S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Jun, 2021

By Allison Good

| Flames from a flaring pit near a well in the Bakken Shale. Oil producers sometimes flare natural gas, the primary component of which is methane. Source: Orjan F. Ellingvag/Corbis News via Getty Images |

.

|

The financial community has turned up the heat on the oil and gas sector, pressing the industry to cut its greenhouse gas emissions. And companies in the space are responding.

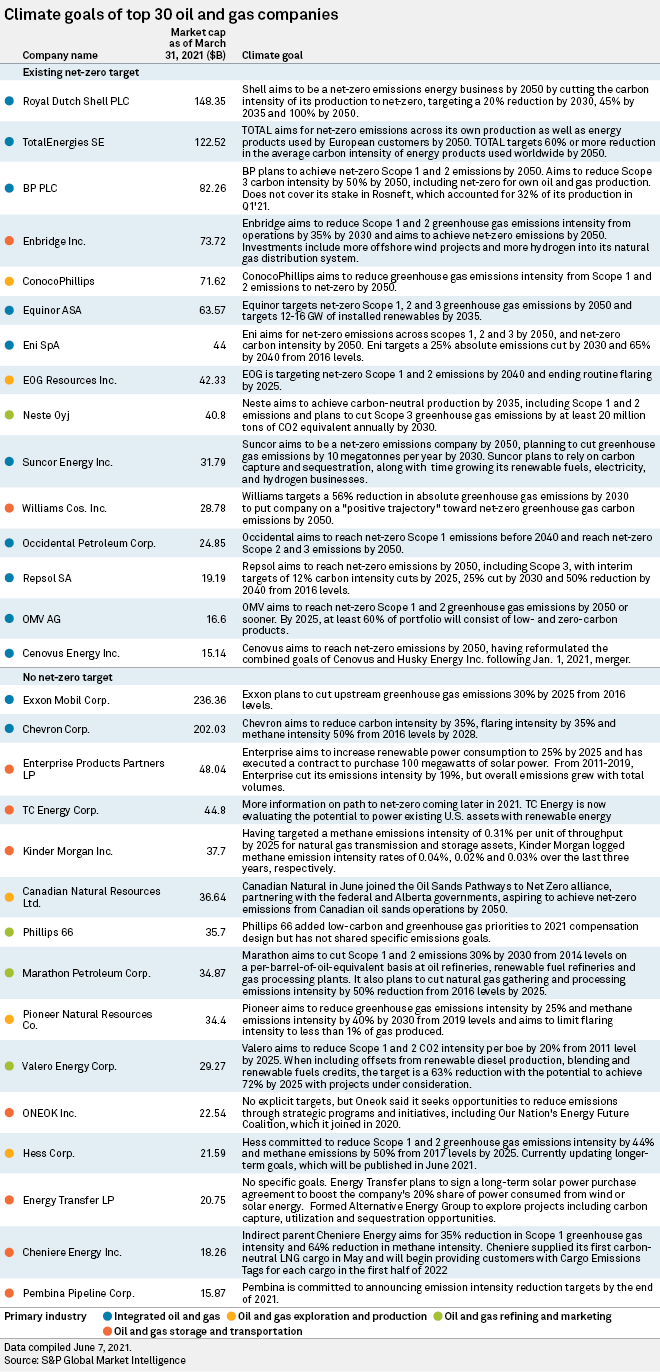

The number of large European and North American oil and gas companies making pledges to reach net-zero greenhouse gas emissions by 2050 or earlier continued to climb in the first half of 2021, with Canadian companies in particular adding to their ranks, an S&P Global Market Intelligence analysis of the industry's emissions pledges found.

The analysis found European majors, such as Royal Dutch Shell PLC and BP PLC, continue to be more likely to have made net-zero pledges than their U.S. counterparts, including Exxon Mobil Corp. and Chevron Corp.

But recently both U.S. majors have been the target of shareholder activism tied in part to climate concerns. Shareholders, aligned with previously passive index funds such as BlackRock Inc., voted against management to name new board members at Exxon and demand that management at Chevron develop new plans for a low-carbon energy future. Exxon and Chevron's current climate goals call for reductions in greenhouse gas emissions but are well short of the net-zero ambitions of the Europeans.

