Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Dec, 2022

By Brian Scheid

After nine months of one of the most aggressive rate-hike cycles in its history, the Federal Reserve on Dec. 14 took a moderate step back, agreeing to boost its benchmark interest rate by 50 basis points.

The latest hike by the rate-setting Federal Open Market Committee was small compared to what it has done this year in its battle against post-pandemic inflation, including four-straight 75-bps hikes. But Chair Jerome Powell made clear in his post-FOMC meeting press conference that the economic pain from higher rates was far from over.

"We will stay the course until the job is done," Powell said, stressing that despite pushing up the benchmark federal funds rate by 425 bps since March, the Fed had still yet to achieve a "sufficiently restrictive" level of monetary policy.

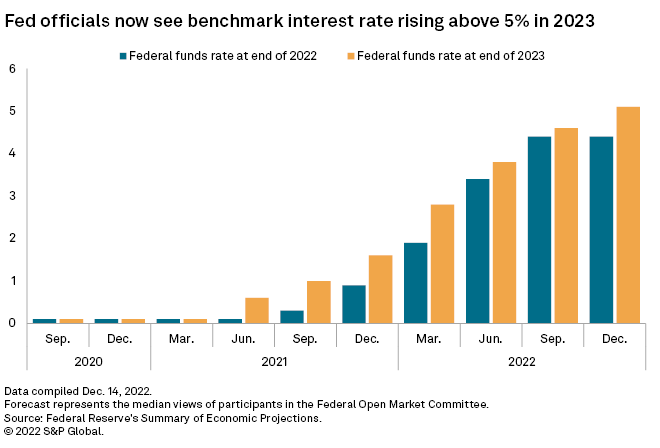

The Fed is already looking beyond the latest rate push, Powell made clear, as officials are now entirely focused on where the benchmark rate will ultimately end up and how long it will remain there. And, as Powell indicated, the rate could be pushed beyond 5% in early 2023, a level it has not been at since 2007, and stay there for a while.

"There are significant pressures here that are not easy to fix," said Dec Mullarkey, managing director of investment strategy and asset allocation at SLC Management, in an interview. "The restrictive range is going to continue, I think, a lot longer than anybody's expecting in the market right now."

While much of the futures market is betting on the Fed beginning to cut rates late next year, Mullarkey believes that it will likely keep its benchmark rate above 5% for the next 18 months, pushing very tight financial conditions well into 2024.

In the quarterly Summary of Economic Projections released after this week's meeting, the median view among Fed officials is for the federal funds rate to end 2023 at 5.1%, or in a target range between 5% and 5.25%, up from the previous quarter's forecast of 4.6%, or a target range between 4.5% and 4.75%. A year ago, most Fed officials believed the rate would be 1.6% at the end of 2023.

The Fed, Powell said, was almost singularly focused on bringing inflation down to its 2% target, a task that involves slowing wage growth, fixing historic imbalances in the domestic labor market and curbing demand for services, which has yet to show clear signs of cooling. Powell said Dec. 14 that he was not considering moving away from that 2% target.

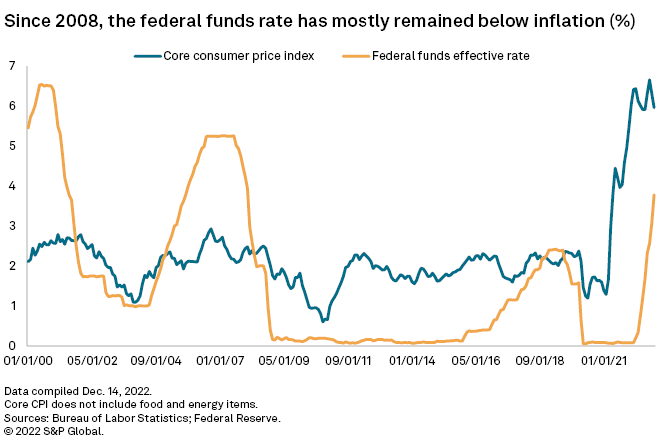

The core consumer price index, the market's preferred inflation metric that excludes food and energy prices, increased 6% in November from the year prior, the Bureau of Labor Statistics reported Dec. 13. That is below the 6.6% annual rise in September, its largest increase in more than 40 years.

The core personal consumption expenditures index, the Fed’s preferred inflation metric, was at 5% in October, down from the recent peak of 5.4% in February, but still well above the Fed's 2% target. November PCE data is scheduled for release Dec. 23.

Fed officials now expect core PCE inflation to end the year at 4.8% and fall to 3.5% in 2023, up from projections of 4.5% and 3.1%, respectively, last quarter.

Officials also lowered their projections for GDP growth, which they now believe will slow to 0.5% in 2023, and they boosted their forecast for unemployment, which they believe will climb to 4.6% at the end of next year, up from its September projection of 4.4%. Such a rise from its most recent level of 3.7% would amount to 1.6 million lost jobs over the course of roughly one year, according to Aneta Markowska, chief financial economist at Jefferies.

"The new economic projections imply an even higher pain threshold than before," Markowska wrote in Dec. 14 note. "In light of these forecasts, the path to a soft landing looks even more narrow than it did in September."

Market misread

While forecasts appear bleaker and Powell now sounds more hawkish than he has, arguably, in his tenure as chair, the market has yet to truly reflect this significant policy shift, said James Camp, managing director of strategic income at Eagle Asset Management.

"I think the market has many times … misread Chairman Powell," Camp said in an interview. "Every time that the market has tried to sniff out this dovish pivot, stocks have rallied and bonds have rallied, and that's not what Powell wants."

Despite signals from Powell and other officials that the Fed will stick with rates above 5% throughout next year, with further hikes possible, the S&P 500 has rallied more than 11.4% from its yearly low Sept. 30. The Nasdaq composite index has rallied over 8.2% from its low this year on Oct. 14.

Since the Great Recession, the Fed has reacted to market stress by loosening policy, and many investors still believe the central bank will do the same this time.

"In every other episode since 2008 when the market has caught a cold, the Fed shoved the monetary medicine down its throat," Camp said. "This is a regime shift, and I don't think the market is getting it yet."

Rather than focusing on what Powell is now telling them, the market remains overly focused on Fed history, said Mullarkey with SLC Management.

"When the Fed tops out, usually within six to eight months, they're cutting rates," Mullarkey said. Investors are "assuming the same template will apply here, but we've been dealt a different hand right now."