Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 May, 2021

By Matt Smith

Saudi Arabia's state-backed mortgage refinancer expects to double or triple its balance sheet and begin issuing mortgage-backed securities in 2021 as a domestic home loan boom shows little sign of easing.

Saudi Real Estate Refinance Co., or SRC, which is sometimes compared to the U.S.'s Fannie Mae, provides low-cost financing to banks and financial institutions so that they can offer cheaper mortgages to nationals. It was founded in 2017 following the kingdom's launch of a National Transformation Program aimed at diversifying and modernizing the domestic economy.

"We're there to help the banks, the primary originators, to make sure that at no point access to liquidity or balance sheet constraints prevent them providing mortgage solutions to Saudi citizens," CEO Fabrice Susini told S&P Global Market Intelligence.

Saudi banks sold a record 46.7 billion Saudi Arabian riyals of new mortgages in the first quarter of 2021, according to central bank data, up from 42.9 billion riyals in the preceding three months and from 31.2 billion riyals in the prior-year period. Banks account for more than 60% of the country's mortgage market share, according to an Al Rajhi Capital report.

Read more: Growth in Saudi Arabia's mortgage market outruns refinancer's targets

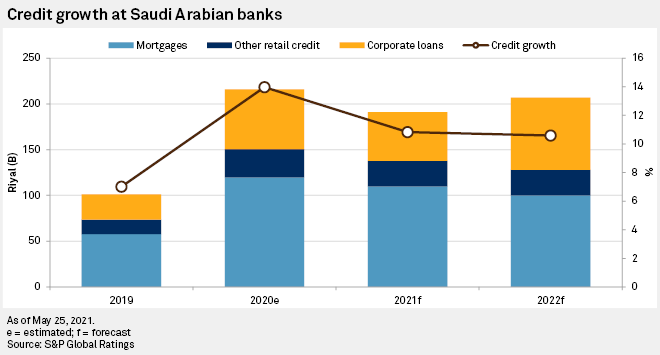

In a May report, S&P Global Ratings forecast Saudi banks' aggregate mortgage portfolio would expand by 30% annually over the next couple of years, with credit demand set to grow through 2021 and 2022. The central bank has eased capital requirements for mortgage lending, Ratings notes, to help achieve a home ownership target of 70% by 2030. In October 2020, Saudi Arabia made real estate transactions exempt from the 15% VAT rate, instead introducing a 5% property tax.

As well as providing finance, the SRC also buys mortgages from local banks and had a loan portfolio of 6.5 billion riyals at the end of 2020, up from 2.2 billion riyals in 2019. The company, which in March issued 4 billion riyals of sukuk, aims to double or triple its balance sheet this year, said Susini.

SRC also plans to sell the mortgages it has acquired from banks as covered bonds or mortgage-backed securities.

"There are a lot of discussions at the moment to make sure we have the proper framework domestically to start issuing domestically, on the basis of which we will look at some point at tapping international markets through structured finance paper," said Susini.

"We want to have a first securitization before the end of 2021, to lay down the foundations. And then we'll start developing from there."

SRC has yet to decide the size of issuance, but this will not exceed 1 billion riyals, said Susini. In April, SRC obtained long-term issuer credit ratings from two of the big three ratings agencies. SRC was rated A2 by Moody's and A by Fitch Ratings.

The firm has been instrumental in developing long-term fixed-rate mortgages, which have become the dominant domestic product offering and which Susini credits for surging demand. Prior to SRC's launch, around two-thirds of mortgages were floating or resettable.

"We're advocating the development of 20-, 25- and eventually 30-year fixed-rate mortgages because the longer you go, the more you can make a mortgage affordable for the borrowers," said Susini.

The riyal's dollar peg also makes fixed-rate mortgages more desirable, because local interest rates must follow those of the U.S. Federal Reserve and so can often be out of sync with the kingdom's economic cycle.

"It doesn't mean it has completely killed the floating rate. There's a place in the market for both products, but it's a question of suitability. Today, most mortgages are long-term and proper fixed rate," said Susini.

Banks enjoy strong liquidity, but struggle to access finance on longer than five to seven years, he noted. That makes selling 25-year mortgages riskier. While mortgages represent a small part of banks' balance sheet such dangers are unproblematic, but this mismatch will become more worrying as the mortgage lending's relative importance increases. At 2020-end, real estate accounted for about 24% of Saudi bank lending, according to S&P Global Ratings data.

"We're looking at adaptations of those products to give some of the originators a better visibility on their long-term fixed rate," said Susini.

Biggest impact

Susini believes SRC's biggest impact has been in helping lower mortgage costs through its creation of a long-term reference fixed rate. Banks that want SRC to refinance their mortgages are urged to follow this benchmark.

When SRC started, the average mortgage rate was around 7% to 8%, which is about 300 basis points higher than UAE mortgage rates, for example, said Susini.

"There was room for something more reasonable, taking into consideration cost of funding, cost of risk et cetera," he said, noting rates now average around 5.8% to 6.0%.

"That's clearly linked to the benchmark we've established."

Rates should fall further, Susini predicts, but are unlikely to drop to levels available in the U.S. and Europe — of less than 2% — due to domestic factors such as the legal environment, foreclosure enforceability and other risks.

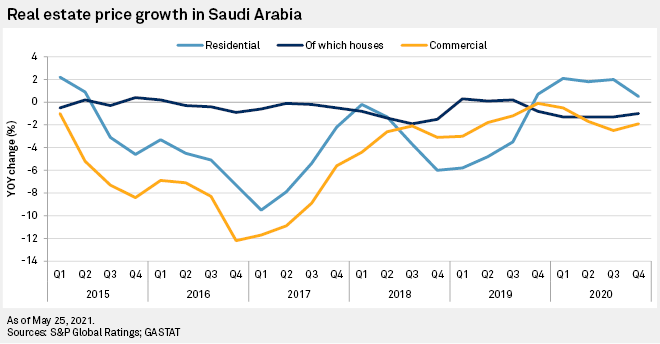

Residential property valuations have fluctuated in Saudi Arabia's major cities. In the first quarter, apartment prices rose 4.4% and 6.5% year over year in Riyadh and Jeddah, respectively, but house prices declined 1.6% and 6.3% over the same period, according to consultants Knight Frank.

Sales remain brisk, with Riyadh's transactions volumes up 25% and sales values surging 80% in the year to March 31, Knight Frank estimates, attributing these increases to sizeable mortgage growth and the completion of large-scale housing projects.

"Despite a sharp increase in mortgage lending, housing price growth remained contained with price levels far below the peaks of 2014," according to S&P Global Ratings. "This expansion was properly underwritten and rapid growth reflected market under-penetration, rather than aggressive lending practices."

SRC failed in its aim to refinance about 10% of total Saudi mortgage lending by the end of 2020.

"We will catch up with this target in the coming one to two years," said Susini, noting SRC's next ambition is to reach 20% by 2028.

While SRC will not diversify its activities beyond the mortgage market, it will provide new products within that.

"We can think about derivatives, wrapped into a process where they are Shariah-compliant, and we can address specific needs of the originators, but always around mortgages for single individual borrowers," added Susini.

As of May 26, US$1 was equivalent to 3.75 Saudi Arabian riyals.

Location

Segment