S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Mar, 2021

By Michael O'Connor and Chris Hudgins

U.S. corporate bankruptcies continued to slow in February as companies battling challenges old and new hope to capitalize on an economic recovery widely expected in the second half of 2021.

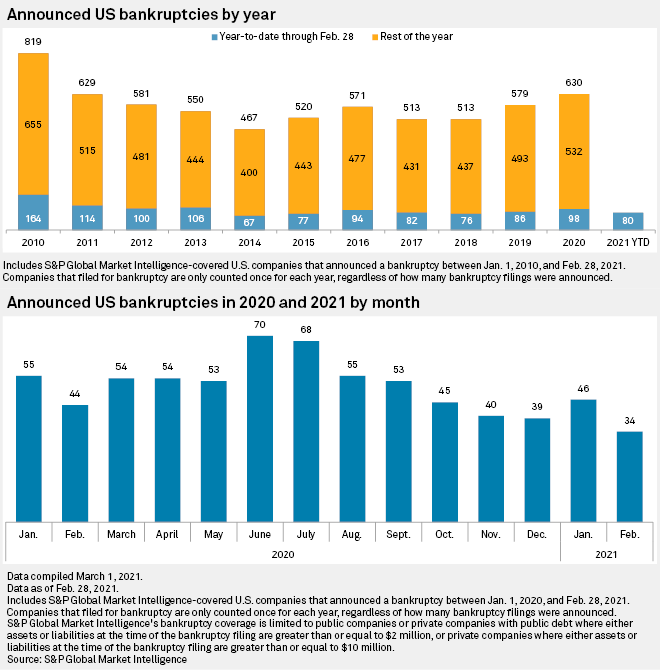

In February, 34 companies filed for bankruptcy protection, a decline from 46 in January and the 2020 single-month peak of 70 in June.

The two-month total for 2021 stands at 80 bankruptcies, a slowdown from the 98 in the same period in 2020 and a slower clip than all but three of the prior 11 years, according to S&P Global Market Intelligence data. Bankruptcies jumped to a 10-year high in 2020 as the coronavirus pandemic hammered already struggling companies.

While the recent slowdown from 2020 is somewhat surprising, it could hint at more distress later in the year, Joseph Malfitano, founder and managing member of Malfitano Partners, said in an interview. In the next 12 to 24 months as the economy comes back, there could be a pretty active M&A market fueled by lenders looking to sell companies they have taken big positions in, Malfitano said. The amount of liquidity in the market, optimism related to vaccine rollouts and steps retailers took to get some expenses off their balance sheets could be keeping companies banking on a reopening boom from filing for bankruptcies, Malfitano said.

"There's not a burning need to pull the plug and file a bankruptcy," Malfitano said. "For a lot of retailers, they can kind of wait it out and see what this reopening kind of looks like and see if they get a big bounce."

Still, not every company is likely to get the big bounce they are hoping for, suggesting there will probably be more distress in the retail sector in the second half of 2021, Malfitano said. Downtown restaurants built around sit-down dining and high-end apparel retailers similarly situated are the kinds of companies facing uphill battles, Malfitano said. Factors like geographic footprint, the extent of e-commerce operations and positioning in the work-from-home trend play a big role in the health and prospects of a company, Malfitano said.

"If you have no online presence, you're getting killed," Malfitano said of retailers, adding restaurants face a similar dynamic. "If you're 100%, sit-down, fine dining, forget about it."

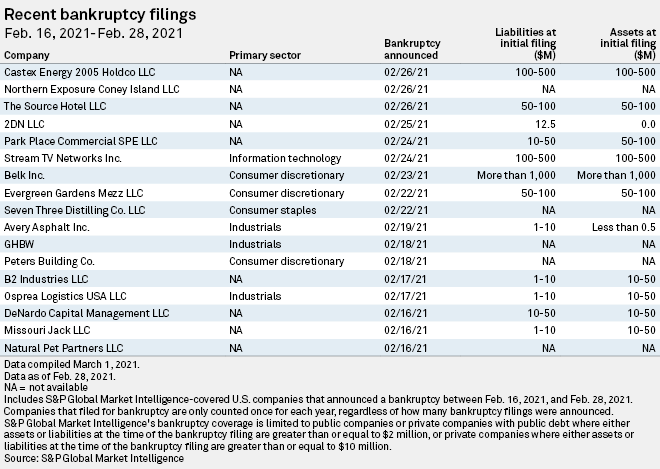

One of the largest bankruptcies announced between Feb. 16 and Feb. 28 was private department store chain Belk Inc.'s completion of its financial restructuring on Feb. 24, a day after it filed for bankruptcy. The reorganization will help Belk, which is majority-owned by Sycamore Partners, slash $450 million of debt and get $225 million in new capital.

