europe to a multiyear high of 215 in 2021. That number collapsed the following year, and the market has remained muted ever since. For 2024, there were 25 tech and media IPOs through Dec. 2.

However, the current environment presents the most favorable conditions for a recovery of IPOs in the past three years. Equity gains recently have expanded beyond mega-cap tech stocks to include smaller and midsize companies, which bodes well for companies considering going public. Also, after hitting a low in 2023, tech valuations have begun to recover somewhat in 2024, making an IPO a more palatable exit option for investors who have been sitting on the sidelines.

"We and our clients have been operating with a view that the IPO markets are closed," Gregory Bedrosian, CEO of investment bank Drake Star Partners, said in an interview with S&P Global Market Intelligence. "But more recently, we've seen IPOs floated as an exit scenario a bit more."

Bulls come for small

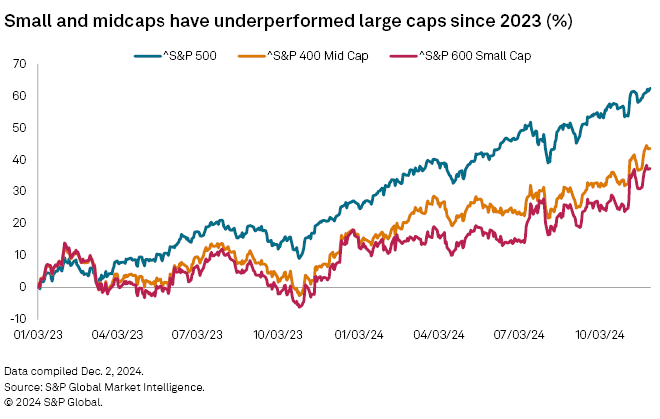

Further fueling the IPO market is rising investor interest in small- and mid-cap stocks. While mega-cap technology stocks have pushed US indexes to multiple all-time highs this year, investors appear to now be shifting their attention away from the dominant Big Tech players such as Microsoft Corp., NVIDIA Corp. and Meta Platforms Inc.

"Performance has been very concentrated in a few names," Joseph Endoso, president of Linqto Capital, said in an interview. "A broadening out of the performance into mid- and small-caps should help the IPO market." Linqto helps retail and small investors invest in private technology startups.

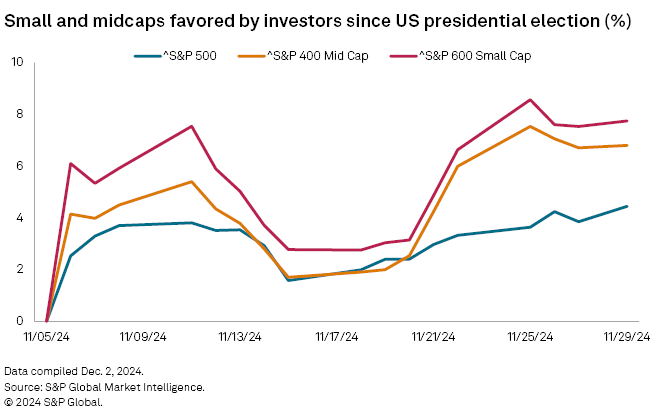

Some of that outperformance has been attributed to declining interest rates as well as the results of the US presidential election. An expected deregulatory environment under President-elect Donald Trump is likely to help small- and mid-cap companies more than large incumbents. The elimination of regulations reduces compliance costs, which frees up critical cash for smaller businesses. Declining interest rates also tend to be more helpful for small- and mid-cap companies because they are more affected by the cost of debt than large companies.

The S&P 400 Midcap Index and the S&P 600 Index has outperformed the S&P 500 Index since the US election Nov. 5. This marks a notable shift; the small- and mid-caps had underperformed large-caps since the start of 2023 as investors crowded into the S&P 500 Index led by the Magnificent Seven stocks. In addition to Microsoft, NVIDIA and Meta, the Magnificent Seven stocks are Apple Inc., Amazon.com Inc., Alphabet Inc. and Tesla Inc.

Liquidity starved

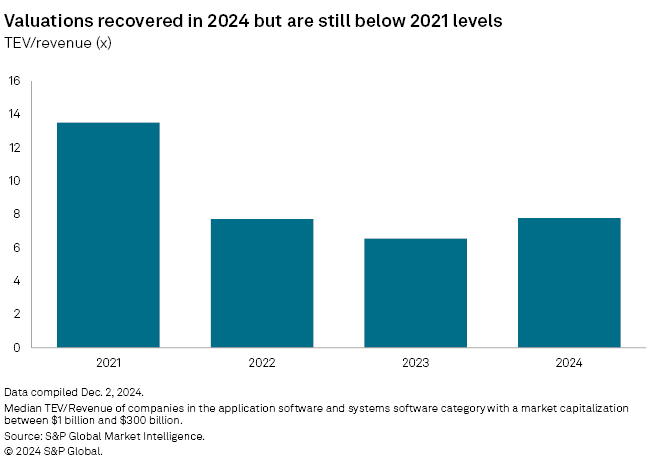

One hurdle that prevented IPOs in recent years was the significant ramp-up in tech valuations right after the pandemic. Startups that fundraised in 2021 or that were purchased by private equity firms around that time have not wanted to IPO at a lower valuation than they achieved in 2021.

At the height of the S&P 500 Index's pandemic peak in December 2021, software companies were valued at a median total enterprise value/revenue ratio of about 13.5x. By 2023, this ratio had declined to 6.5x. In 2024, valuations rebounded somewhat to 7.8x.

"There is a period when you need to reset expectations, and it's more than resetting expectations, it's deciding that you are going to realize some losses," Endoso said. "Everybody, the VCs, the big institutional investors, need to have IPOs."

Analysts caution that 2025 will not bring a return of the kind of activity seen in 2021. Rather, they are looking for the kind of numbers seen in the years before 2020.

"IPO windows have been open and closed periodically, very robust IPO windows tend to be open for quite brief periods of time," Bedrosian said. "We are not looking for a boom or spike in 2025, but a more normalized IPO activity."