S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Dec, 2021

By Pam Rosacia and Gaurang Dholakia

A number of alternative asset managers with a private equity focus have decided to list in 2021, as they increasingly shift away "from a traditional partnership structure to more of an institutional setup," said Preqin Inc. Vice President of Research Insights Cameron Joyce.

Limited partners "favor the additional transparency that a public listing will bring, especially in a market that has traditionally been known for favoring confidentiality," Joyce said in emailed comments.

Additionally, the market has been on fire. "Loose monetary policies and low interest rates have sent valuations through the roof, so if you want to go public at some point, you better do it on top of the wave," said Allianz SE Senior Investment Expert Jordi Basco Carrera in an interview with S&P Global Market Intelligence.

A public listing also expands a private equity firm's investor base. The ease-of-use of trading applications and the quick exchange of information online during the pandemic led to a new wave of retail investors participating in IPOs, he added.

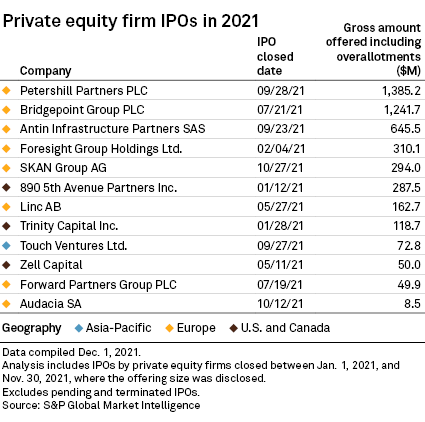

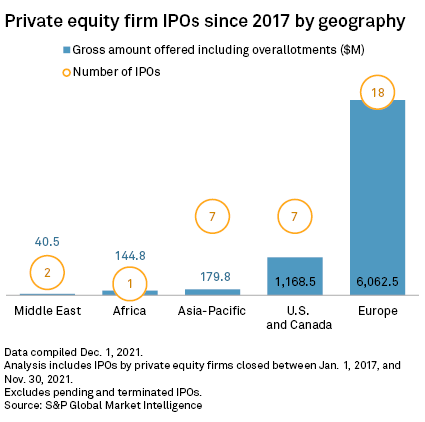

The majority of private equity firm IPOs in 2021 were held in Europe. Joyce said European listings are a recent phenomenon, which signals that the region's private equity market is nearing maturity.

High-profile IPOs by private equity firms include Antin Infrastructure Partners' offering, which was completed in September and sought to raise about €550 million.

In July, London-based mid-market investment firm Bridgepoint Group PLC launched and completed its IPO, which priced at 350 pence per share, implying a market capitalization of about £2.88 billion.

The Goldman Sachs Group Inc.'s Petershill Partners PLC business, which acquires minority stakes in alternative asset managers, also went public in London in September to raise approximately $750 million.

Private equity firms that could go public in the near term include TPG Capital LP, which is exploring a potential listing at a valuation of roughly $10 billion, and L Catterton Partners, which is evaluating an IPO or a merger with a blank-check company.

Ardian and CVC Capital Partners Ltd. could also follow suit after the successful listings and strong stock performance of their fellow European buyout firms EQT AB (publ) and Bridgepoint.

Public market prospects

Market Intelligence data shows that a total of 20 private equity firm IPOs amounting to roughly $5.27 billion were completed globally in the 2020-21 period, and Carrera forecasts activity will continue at a slower pace in the next couple of years.

There will still be high levels of IPOs, "but not with the acceleration that we have seen since 2020," and markets should stabilize as monetary and fiscal policies fade, Carrera said.

Europe will continue to be a good place for public listings in the 2022-23 period. "If you want a bit more organic growth, Europe is a better option, providing a bit more market stability and with a lower-for-longer monetary policy," Carrera said. He expects the retail wave to continue as a driver of IPO activity unless there is a market downturn, which he said seems unlikely in 2022.

However, Joyce, from Preqin, added that building a meaningful retail investor base may be difficult because private equity is a "relatively complex business to understand and the earnings from carried interest can be quite lumpy."

Index outperformance

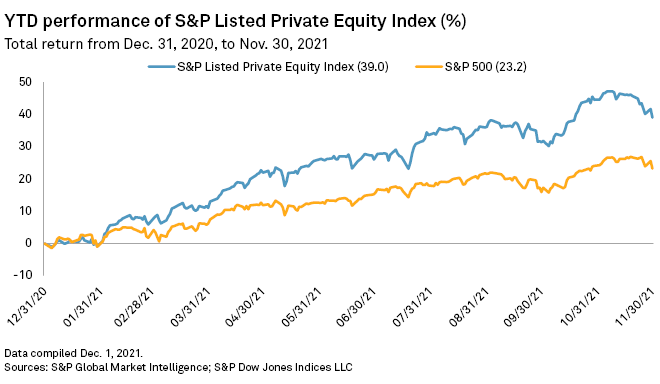

The S&P Listed Private Equity Index, with constituents including Blackstone Inc., KKR & Co. Inc. and Apollo Global Management Inc., has outperformed the S&P 500 year to Nov. 30. During the period, listed private equity firms recorded a total return of 39% compared to 23.2% for the S&P 500.

"Given the risk-on environment that we have seen recently, private equity returns are levered to the strong returns we have seen in public markets," Joyce said.

Large investments in the technology sector have also contributed to outperformance and higher carried interest for listed private equity firms, he concluded.