Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Dec, 2024

By Iuri Struta

For the first time in several quarters, the broader semiconductor sector is showing early signs of recovery in terms of clearing inventory.

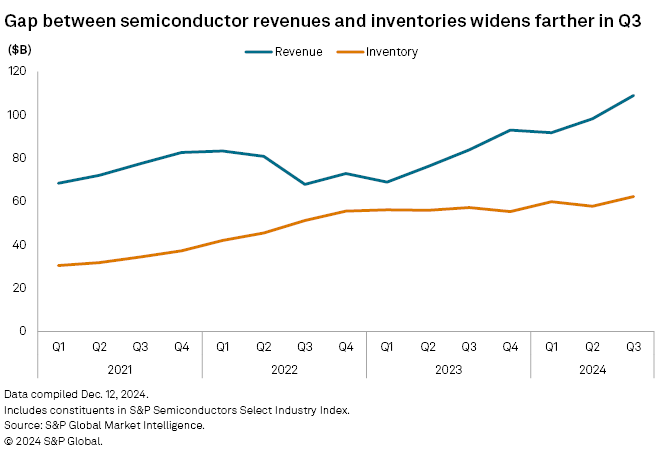

The gap between chip companies' revenue and inventories — a sign the companies are selling more chips than they are holding onto — reached its highest point in the third quarter since 2021, when there was a widespread shortage of semiconductors of all types. In reaction to outsize demand in 2021 and 2022, semiconductor companies built up inventories but found themselves with excess supply as demand collapsed.

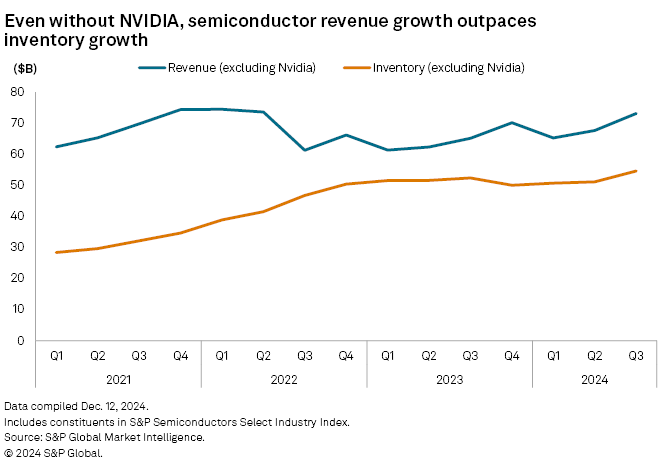

Until the third quarter, semiconductor demand was mainly driven by chips used for AI, primarily those from advanced chipmaker NVIDIA Corp. Excluding NVIDIA, which sees strong sales and weak inventories, the gap between revenue and inventories is smaller, although revenue is approaching the all-time highs of late 2021 and early 2022.

Autos see strength

One strong end market in the third quarter was the automotive industry, which saw a notable recovery in the Chinese electric vehicle industry and a smaller ramp in the US. PCs and personal electronics also experienced an increase in demand, several semiconductor companies reported.

Analog Devices Inc., Qualcomm Inc. and Texas Instruments Inc. all said that the EV market drove revenue growth in the most recently ended quarter.

"Toward the end of [fiscal] Q3, bookings started to improve and that continued throughout our [fiscal] Q4 with stronger demand in China, reflecting EV volume growth, share gains and content growth," Analog Devices CFO Richard Puccio said on an earnings call. Analog Devices' fiscal 2024 ended Nov. 2.

Qualcomm President and CEO Cristiano Amon also said on the company's fiscal fourth-quarter earnings call that he saw "strength" in the auto market, partly due to market share gains. Qualcomm's fiscal fourth quarter ended Sept. 29.

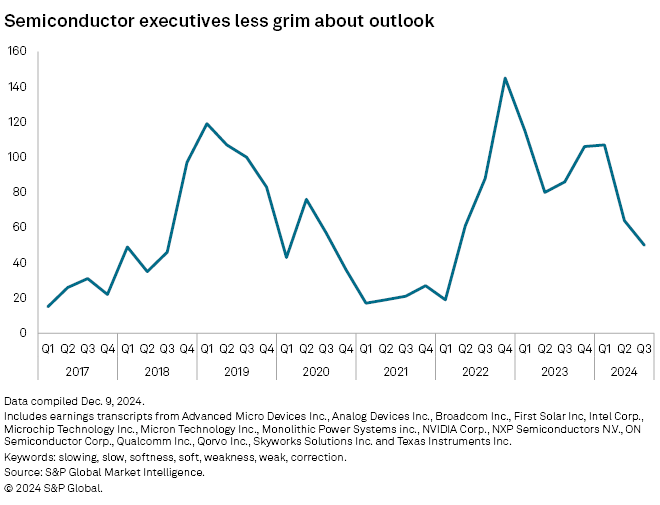

A sentiment analysis by S&P Global Market Intelligence indicates that semiconductor CEOs are less gloomy about the outlook, with the number of negative keywords mentioned in earnings calls reaching a two-year low. However, executives from major US semiconductor companies caution that their customers remain in the inventory digestion phase.

AI broadening

Amid improvements in more traditional end markets, AI semiconductor revenue is expanding beyond major players such as NVIDIA and Broadcom Inc. Companies like Astera Labs Inc., Marvell Technology Inc. and Credo Technology Group Holding Ltd. benefited from strong demand for datacenter chips, with revenue growth surging in the third quarter.

For instance, Marvell expanded its strategic relationship with Amazon.com Inc.'s Amazon Web Services to assist in chip production, as the hyperscaler aims to reduce its reliance on NVIDIA.

Microsoft Corp. first introduced its own custom AI chip, the Azure Maia AI chip, in November 2023 to power its Azure datacenters. Additionally, it has continued to debut custom chips, including data processing units and hardware security modules.

These moves reflect a broader trend among hyperscalers to manufacture their own chips as they expand their datacenter footprint. Broadcom and Marvell serve as key enablers and beneficiaries of this trend.

Broadcom President and CEO Hock Tan said on an earnings call in September that hyperscalers are likely to move "towards creating as much as possible their own compute silicon."

"We are in the midst of seeing that transition, which may take a few years for that to happen," Tan added.

Most recently, The Information reported that Apple Inc. is working with Broadcom to develop its first server chip specifically designed for AI. The AI chip, internally known as Baltra, is expected to be ready for mass production by 2026.

On its latest earnings call, Broadcom said its “serviceable addressable market” in AI, which includes custom accelerator chips and networking chips, could grow to between $60 billion and $90 billion in fiscal 2027. Broadcom's AI revenue stood at $12.2 billion in fiscal 2024, up 220% versus fiscal 2023.

Looking at 15 key companies from the S&P 500 Semiconductors Index that represent various end markets, only two recorded quarter-over-quarter revenue declines, compared with four in the second quarter.