Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Nov, 2021

Workers pack and ship customer orders at the 750,000-square-foot Amazon fulfillment center in Romeoville, Ill.

Amazon.com Inc.'s one-day shipping program in the U.S. could advance next year if the e-commerce company more fully builds out fulfillment capacity closer to the customer and successfully attracts high-demand workers for last-mile delivery, retail analysts say.

Unexpected labor constraints and other pandemic-related disruptions slowed Amazon's progress on ramping up one-day shipping for its Prime members, but the company hopes to shorten its standard two-day Prime shipping to one day for millions of items in 2022, CFO Brian Olsavsky recently told analysts during Amazon's third-quarter conference call. One-day shipping would add to the perks that Amazon offers its Prime members, who also have access to exclusive deals, TV shows and other media.

"We don't want to be just as good as we were before the pandemic," Olsavsky said. "We expect that [one-day shipping] to increase in 2022. And we're going to plan accordingly."

While Amazon is still playing catch-up on the expansion of its one-day shipping program, the company has positioned itself to expedite the initiative in 2022, said Tom Forte, an analyst with investment banking firm D.A. Davidson.

Amazon invested heavily in its logistics infrastructure in rural areas to meet unprecedented demand during the pandemic. Now, it must build out smaller sorting facilities in urban centers to further speed the delivery of packages nearing their final destinations.

"They are going to be in a position where they have got the current state of the pandemic under control so they can return to focusing on initiatives that were important to them independent of the pandemic," Forte said.

Delivery goals

Amazon in 2019 announced plans to roll out its free one-day shipping program for Prime members across North America, upping the delivery ante against brick-and-mortar competitors such as Walmart Inc., which launched its own one-day shipping service in 2019. Amazon did not immediately respond to questions from S&P Global Market Intelligence about how extensive its one-day service is and where it is available currently.

Mark Shmulik, vice president with AB Bernstein, said building out the one-day shipping program coast to coast in the U.S. was Amazon's "No. 1" investment priority before the pandemic hit in early 2020, but unprecedented demand for consumer goods last year forced Amazon to place limits on how many packages could move through its system and pivot to new priorities to ease shipping logjams. This included spending billions of dollars on building new warehouses and fulfillment centers to stock and store products in rural areas.

"They doubled their capacity over the last year from a square footage perspective, but where they doubled it wasn't necessarily conducive to getting you a product in 24 hours," Shmulik said.

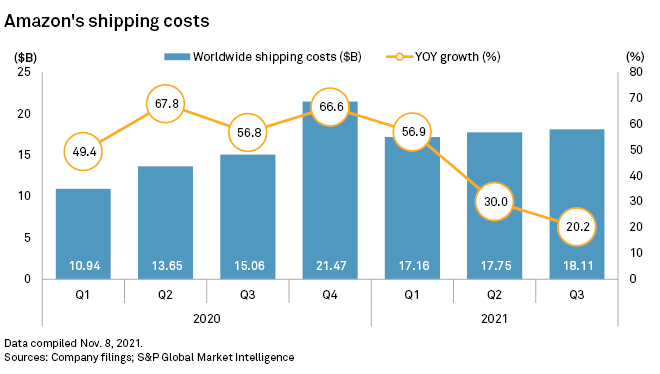

Amazon's worldwide shipping costs reached $13.65 billion in the second quarter of 2020, up 67.8% year over year. Those costs rose to a high of $21.47 billion in the critical fourth-quarter 2020 holiday season but tapered in early 2021 when e-commerce sales began to cool.

Now that demand has normalized, Amazon can refocus efforts on building fulfillment capacity closer to people's homes, Shmulik said.

Amazon spent about $1.5 billion on the one-day shipping program in the fourth quarter of 2019 and $1 billion in the first quarter of 2020. Shmulik said he believes that Amazon has about "three quarters of investments left" before it can get the one-day shipping program back above and beyond pre-pandemic levels in the U.S.

Dan Romanoff, a Morningstar analyst who covers Amazon, said it is reasonable to assume that the program could be on track by next year because Amazon is building capacity where one-day service has already ramped up in the U.S. It is also working to roll out the program in areas where that service is not yet available, Romanoff said.

Still, Romanoff noted that the one-day shipping service is limited to easy-to-pack items such as household items and electronics and excludes bigger, bulky items.

"It's not one-day delivery on everything," Romanoff said. "You're not ordering a couch, for example, and getting it the next day."

Labor challenges

How quickly the one-day shipping service gets back on track also depends on Amazon's ability to recruit more specialized workers to deliver goods.

It will not be easy, given that Amazon faces competition for employees who could just as easily work for Instacart or DoorDash, said Guru Hariharan, CEO of CommerceIQ, an e-commerce management platform based in Palo Alto, Calif.

Last-mile delivery employees in city centers also command higher wages due to higher costs of living and the skills they require in terms of customer service and technical ability, such as working with an app. "You have to train your workforce to be a lot more tech-savvy," Hariharan said. "There is a high bar in choosing those folks."

Amazon has increased wages in some areas of the country past its minimum wage of $15 per hour to $18 and offered up to $3,000 in sign-on bonuses. But higher wages and benefits are only part of the recruitment equation, said Patricia Campos-Medina, executive director of The Worker Institute at the ILR School at Cornell University.

Workers also want more flexibility in their schedule, she said.

"I think workers want more security for going back to work, which includes more control over their lives," Campos-Medina said. "We are seeing a seismic shift in what workers expect. It's not as easy as a sign-on bonus or raising wages."