S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Sep, 2022

By Zoe Sagalow and Syed Muhammad Ghaznavi

Recent opposition from community groups and lawmakers over Toronto-Dominion Bank's planned acquisition of First Horizon Corp.

As the companies await regulatory approval of their $13.67 billion merger, they are now receiving blowback from industry observers, largely related to TD's overdraft practices.

On Aug. 23, the Center for Responsible Lending, or CRL, and other consumer advocates sent a letter to the Federal Reserve Bank of Philadelphia and the Office of the Comptroller of the Currency urging the regulators to reject the planned merger. The letter was an uncommon move for the CRL, which rarely presses regulators to strike down specific bank deal proposals.

The letter came less than a week after regulators held a public meeting on the deal where many community groups also expressed their concerns. And earlier in the summer, a group of lawmakers led by Sen. Elizabeth Warren, D-Mass., asked the OCC to block the deal until the bank "is held responsible for its abusive practices" to consumers.

That public opposition, particularly at a time when large bank deals are already facing increased regulatory scrutiny and subsequent prolonged closing timelines, makes it unlikely the merger will close within TD's estimated timeframe of between November and January, experts said.

"When they announced it at the end of February, they were pretty adamant that they were going to go to close in nine months, which to me was an aggressive timetable for TD to say that kind of openly," Christopher Marinac, director of research at Janney Montgomery Scott, said in an interview.

Potential delay would jack up price tag

Nevertheless, TD Bank still expects the deal to close on time, Group President and CEO Bharat Masrani said on the company's fiscal third-quarter 2022 earnings call. But given the public objection, Ebrahim Poonawala, managing director and head of North American banks research at BofA Securities, was not so sure.

"I think the risk of this extending the deal approval timeline is very much there," he said in an interview.

In what experts said was an unusual deal structure, First Horizon could receive an annualized 65 cents per share more than the $25 per share price if closing extends past Nov. 27. Further, the deal will automatically terminate if it does not close within a year, meaning by Feb. 27, 2023, unless otherwise extended.

"I think it's a high likelihood that [First Horizon] gets that additional compensation because it just feels to me like it's going to take longer than nine months to close," Marinac said.