The new cash and reduced debt will help Belk focus on efforts like expanding its merchandising into new categories, according to a Feb. 24 news release. Belk had tripled its web business and fulfilled over 70% of its web orders from its stores, Stefan Kaluzny, managing director of Sycamore Partners, said in the release. A Sycamore Partners spokesperson declined to comment beyond its public statements, and Belk did not respond to requests for comment.

The pandemic's halt to foot traffic coupled with its acceleration of the e-commerce trend has bedeviled retailers, especially department stores like J.C. Penney Co. Inc., now known as Old COPPER Company Inc. The company filed for Chapter 11 protection May 2020 after struggling for years to adapt its business as large amounts of debt and the decline of malls put further pressure on the company.

Other department stores are faring better. Kohl's Corp. on March 2 reported a 29% jump in profit for the quarter ended Jan. 30 and forecast expectations that 2021 net sales will grow in the mid-teens percentage range over the prior year. The company ended the quarter with $2.27 billion in cash and $2.45 billion in long-term debt. Digital sales for the quarter were up 22% and accounted for 42% of net sales compared with 31% a year ago, Kohl's CEO Michelle Gass said during a March 2 post-earnings call. Kohl's did not respond to a request for comment.

Belk's restructuring plan prompted S&P Global Ratings to upgrade the company's issuer credit rating to CCC+ from D on Feb. 25 as Belk emerges from bankruptcy with less heavy debt and near-term cash interest burden. Ratings holds a negative outlook on Belk, based on continued challenges to the company's operating performance and competitive standing and cautioned a downgrade could come if recovery is weaker than expected.

The reorganization gives Belk some room to try to recover traffic trends at its stores and try to recover revenue in their omnichannel business, but whether or not the company can overcome such challenges remains to be seen, Pasha Azadmard, an associate with Ratings and lead author on the Belk upgrade, said in an interview.

"The real takeaway from this transaction is it's something to buy the company time to come out the other side of this pandemic," Azadmard. "We'll see how much of their business they can recover."

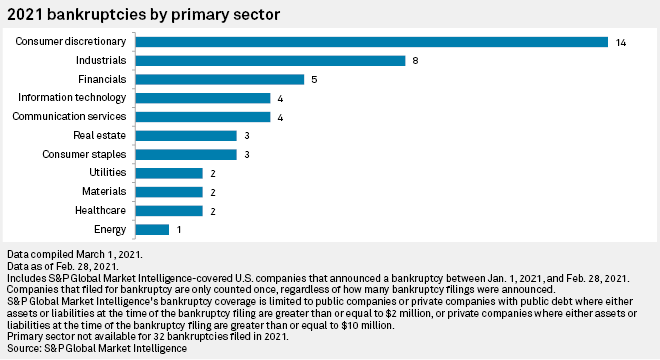

Belk was one of three consumer discretionary companies to announce a bankruptcy between Feb. 16 and Feb. 28, which pushed the total bankruptcies for announced bankruptcies in the sector during 2021 to 14, the most of any primary sector, according to a Market Intelligence analysis. Consumer discretionary businesses include department stores and casual dining restaurants, many of which have been caught on the wrong end of the work-from-home trend and pandemic lockdown measures, experts say.

The pressure on brick-and-mortar businesses from an ongoing shift to e-commerce, combined with the continuing challenges of the pandemic, means that retailers need to have their capital structures and cash flows in the right place, Helena Song, a director at Ratings, said in an interview. Embattled companies need to develop a business that is sustainable in the longer term for them to truly get away from the distressed arena, Song said. Whether companies can benefit as the economy recovers depends on factors like the type of business they are in, their competitive position and consumer confidence, Song said.

"We think the picture is mixed," Song said.

Editor's note: This Data Dispatch is updated on a biweekly basis and the last edition was published Feb. 17. Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion. Click here to download the charts.

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.