S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Apr, 2022

The conflict between Russia and Ukraine is adding new limitations on auto suppliers for semiconductors and other auto components.

Source: Monty Rakusen/Image Source via Getty Images

Russia's invasion of Ukraine is adding stress to the global auto supply chain, threatening to send surging prices for new cars even higher.

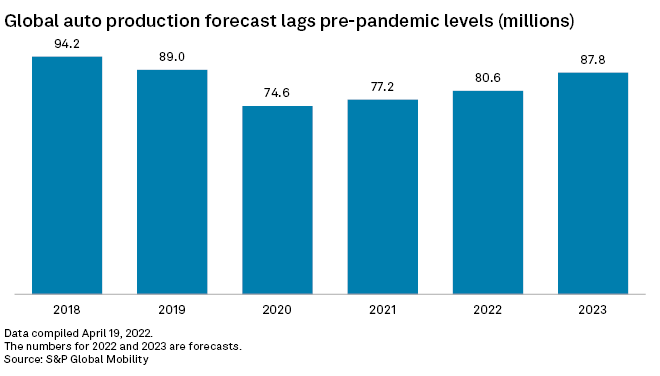

The conflict has prompted cuts to production forecasts for this year and next, already lower than pre-pandemic levels as COVID-19-related shutdowns and semiconductor shortages have dragged on global automakers. Fiat and Chrysler producer Stellantis NV on April 19 announced the suspension of business in Russia, joining a growing list of automakers making similar moves.

Sanctions against Russia are impacting energy prices, agricultural goods and raw materials, and the conflict is prompting logistical challenges and production stops related to operations on the western Ukrainian border, according to S&P Global Mobility. Supply shortages will hit auto production for years to come, offering little relief to high prices.

"We anticipate auto price inflation will be sticky," said Tom Mayor, partner at consulting firm Kearney. "Even when supply disruptions end, there will be a 6-10 million vehicle hole in the U.S. market from new vehicles the industry couldn't build in 2020, 2021 and 2022, which will keep used car and new car prices at a premium."

Forecast cuts

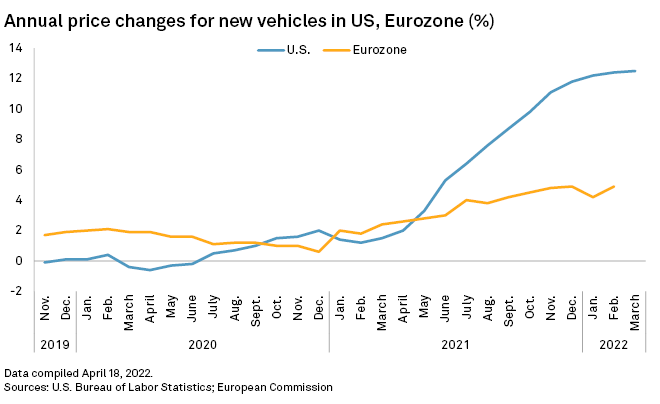

New car prices in the U.S., for example, jumped 12.6% year over year in March to their highest level on record and contributed to broader inflation rising at the fastest rate in 40 years, according to the Bureau of Labor Statistics. Vehicle prices in the eurozone are also rising at faster rates than before the pandemic.

Russia's invasion of Ukraine is having a substantial effect on Ukraine's auto suppliers, resulting in production interruptions at several Bayerische Motoren Werke AG plants, said Nicolas Peter, BMW Group CFO, on March 17 during the automaker's analyst and investor day. The effect of the semiconductor shortage will likely not ease before the second half of the year, Peter said.

Increasing sanctions against Russia and logistical difficulties drove Stellantis to suspend its operations in the country, according to a company statement. The move follows suspensions by Ford Motor Co. and French automaker Renault SA.

S&P Global Mobility has shaved 2.6 million vehicles off its global production forecasts for 2022 and 2023 to reflect the impacts of the conflict between the two countries. Between now and 2030, Global Mobility expects nearly 25 million fewer light vehicles will be produced than its earlier forecasts.

Semiconductor shortage

Additionally, shortages of neon and palladium are two risks to the semiconductor supply chain, a key component that is limiting auto production worldwide. Ukraine is a key supplier of neon, while Russia mines much of the world’s palladium, said Mark Fulthorpe, executive director, global light vehicle production forecast at Global Mobility.

Although there are other facilities that distill purified neon gas, the capacity at those facilities is tiny compared with Ukraine, Fulthorpe said.

Connectors on semiconductors are finished with palladium. Alternatives like gold can be used, so the concern there is about friction in that supply chain, not outright stoppage as would be the case with purified neon gas, Fulthorpe said

"If you have to switch to gold, it’s going to take them time and resource effort," Fulthorpe said. "It would add to the general burden."

Additional capacity to build the chips will be needed to solve the shortages, a process that will be "measured in years and in tens or hundreds of billions of dollars," said Kearney's Mayor. Still, the loss of neon supplies may make the problem worse. Those shortages will likely start to bite in the second and third quarters as global inventories are depleted.

"Soon we expect to see further and more global impacts due to the loss of access to Russian palladium and platinum supplies and Russian neon production, which will further exacerbate semiconductor shortages," Mayor said.

Other critical items like wire harnesses, which run throughout the vehicle and relay information and electric power, were sourced from low-cost, near-shore suppliers in Russia and Ukraine, Kearney’s Mayor said. Tire makers across Europe are also being forced to reduce volumes or temporarily close plants that had been dependent on Russian carbon black and bead wire supplies.

"Until Ukrainian suppliers can be rebuilt and Russian suppliers replaced with reliable, cost-effective alternatives, European assembly plants will carry an extra burden of supply risk and cost," Mayor said.

Higher prices

The average new car price in the U.S. was $45,927 in March, down from a peak of $47,000 in December 2021 but still 12.9% higher than March 2021, according to the latest data from Kelly Blue Book. The average used car price was $27,246 in March, down nearly $1,000 from December's peak. The price is still up 28% year over year, Cox Automotive executive analyst Michelle Krebs said in an April 14 note.

Prices are up as automakers try to fill dealerships for customers.

"That's what's been really slow to pick up," said Paul Jacobson, General Motors Co. executive vice president and CFO, on April 12 during the BofA 2022 Automotive Summit. "And even today, with the inflation that we've seen, we still see a lot of demand where we just don't have a lot of vehicles out on the lot."

S&P Global Mobility and S&P Global Market Intelligence are owned by S&P Global Inc.