Even among the European oil and gas operators, though, few have tackled the emissions that come from the use of their products, leaving much of the value chain's emissions untouched by net-zero goals.

With net-zero carbon emissions pledges carrying increasing weight among investors and policymakers, companies are shifting. The number of large upstream and midstream operators pledging net-zero emissions increased from 11 to 15 in the past six months, S&P Global Market Intelligence found. Two of the companies that established new targets are Canadian. The analysis tracks net-zero pledges among the 30 largest European and U.S. oil and gas companies, by market capitalization.

"The pace of change is clearly accelerating," Andrew Logan, senior director for oil and gas at Ceres, a nonprofit investor network, said in an interview. "At the same time there's also a sense that things need to move even faster."

'A global concern'

The shareholder votes at Exxon and Chevron, coupled with a recent ruling by a Dutch court that Shell's plans to reduce carbon intensity are inadequate, make it clear that reductions in emissions are no longer optional, according to the credit analysts at rating agency S&P Global Ratings. This set of developments "underscores what has become a global concern among sovereign nations and investors and could serve as a wakeup call for an industry that is perceived by many to be slow to adjust to climate change and emission mandates," Ratings said.

|

The growth in the amount of investment under the control of funds pledged to invest solely in firms transitioning to a carbon-free economy is too large to ignore, said Raymond James & Associates Inc. oil, gas and renewables analyst Pavel Molchanov.

"The scale of ESG funds has become so massive that this category of investors is an inescapable presence for every public company, in every sector," Molchanov said. "It is a striking but underappreciated fact that one out of three professionally managed assets in the U.S. are currently in ESG funds. This equates to a staggering $17 trillion. Even more to the point for fossil fuel companies, the largest single slice of that $17 trillion — $4 trillion — is in climate funds" with a mandate to invest in carbon reductions.

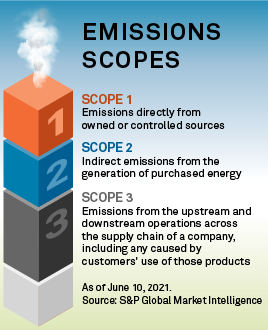

The four companies joining the net-zero club since December 2020 include Italian major Eni SpA, U.S. shale oil and gas producer EOG Resources Inc., Canadian oil driller Cenovus Energy Inc. and Canadian refiner Suncor Energy Inc. Like most U.S. upstream oil and gas producers, though, EOG's pledge comes with an asterisk — it does not include Scope 3 emissions, carbon emissions resulting from customers' burning oil or gas. Exxon and Chevron, among others, all pledge to reduce emission from their own operations but stop short of trying to limit the emissions their products generate downstream.

Another caveat for many companies is that their goal is to reduce carbon intensity — carbon emitted divided by production — to zero, not total carbon emissions. Shell and others who are focused on carbon intensity argue that reducing intensity to net-zero is functionally the same as achieving net-zero emissions, but critics counter that companies can plant trees and build solar projects to reduce their intensity without reducing overall emissions. "Societal pressures will ask oil and gas operators to commit to more and in absolute emission cuts using science-based targets," the oil and gas consultants at ADI Analytics said in a note.

Midstream holdouts

On the midstream side, meanwhile, none of the biggest companies have made pledges to zero out Scope 1 and Scope 2 emissions by 2050 since gas pipeline heavyweights The Williams Cos. Inc. and Enbridge Inc. announced their targets in August 2020 and November 2020, respectively.

Instead, many management teams are committing to using more renewable energy sources to power existing operations while they explore opportunities for integrating hydrogen blending and carbon capture, sequestration and utilization into their infrastructure. In the processing segment, some refiners such as Phillips 66 also have yet to set specific emissions goals.

"It's been a more challenging conversation with pipeline companies," Ceres' Logan said. "I think there's going to be a real concerted push on the biggest midstream companies over the next six months or so to begin to address Scope 3 [emissions] ... and likewise with refiners."

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.