S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 Oct, 2022

By Zeeshan Murtaza and Dylan Thomas

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity fund managers have plenty of investable capital at their disposal, but they've been slower to put that money to work this year amid high inflation and signs of a global recession.

The total value of private equity entries across the globe dropped more than 60% year over year in September to $34.91 billion. The industry recorded $587.99 billion in entries between Jan. 1 and Sept. 30, about 30% lower than the $853.01 billion total through the first nine months of 2021. In fact, global private equity entry totals have declined each quarter since peaking in the fourth quarter of last year.

It is not that there are no opportunities out there. Private equity managers have been talking for months about taking advantage of market dislocation to buy companies on the cheap, and global entries this year are still pacing well ahead of where they were at the same time in 2018, 2019 or 2020.

General partners are also treading cautiously, aware that the same market forces creating buying opportunities, including rising interest rates and slower economic growth, could sour their investments.

For example, on Blackstone Inc.'s third-quarter earnings call, President Jonathan Gray weighed the current opportunity the firm sees in Europe and the U.K., where a strong dollar is meeting falling public sector valuations, against the risks of an emerging energy crisis and rising housing costs on the continent, as well as upward-trending interest rates and inflation. Gray said Blackstone is keeping a close eye on potential targets in Europe but cautioned analysts and investors that it may take years for deals to materialize.

Get more detail on global private equity entry trends, including the sector most active in September, here.

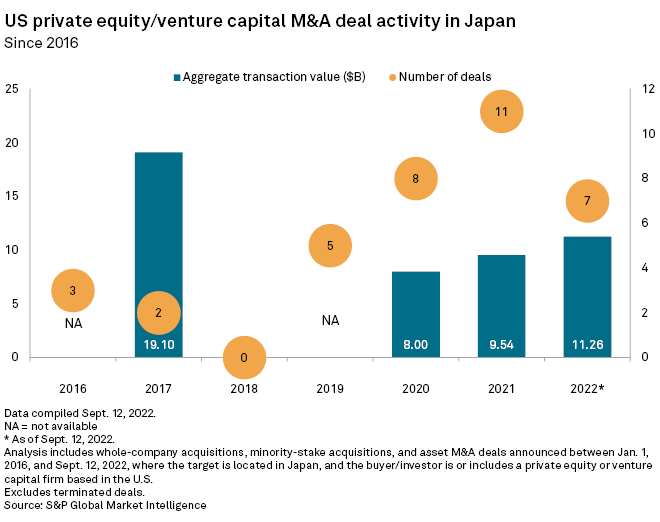

CHART OF THE WEEK: Increasing U.S. private equity investment in Japan

⮞ With $11.26 billion in aggregate transaction value recorded between Jan. 1 and Sept. 12, U.S. private equity firms have already invested more in Japanese businesses in 2022 than in all of 2021.

⮞ The relative strength of the U.S. dollar against the Japanese yen and lower corporate valuations are two factors driving acquisition activity by U.S.-based firms.

⮞ Also drawing private equity investment to Japan are the country's low interest rates and stable regulatory environment.

DEALS AND FUNDRAISING

* General Atlantic is acquiring investment manager Iron Park Capital Partners LP to create General Atlantic Credit. The deal could close in the first quarter of 2023.

* KKR & Co. Inc. agreed to purchase full life cycle digital services transformation company Ness Technologies Inc. from The Rohatyn Group.

* NovaQuest Private Equity management company QHP Capital LP closed the acquisition of AutoCruitment, a digital patient recruitment company.

* TPG Capital LP's TPG Real Estate closed its opportunistic real estate equity fund TPG Real Estate Partners IV with $6.8 billion in capital commitments.

* Ridgemont Equity Partners concluded Ridgemont Equity Partners IV LP at its hard cap with $2.35 billion in commitments. The initial target for the fund was $2.0 billion.

ELSEWHERE IN THE INDUSTRY

* French digital platform and services company Plus que PRO SAS received a capital injection from IK Partners.

* MSP Sports Capital acquired a majority stake in action sports and entertainment brand X Games from ESPN Inc. unit ESPN Productions Inc.

* Sky Peak Capital completed the purchase of Hicks Machine Inc., a precision machine shop.

* Long Ridge Equity Partners LLC closed the acquisition of a majority stake in Acqueon, a provider of omnichannel customer engagement software, from Everstone Capital Asia Pte. Ltd. Everstone will retain a minority stake in Acqueon.

FOCUS ON: FOOD

* Suja Life LLC, a portfolio company of Paine Schwartz Partners LLC, bought Vive Organic Inc. The target company produces organic juices.

* Ara Partners Group LLC committed $65 million in additional capital to BioVeritas, a bio-based ingredients company. Ara already holds a majority stake in the company.

* BRS & Co. and Rosser Capital Partners agreed to jointly acquire Tumble 22 Holdings LLC. The target company is a hot chicken restaurant concept with five Texas locations.