Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Aug, 2022

By Karin Rives

|

The U.S Securities and Exchange Commission building in Washington, D.C. |

While some of the nation's largest banks and corporations support the U.S. Securities and Exchange Commission's proposed climate risk disclosure rule, many businesses remain concerned over the agency's plan to require some publicly traded firms to report Scope 3 emissions.

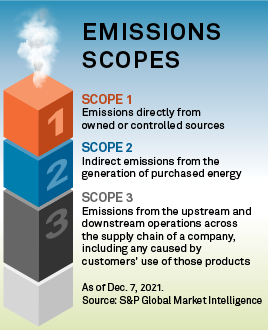

Scope 3 greenhouse gas emissions arise indirectly along a company's value chain and include emissions tied to end-users. Many critics of the SEC's proposed rule disagree with the idea that Scope 3 emissions are material to a company's business and should be disclosed.

"When we've engaged with companies as an asset manager, not one of those companies says, 'Thank you for reaching out, you're right, this is material,'" Ivan Frishberg, senior vice president and chief sustainability officer of Amalgamated Bank, told an Aug. 2 Senate Climate Change Task Force hearing on the SEC rule. "They all start from the premise of saying, 'Scope 3 is not material to us.' But the more time we spend with them, they start to agree, and ultimately understand, that this is, in fact, something within their control."

Investors, as well as publicly traded companies, have for years requested more clarity on how corporations should report their carbon footprints and growing exposure to extreme weather and other climate risks. In the absence of clear regulations, many companies have taken voluntary steps to disclose such risks.

The Task Force on Climate-Related Financial Disclosures receives climate disclosures that include Scope 3 emissions from 13,000 companies worldwide, representing 64% of global capitalization, Frishberg said.

|

The SEC has received more than 10,600 comments on its proposed rule, evidence of the broad attention the agency's proposal has received from Wall Street investors, citizens, shareholders, the business community, environmental groups and others with a stake in financial disclosures.

Many commenters have focused on the SEC's plan to mandate Scope 3 reporting requirements for companies for which such emissions are deemed material or for companies that already have a Scope 3 carbon reduction goal. Some small companies would be exempted from the provisions.

Some groups that generally support the broad disclosure proposal have cautioned the SEC against requiring companies to disclose Scope 3 emissions, saying it would prove too onerous and expensive.

"We commend and support the commission's efforts to enhance and standardize climate-related disclosures," the Edison Electric Institute and American Gas Association wrote in a joint comment in June. "[The Edison Electric Institute and American Gas Association] welcome the commission's proposal as an important step forward in ensuring more complete [greenhouse gas] disclosure across all industries. We believe, however, that some of the most burdensome aspects of the incremental disclosure would not produce benefits that outweigh the costs and, in some cases, would lead to investor confusion by requiring the disclosure of overwhelmingly voluminous, immaterial information."

A $9 trillion opportunity

Sen. Tom Carper, D-Del., chairman of the Senate Environment and Public Works Committee, asked witnesses at the Aug. 2 hearing how the SEC rule as a whole could be translated into opportunity.

"This [rule] will lead to more transparency so investors and companies know more about what's happening. They can make smarter decisions," responded Steve Rothstein, managing director of the Accelerator for Sustainable Capital Markets for investor network Ceres. "That makes our economy stronger in this country."

Without the rule, the U.S. risks falling behind eight nations that are moving forward with similar regulations, Rothstein said, adding that with up to $9 trillion annually needed to tackle climate change, there are also enormous economic opportunities.

No opponents to the SEC climate risk rule were present at the Senate task force hearing, but the agency's proposal remains controversial. Attorneys general from 24 Republican-led states reiterated their opposition to the SEC's plan in new comments filed in July after the U.S. Supreme Court issued a momentous ruling in June curtailing the U.S. Environmental Protection Agency's authority under the Clean Air Act.

"The court confirmed that Congress — not a federal administrative agency — has the power to decide major issues of the day," they wrote. "... The SEC claims the right to reorder how publicly registered companies can operate. ... If this sort of regulatory overreach does not constitute a sweeping policy judgment on a major question, then we struggle to see what would."

The GOP states also asked the SEC to "save everyone years of [legal] strife" and abandon the rule.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.