Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Jul, 2021

Small online merchants could soon get a boost if Congress succeeds in passing a bipartisan bill that aims to prohibit Amazon.com Inc. and other online platforms from promoting their own products over those of competitors.

The American Choice and Innovation Online Act, sponsored by Reps. David Cicilline, D-R.I., and Lance Gooden, R-Texas, is among a series of House proposals designed to restrain Big Tech's dominance. Specifically, the bill aims to prohibit dominant platforms from providing an advantage to their own private-label products, a practice known as self-preferencing.

The bill, experts say, could have major implications not only for Amazon's growing private label brands but also for thousands of third-party merchants who fuel sales on the company's platform. Some policy experts say it will enhance competition, while others believe it will hurt consumer choice.

Amazon did not return inquiries for this story, including a question about the criteria it uses to determine top search results.

Boosting smaller merchants

Under the proposed regulations, items from Amazon's third-party merchants might become easier to find, according to Alex Petros, policy counsel for Public Knowledge, a Washington, D.C.-based public interest group. Amazon would not be able to promote its Amazon Basics products over third-party sellers on the top pages of Amazon.com search results, Petros said.

|

|

The bill would also require the e-commerce giant to be transparent about the standards it uses to showcase products on the first pages of search results on Amazon.com. Those neutral criteria might include fastest shipping times, best reviews or lowest prices.

Both the Federal Trade Commission and the Justice Department would enforce the new rules if passed.

Iain Murray — a vice president with the Competitive Enterprise Institute, a think tank that promotes free market policies — said the proposal could end up suppressing a line of Amazon-branded goods that is cheaper, and oftentimes better, than alternative products.

"Every retail business of scale has some sort of branded products," Murray said. "Walk into a pharmacy and there you see the competing product advertised right beside the brand product at a lower price, often with a discount if you are a loyalty member. This is a common practice throughout retail, and it gives consumers far more choice."

Geoffrey Manne, president and founder of the nonprofit, nonpartisan research center International Center for Law and Economics, said the proposal could end up raising consumer prices if Amazon is unable to promote its brands as much. "Currently, Amazon has an incentive to create its own private label products to compete with existing products, and it sells them more cheaply," Manne said.

Small but growing

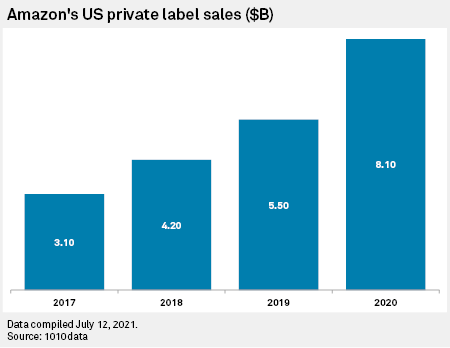

Sales derived from Amazon's U.S. private label goods in 2020 represented only 2.1% of the $386.06 billion Amazon generated in revenue last year. But the business is growing rapidly.

Revenue from Amazon private labels in the U.S. such as Goodthreads and Amazon Essentials reached $8.10 billion in 2020, up nearly 93% from $4.20 billion in 2018, according to 1010data, a provider of analytical data to the financial, retail and consumer markets. That figure could exceed $9 billion in 2021, said Jonah Ellin, chief product officer at 1010data.

Amazon's electronics products, such as Alexa and Echo devices, made up more than half of the company's private label sales last year, but non-electronics categories surged during the pandemic.

Lawmakers have expressed concern that Amazon uses data from small and medium-sized third-party merchants to create similar private label products and undermine competition online.

Former Amazon CEO Jeff Bezos testified before Congress last year that he could not guarantee Amazon did not violate its policy prohibiting the company from using data from third-party sellers to inform its own private-label products.

The percentage of gross merchandise units sold by independent third-party merchants on Amazon's site grew from 3% in 1999 to 60% in 2019, according to the latest data from Marketplace Pulse. Amazon has about 1.5 million active sellers, according to the firm's estimates.

A House Antitrust Subcommittee investigation released last fall concluded that Amazon's dual role as an operator of a marketplace and a seller in that same venue creates an inherent conflict of interest. "This conflict incentivizes Amazon to exploit its access to competing sellers' data and information, among other anticompetitive conduct," the report stated.

Steven Yates, CEO of management consultancy Prime Guidance, said he believes Amazon tends to clone top-performing products that it can make cheaper and better.

"Every seller is worried that Amazon is going to compete against them," Yates said.

Spurring innovation

Cicilline's bill could lead entrepreneurs to offer new and creative products, enhancing competition and consumer choice, said Kunal Chopra, CEO of Kaspien, a Spokane, Wash., company that helps brands sell on Amazon.com and other marketplaces.

"If they knew that this platform was fair for all, that would spur innovation not only from entrepreneurs but also bigger brands — they would want to be on the platform," Chopra said.

Eric Martindale is the owner of Elite Commerce Group, an e-commerce agency that manages its own brand and other brands on Amazon.com and other marketplaces. He said his company would likely put more effort into new ideas for its own brand of specialty food products, including keto and low-carb snacks, if it did not fear Amazon clones.

"I know myself, and others, are sometimes afraid to have a product come up at the very top of search," Martindale said.

The bill would not prevent Amazon from cloning items but would prohibit the platform from giving preference to its own products, said Hal Singer, managing director of Econ One Research and an antitrust expert.

"You can compete, but you have to compete on a level playing field," Singer said.

Bipartisan support

Sen. Amy Klobuchar, chair of the Senate's antitrust subcommittee, is working on a companion bill to Cicilline's proposal that could be released in the coming month, Singer said. The White House also supports the bill, along with Republicans and Democrats. Of the bill's 14 co-sponsors, nine are Democrats and five are Republicans.

The Cicilline could attract more support because it is not suggesting a restructuring, such as a spin-off of Amazon's private label business, Singer said.

"You're just coming up with rules that try to create an open and fair competition in these vertical markets," Singer said. "I think that is about as much of an intervention that Republicans can swallow."