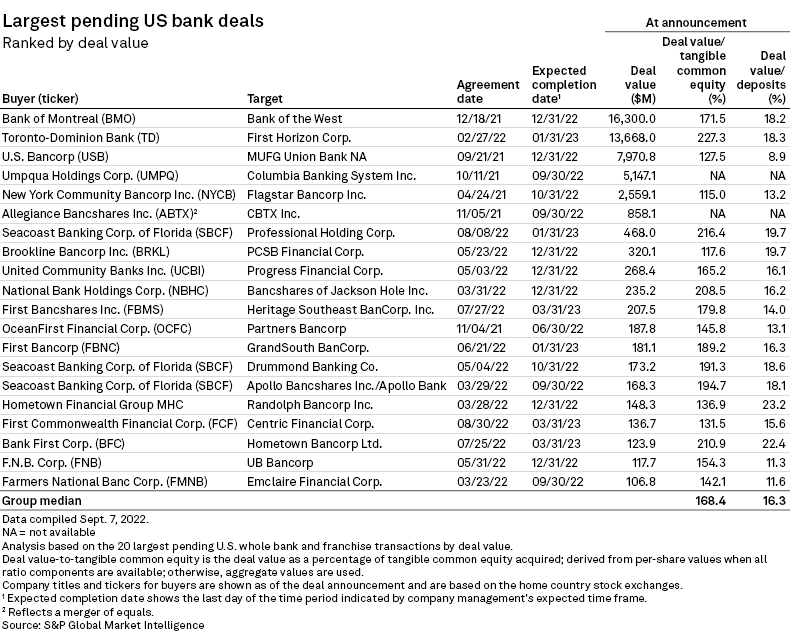

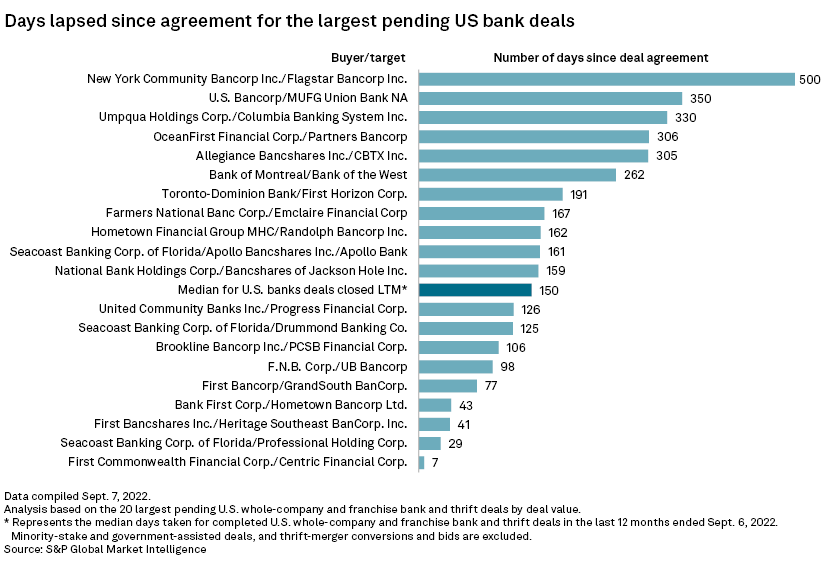

The announced transaction has been pending for more than 190 days, above the median of 150 days for U.S. bank deals over the past 12 months.

Pressure from public opposition

After facing similar public backlash, many banks involved in large mergers have struck community benefit agreements in which they pledge to offer services such as increased lending in low- and moderate-income communities.

TD intends to establish such a plan and has heard from the National Community Reinvestment Coalition, or NCRC, and other groups about needs in both banks' markets, Paul Beltrame, TD Bank's U.S. head of merger integration, said in a statement to S&P Global Market Intelligence in June. The NCRC, which advocates for fairness in lending and has helped strike nine benefit agreements with banks since 2021, also told S&P Global Market Intelligence that it is working on a community benefit agreement with TD.

The CRL is particularly concerned about TD's overdraft practices and is advocating for the bank to change those policies, said Nadine Chabrier, senior policy and litigation counsel at the center. Such a change could be part of a community benefit agreement, but those tend to focus on lending, and the center wants those changes to be made now, she added.

"We're going to advocate for them to revise their overdraft policies to stop harming consumers before the merger happens," Chabrier said in an interview. "It should be a condition of it."

In the second quarter, TD Bank NA, the U.S. banking subsidiary of TD, ranked seventh among the top 20 banks with the highest proportion of consumer deposit fee income relative to operating revenue. The bank reported $799.4 million in service charges on consumer deposits, or 9.1% of its operating revenue.

In response to a request for comment for this story, TD spokesperson Kate Toy said the company has launched an account that does not charge overdraft fees, called TD Essential Banking. Additionally, the company allows a 24-hour grace period and $50 cushion before assessing overdraft fees and plans to eliminate nonsufficient funds fees for retail customers in the fiscal fourth quarter, she said.

Separately, TD does not plan to close First Horizon branches, and the bank intends to open 20 to 25 new branches in majority-minority or low- to moderate-income communities in the U.S., according to Toy.

Another group expressing concern about the merger is Community Legal Services of Philadelphia, which is a member of the NCRC.

"We want TD to do better in whatever markets it's operating in and especially including the Philadelphia metropolitan area, and we felt like this was an opportunity to raise concerns that we have about TD Bank's lending and get the attention of the regulators and exert pressure for them to do better," Rachel Labush, supervising attorney at Community Legal Services of Philadelphia, said in an interview.

On top of community group opposition, a group of lawmakers, led by Sen. Warren, penned a letter in June to the OCC urging it to examine whether TD enrolled customers in accounts and services, such as overdraft protection, without permission.

Rep. Katie Porter, D-Calif.; Rep. Jesús "Chuy" García, D-Ill.; and Rep. Al Green, D-Texas, all co-signed the letter.