Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Mar, 2024

By Allison Good

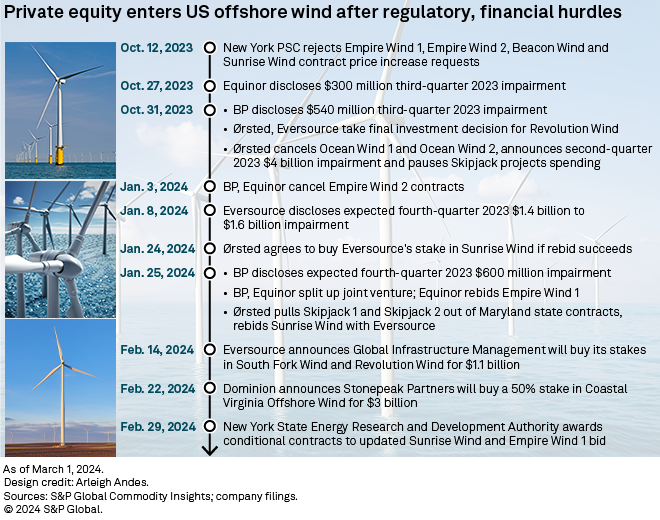

From lease sales and port logistics to the projects themselves, some of the largest alternative asset managers are leaning into demand for infrastructure supported by federal tax credits and the Biden administration's goal of 30 GW of offshore wind energy capacity by 2030 and an additional goal of 15 GW of floating offshore wind energy capacity by 2035.

Global Infrastructure Management LLC announced a deal in mid-February to take over Eversource Energy's 50% interest in two of the utility company's joint offshore wind farms with Ørsted A/S for $1.1 billion in cash. The following week, Dominion Energy Inc. saw its stock pop after announcing its own deal to unload a 50% stake in the 2,587-MW Coastal Virginia Offshore Wind project to Stonepeak Partners LP, with an expectation of $3 billion in proceeds for the utility upon close.

Due to high interest rates, cost inflation and supply chain clogs, Eversource had been forced to take a billion-dollar writedown on its offshore wind portfolio. Global Infrastructure Management will acquire the utility's interest in the 132-MW South Fork Wind and 700-MW Revolution Wind projects, while Ørsted is moving to take complete ownership of the 924-MW Sunrise Wind project.

"Private equity does well when some of the initial development work has already been done and then they come in and fund it across the finish line," Norton Rose Fulbright attorney Becky Diffen, who focuses on renewables project development, said in an interview.

Stonepeak and Global Infrastructure Management declined to comment further on the deals, but both transactions' terms include cost overrun stipulations. Eversource will shoulder potential extra spending for Revolution Wind equally with Global Infrastructure Management up to about $240 million, after which any additional overruns would be paid for by Eversource.

Dominion and Stonepeak will each contribute 50% of the remaining capital necessary to fund Coastal Virginia's project construction up to $11.3 billion. For project costs between $11.3 billion and $13.7 billion, Stonepeak has the option to make additional contributions, with Dominion contributing between 67% and 83% of such capital and Stonepeak funding the remainder.

Those protections are positive for prospective private equity investors, according to Chris Ortega, managing director and Americas head at Morgan Stanley Infrastructure Partners LP.

"A year or two or three ago we were pretty convinced that we thought the unit economics could be challenged," Ortega said in an interview. "We're starting to see that evolve with some of the newer deals."

Norton Rose Fulbright's Diffen also emphasized that there are "not enough good opportunities to go around" for private investors who have recently raised energy transition funds, making offshore wind "a prime opportunity."

"A lot of these projects are still good projects," she said. "The problem that they ran into was they were locked into [power purchase agreement] prices before this latest run of challenges."

Another transaction may be on the horizon, with Equinor ASA saying Feb. 29 it is looking to bring in a partner to "reduce ownership share and exposure in" its 810-MW Empire Wind 1 project after a successful rebid during New York's fourth offshore solicitation.

Port, land leases

Morgan Stanley Infrastructure Partners is taking a different approach, investing in repurposing and operating existing ports in the Northeast and leasing them to developers for storage, assembly and manufacturing of windfarm components through a joint venture with Crowley Maritime Corp.

The asset manager owns 80% of the Crowley Wind Services Holdings LLC joint venture, announced in August 2023.

"Being a solutions provider there seems like a really interesting way to play the opportunity," Ortega said.

"When we initially looked at some of the offshore wind projects we were concerned," he added. "Obviously those concerns ended up being warranted."

Crowley Maritime also owns vessels compliant with the Jones Act, under which only US-flagged vessels are able to operate out of the country's ports. A lack of available vessels that adhere to the maritime law has been a factor in the Eversource and Ørsted projects' delays and cost issues, though Dominion is building a Jones Act-compliant installation vessel.

Crowley Wind will be able to provide vessels that will go back and forth to windfarms during construction and operation, Ortega said.

Morgan Stanley Infrastructure Partners also sees a bottleneck on the transmission side of the offshore wind industry, but Ortega said it has not made any investments yet.

Private equity is getting involved in offshore wind leases as well. Invenergy LLC and energyRe LLC, backed by a consortium including Blackstone Inc., won an 83,976-acre lease area with a bid of $645 million in a 2022 sale. The auction by the US Bureau of Ocean Energy Management (BOEM) for areas off the coast of New York and New Jersey known as the New York Bight raised a total of $4.37 billion.

Global Infrastructure Management, which is being acquired by BlackRock Inc., also backed one of the winning bids along with European energy companies EDP - Energias de Portugal SA and Engie SA.

Copenhagen Infrastructure Partners P/S, which co-owns the Vineyard Wind project under construction off the coast of Massachusetts with Avangrid Inc., won a bid as well. Avangrid has an option to gain operational control of the 800-MW Vineyard Wind project once it achieves commercial operation.

Earlier-stage project development

Apollo Global Management Inc. announced in 2020 that funds managed by affiliates would invest up to $265 million through convertible debt and equity in offshore wind development company US Wind Inc., which controls 80,000 acres off the coast of Maryland.

US Wind plans to construct two projects with a combined 1,100 MW of capacity, according to the company. Both the Ocean City Offshore Wind Project (Marwin) and Momentum Offshore Wind Project, which are due to come online in 2025 and 2026, respectively, have been awarded offshore renewable energy credits by the state of Maryland, and BOEM released a draft environmental impact statement for the projects in October 2023.

Chris DeLucia, head of global power and renewables at S&P Global Commodity Insights, does not see many other private equity firms following suit.

"For a lot of these capital providers, the full offshore wind development timeline will be too long a period for capital to be tied up before it starts to generate a return," DeLucia said in an email. "It may also be more difficult for these funds to manage the development risk of a small number of large-scale projects (as opposed to corporates that can spread the risk over a large operating portfolio)."

Still, US utility companies are not likely to step up either because they are focused on exiting merchant renewables portfolios and redeploying capital to their core regulated businesses, DeLucia added.

Coastal Virginia Offshore Wind is the only planned project currently that will be included in an electric utility's rate base.

As the next generation of projects takes shape, Morgan Stanley's Ortega anticipates more bumps in the road as the industry resets its expectations.

"We continue to think there will be blips along the way," Ortega said. "It won't be a straight line with offshore wind development."