S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 Jun, 2021

By Pam Rosacia and Annie Sabater

The specialty chemical industry is seeing a rebound in M&A and corporate carve-out activity after a period of disruption caused by COVID-19, thanks in large part to private equity funds holding ample capital to invest and corporations focused on efficient operations to better navigate the impact of the pandemic.

"[C]ontinued portfolio realignment by corporations, abundant dry powder from private equity funds, a favorable interest-rate environment, an improving economic backdrop and corporations now looking for growth" are creating a favorable climate for robust M&A activity in the sector, Deloitte LLP said in its recent outlook report on the industry.

With roughly $1.5 trillion of dry powder and liquidity, private equity firms are aiming to bridge the gap in their investment goals from 2020 and are targeting opportunities in the overall chemical sector, added Salman Ahmed, an analyst at India-based research firm Aranca.

M&A momentum is likely to be driven by pent-up demand for corporate divestitures, "as pure-play chemical companies continue to manage their portfolio and shed noncore and less attractive businesses," Ahmed said.

Additionally, on the PE side, firms have been holding assets "while waiting for the macroeconomic picture to improve to get better deal valuations," he added.

From a broader perspective, global economic recovery optimism as a result of the vaccine rollouts, stimulus funds to boost liquidity and an anticipated ease of global trade tensions are all supporting M&A activity in the industry, Ahmed said.

Key sector deals

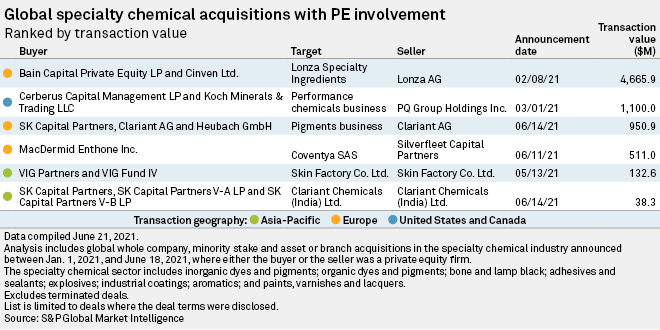

Year to June 18, private equity firms have deployed about $7.40 billion into the specialty chemical sector based on disclosed deal value, according to S&P Global Market Intelligence data.

The largest of these deals so far is the planned acquisition of Lonza Specialty Ingredients by Bain Capital Pvt. Equity LP and Cinven Ltd. from Lonza Group Ltd. for a total transaction value of about $4.67 billion. The Basel, Switzerland-based company makes specialty chemicals for microbial control solutions and serves diverse end markets, including professional hygiene and personal care.

Bain and Cinven plan to use the company as "a platform for further industry consolidation," Bain Managing Director David Danon said in a release. The deal, which was announced Feb. 8, is slated to close in the second half of 2021.

In two of the biggest corporate carve-outs in the sector year-to-date, U.S.-based PQ Group Holdings Inc. will divest its performance chemical business in a deal valued at $1.1 billion and Switzerland-based Clariant AG will sell its pigment business in a transaction worth $950.9 million.

Cerberus Capital Management LP and Koch Industries Inc. unit Koch Minerals & Trading LLC will acquire the PQ business, while German specialty chemical company Heubach GmbH is partnering with SK Capital Partners on the Clariant deal. Clariant will retain a minority stake in its pigment business.

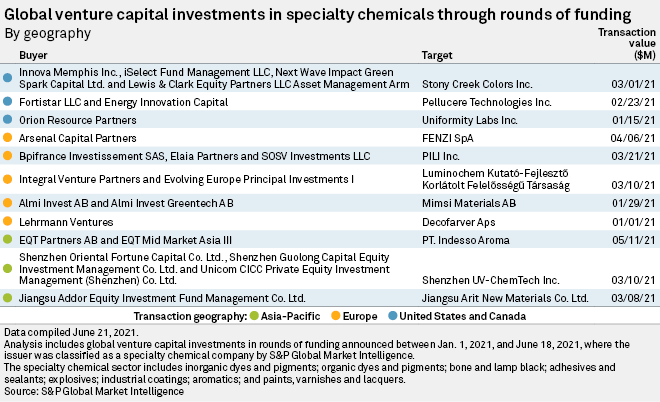

On the venture capital front, 11 specialty chemical companies have secured funding worldwide since Jan. 1, according to Market Intelligence data.

In the U.S., Uniformity Labs Inc. received about $38.4 million in series B financing from Orion Resource Partners, while Stony Creek Colors Inc. obtained $9.0 million in a series B round that included participation from Innova Memphis Inc., iSelect Fund Management LLC and Next Wave Impact. Pellucere Technologies Inc. raised an undisclosed sum from Energy Innovation Capital and Fortistar LLC.

In a cross-border funding round, Swedish private equity firm EQT Partners AB provided an undisclosed amount of venture capital to Indonesia-based Indesso Aroma, which specializes in food, flavor and fragrance ingredients.

Opportunities and challenges

Specialty chemical segments that were highly sought after before the pandemic continue to be in demand, including coatings, adhesives, sealants and elastomers. Flavors and fragrances, personal care ingredients, paints, water treatment and surfactants also command relatively high valuations, Ahmed noted.

"Considering that these sectors have performed well during the pandemic, they could attract strong interest from private equity players from an M&A standpoint. They are highly attractive as they are noncyclical, having demand all-year round with a wide array of end-use applications," he explained.

With a slight uptick in activist investors pushing for companies to sell certain businesses or pursue outright sales, M&A activity could further increase. In some cases, companies could "proactively take steps to divest noncore assets or accelerate these plans to ward off activist investors," presenting an opportunity for PE players to transact, Ahmed said.

With leverage levels higher now than in the pre-pandemic period, the challenge for PE firms is to successfully fight off their peers and strategic acquirers to buy assets "at the lowest multiple while leaving enough value creation opportunities on the table."

M&A opportunities also vary by region, with Asia experiencing a strong rebound since the coronavirus outbreak, particularly in China. Conversely, Europe has seen a drop in ranking as a deal destination amid stringent environmental laws, which could hinder investments in that region and prompt investors to look elsewhere, Ahmed concluded.