Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Nov, 2024

By Nick Lazzaro

| US President-elect Donald Trump and Xi Jinping, president of the People's Republic of China, meet during Trump's previous presidential term at the Great Hall of the People in Beijing on Nov. 9, 2017. Source: Kyodo News/Kyodo News Stills via Getty Images. |

More resilient supply chains and a narrowing trade deficit with China may curb the inflationary risks of President-elect Donald Trump's proposed universal US import tariffs.

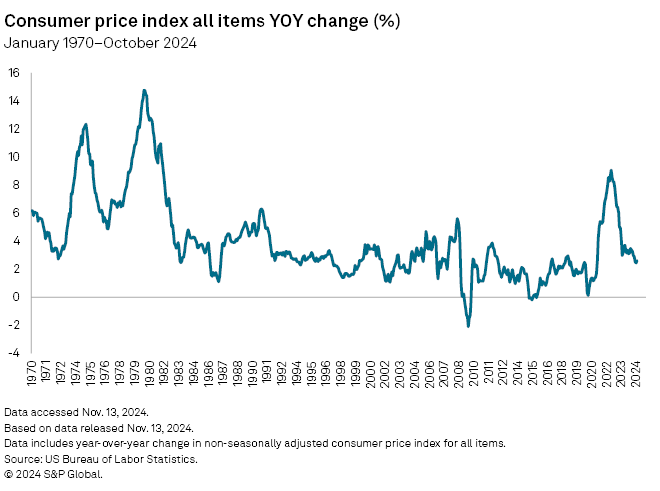

Supply chain turmoil and spiking inflation have been linked since 2020, both aggravated by the COVID-19 pandemic, geopolitical conflicts, shipping piracy, trade route shutdowns and port labor strike threats. Trump's tariffs, if enforced, of up to 60% on China and up to 10% to 20% on all other countries would come as inflation sluggishly decelerates from its highest level in decades, sparking concern that the tariffs could renew price growth and add thousands of dollars to household costs each year.

Estimates of the effects of any new tariffs vary. For example, a 10% universal tariff could raise the level of both the headline and core personal consumption expenditures price index by about 0.8 percentage points, with most of the increase occurring within 12 months of tariff implementation, according to a report from Pantheon Macroeconomics. Over a 10-year period, the 10% tariff along with the 60% tariff could lift the level of consumer price inflation anywhere from 1.4% to 5.1%, according to a separate analysis by The Budget Lab at Yale University.

Still, trade relationships have changed since 2016, and supply chains may now prove more resilient than in recent years, potentially limiting the ceiling for rising inflation. New tariffs could help to accelerate the pace of changes that have led to this resiliency.

"[Supply chains are] certainly in a better position than they were 10 years ago or even back in 2017 and 2018," Matt Lekstutis, director at procurement and supply chain consultancy Efficio, said in an interview with S&P Global Market Intelligence. "The markets are different, too. We have companies that have less exposure to China than they had at that time. We have companies that are nimbler."

Evolving supply chains

Strategies, such as industrial onshoring investment in the US, may initially add to costs upfront but ultimately provide long-term benefits to curb inflation.

"[The US has] a phenomenal ecosystem of technology, and our capabilities in terms of automation are second to none," Lekstutis said. "That investment is going to put some pressure on costs, but downstream, it's going to create more efficiency, and it should be driving to lower cost."

For products where international manufacturing still offers a cost advantage, companies have also shifted investment away from China and toward other regions to unlock diversified sourcing options, Lekstutis said.

Rate cuts could slow, but hike unlikely

In September the US Federal Reserve began reducing its benchmark interest rate from a two-decade high amid cooling inflation and concerns over the unemployment rate. The current cutting cycle reverses a series of rate increases since 2021 meant to battle skyrocketing inflation.

A return to rate hikes, though, is not probable as the inflationary pressure presented by the tariffs would not be severe enough to outweigh other stresses on the economy.

"To argue for a rate hike is a little bit of a stretch," Jeffrey Roach, chief economist for LPL Financial, said in an interview. "I think the Fed does this cadence of cut and pause and not cut every meeting, certainly not 50 basis points."

Trump's tariff policies during his previous presidency were not accompanied by swings in inflation, a reminder that the burden of import taxes is not fully borne by the consumer, Roach said.

However, inflation will be more sensitive to the Fed's response to tariffs, rather than the tariffs themselves.

"Tariffs on their own raise prices of tariffed goods, but if I have to spend $1,000 more on certain goods because of tariffs, I have $1,000 less to spend elsewhere, demand falls in other parts of the economy," Tax Foundation economist Erica York said in an email to Market Intelligence.

"Whether tariffs have an impact on the overall price level depends on how the Federal Reserve responds — it would require a change in Fed policy to accommodate the tax for it to result in inflation," York added.

The Fed may opt to leave its monetary policy stance untouched if it recognizes any near-term inflation following new tariffs as a "one-time price level shock," according to the Yale report.

Changes to US-China trade situation

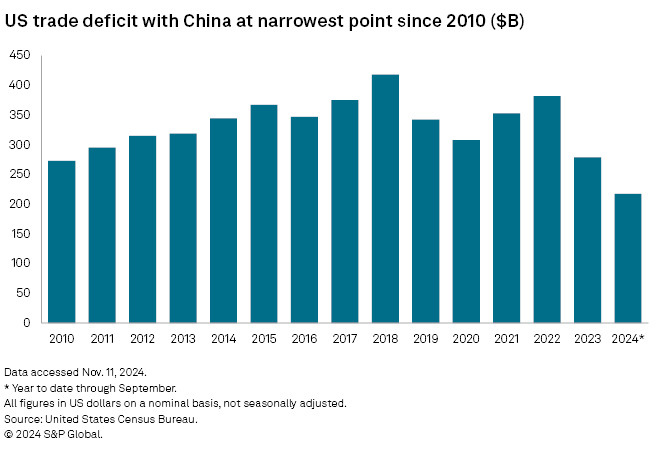

Compared with Trump's first presidency, the incoming administration should also be in a better position to successfully use the threat of tariffs as a negotiating tool, especially with China. Therefore, universal tariffs may not be enforced to the extent that they have been proposed.

"Our deficit with China is much narrower than 2018, and the growth trajectory in China is drastically weaker now than it was in 2018," LPL's Roach said. "The trend looked bad for the US relative to China, and those tables have completely turned."

The US trade deficit with China was reported at about $279 billion in 2023, according to US Census Bureau data. Before that, the deficit had not been below $300 billion since 2011.

Considerations beyond inflation

The ultimate impact of tariffs on inflation will remain unclear for some time, but other economic consequences must be considered as well.

"Taxes are never efficient for an economy," Roach said.

Moreover, tariffs present economic harm from a reduction in after-tax incomes, which has knock-on effects for hours worked, capital investment and economic output, according to the Tax Foundation's York. These types of trade policies also shift resources and benefits to specific sectors that are afforded a greater degree of protection from the tariffs.

"That reduces the overall level of productivity in the economy," York said. "Under higher tariffs, we would see gains in some sectors at the expense of other sectors, resulting in a redistribution that lowers our incomes and leads to a less efficient allocation of resources."