Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Aug, 2021

By Karin Rives

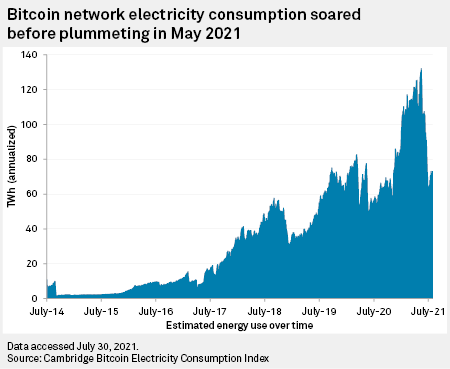

Even after bitcoin mining activity dipped in recent months, the cryptocurrency network consumed almost as much energy as the entire nation of Chile and more than twice what homes and businesses in Denmark use in a year, real-time estimates show.

Such heavy power consumption explains why operators of the sprawling and lucrative data centers used to verify, process and record transactions of cryptocurrencies are racing to find inexpensive energy to keep their costs down. If the energy is clean, so much the better.

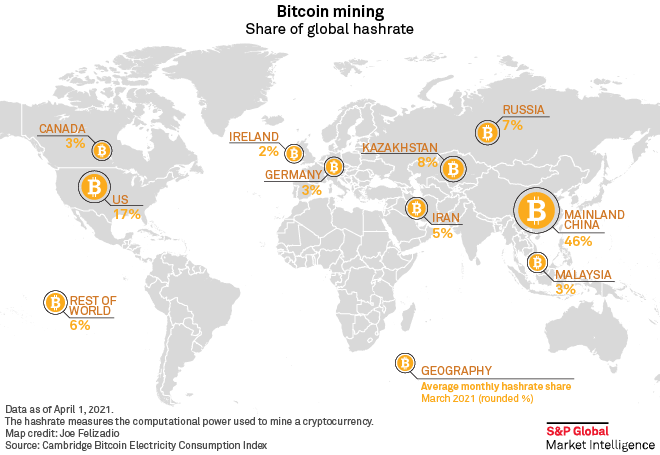

China cracked down on its massive bitcoin industry in June, citing environmental and regulatory concerns. The decision accelerated an exodus of crypto miners heading to new and affordable nations such as Kazakhstan, Russia and Canada.

Crypto miners are also moving their operations to energy-producing U.S. states like Pennsylvania, Texas and Wyoming. The U.S. this year surpassed Russia to become the second-largest market after China for miners of bitcoin and other much smaller cryptocurrencies known as altcoin, according to the Cambridge Bitcoin Electricity Consumption Index.

"The trend is clearly for the U.S. to be gaining market share," said Anton Dek, a co-author of the well-respected index.

Whereas Chinese provinces were concerned that energy-guzzling bitcoin mining centers would undercut their climate goals, Texas has used incentives like generous demand response programs for large industrial and commercial customers to lure crypto miners to the Lone Star State.

Under such programs, miners that offer to turn off their computers and curtail their energy consumption by at least 100 kWh on days when energy demand peaks can expect to receive tens of thousands of dollars annually from the state. Such arrangements can offset whatever business miners lose by turning off their computers and ease energy costs.

The demand response programs serve as a magnet for bitcoin miners, said Katie Coleman, a Texas energy attorney and expert on the state's electricity market.

"Electricity is the largest overhead cost for most of these facilities," Coleman said. "Texas provides unique opportunities for demand response providers compared to other regions that are not fully deregulated and have a different resource mix. It is a huge draw not only for bitcoin mining but for any energy-intensive industry."

Crypto miners use computers to solve mathematical puzzles required to complete "blocks" of verified transactions, which are then added to a blockchain. Those with the most powerful and fastest systems have the best chance of being rewarded with digital coin.

A single bitcoin transaction requires 1,695 kWh of electricity, about what an average U.S. household uses in 58 days, according to Digiconomist, a platform managed by Dutch economist and blockchain expert Alex de Vries. That same transaction produces 805 kilos of carbon dioxide, equivalent to the carbon footprint of 1.8 million Visa transactions, de Vries estimates.

"What Texas doesn't need is 1 million mining machines running around the clock," de Vries said. "They had that power failure last winter, their grid is just not stable. So how would bitcoin mining not affect their energy supply?"

Even if miners sometimes shut down their computers as part of their demand response agreement, it will ultimately be Texas ratepayers who pay them to do so, de Vries asserted.

Bitcoin market value tops $860 billion

In China, bitcoin miners relied on a mix of clean hydropower and on fossil-fuel sources like coal. In Kazakhstan, which draws half of its energy from coal and the rest from oil and gas, individual miners will have a larger carbon footprint than their Chinese peers because they do not use hydro, industry analysts say.

To what extent the crypto industry's changes and move out of China will ultimately grow or shrink its energy consumption and emissions remains unknown.

If the miners move from China, settle in new locations and restart operations, the hashrate will go back up, said Dek, using an industry term describing the computational processing power of a cryptocurrency network. If the price of bitcoin rises, the energy consumption will also have a tendency to grow, he added.

With a market value of more than $860 billion, bitcoin was trading above $46,000 on Aug. 11, its highest level in several months. Meanwhile, energy use from the network is creeping back up. But crypto miners are also finding new partners in energy producers and providers.

A new purpose for wasted gas

For instance, oil and natural gas companies are under growing pressure from investors to tackle emissions and are mindful of the Biden administration's plans to crack down on methane leaks for existing facilities after regulations on new and modified production and processing sites were reinstated in June. The main ingredient in natural gas, methane is 82 times more potent of a greenhouse gas than carbon dioxide for 20 years after being released.

A new crop of entrepreneurs is helping oil and gas companies tackle the issue by finding ways to generate inexpensive power for bitcoin miners using excess oil and gas that would otherwise have to be flared and vented, releasing greenhouse gases in the process. As an extra incentive, lawmakers in North Dakota and Wyoming recently passed bills exempting oil drillers from taxes on gas they offer to bitcoin miners that set up shop near their wells.

|

EZ Blockchain's mobile crypto mining unit comes with a 1.5-MW natural gas-fired power generator. |

"We can help them monetize their gas," said Sergii Gerasymovych, CEO and co-founder of EZ Blockchain, which deploys mobile crypto mining centers to mostly small oil and gas production sites. "Crypto is basically cleaning up after the other guys, doing everyone a favor over the past couple of years."

The EZ Smartbox solution that Gerasymovych's company offers also comes with a mobile 1.5-MW natural gas-fired generator. Crypto miners that use the EZ Smartbox pay a starting price of $75 per kW, not including the mining equipment. Although the gas generator will emit some carbon dioxide and other harmful volatile organic compounds, the overall environmental impact is up to 60% lower than if the drillers would have flared or vented the methane into the air, Gerasymovych said.

Nuclear plant operators are also seeing opportunities in the rapidly growing cryptocurrency industry to help boost the economics of their struggling plants.

Talen Energy Corp. on Aug. 3 announced that it formed a partnership with TeraWulf Inc. to develop as much as 300 MW of fossil-free mining capacity by the Susquehanna nuclear power plant in Pennsylvania. Once it is operational in 2022, the new facility will benefit from one of the lowest electricity costs publicly traded bitcoin mining companies enjoy in the U.S., the new partners promised.

And in July, Energy Harbor Corp announced a similar deal to provide electricity from its nuclear fleet to Standard Power. The data center hosting company claims to have more than 1,000 MW of power capacity under development for crypto miners who will pay $30 per MW or less for the power.