S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

1 Jun, 2022

By Anthony Barich and Susan Dlin

| Zinc production at Glencore's San Juan de Nieva refinery in Spain. |

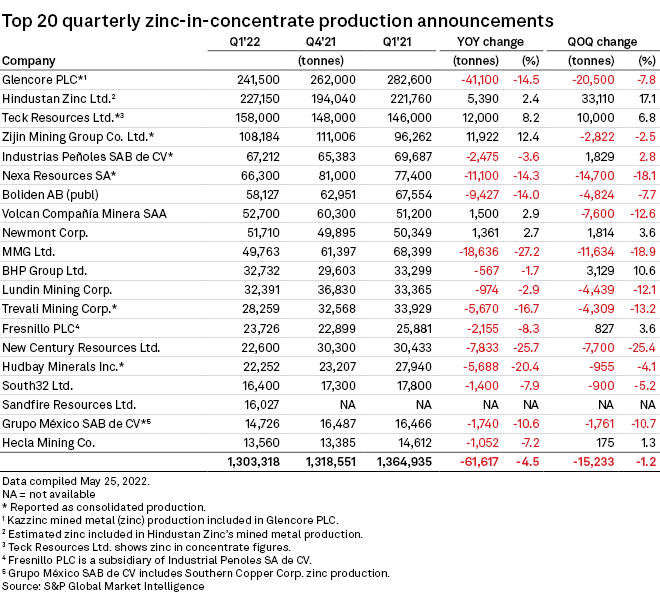

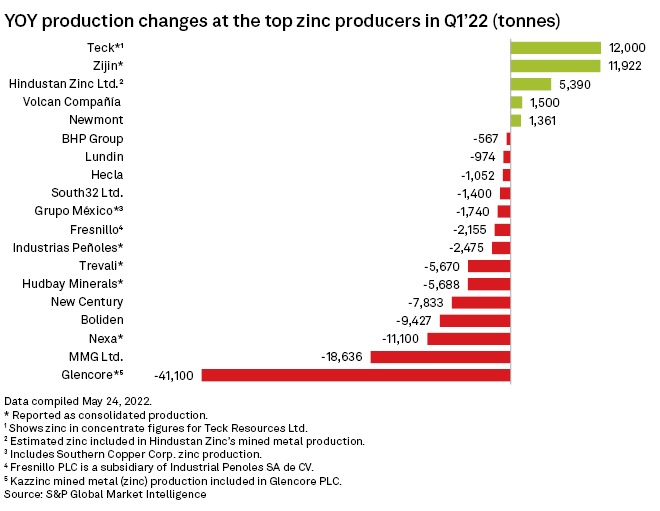

Nearly half of the world's top 20 zinc producers recorded double-digit percentage losses in first-quarter output year over year as zinc prices soared along with European energy prices following the Ukraine conflict, according to data from S&P Global Market Intelligence.

Certain metal prices have also risen in recent months, and the London Metal Exchange three-month zinc price hit a 15-year high of $4,136 per tonne on March 8. Meanwhile, only five of the world's top 20 zinc producers increased output in the first quarter compared to the same period of 2021.

"Given current supply chain issues, it has been difficult for producers to increase output quickly to take advantage of the pricing increases," BDO corporate finance partner Adam Myers told S&P Global Commodity Insights.

Glencore PLC, the world's biggest zinc producer, lost the most output in terms of tonnage, down 41,100 tonnes compared to the prior-year quarter, more than double the reduction in output of MMG Ltd., which booked the next largest decrease in production.

Glencore's output fell 14.5% year over year to 241,500 tonnes in the first quarter. The company attributed the drop to COVID-19-related worker absences at the Mount Isa Mines Ltd. operations in Australia and the end of mining at the Iscaycruz site in Peru in the third quarter of 2021 as planned.

The Swiss miner was one of eight companies among the world's top 20 zinc producers to have booked a double-digit percentage drop year over year. MMG suffered the biggest percentage loss, down 27.2% to 49,763 tonnes.

New Century Resources Ltd.'s zinc production dropped 25.7% year over year amid heavy rainfall and ball mill issues at its Century mine in Australia in the first quarter. Hudbay Minerals Inc.'s output slipped 20.4% amid lower zinc grades at the Lalor and 777 mines in Canada.

Trevali Mining Corp., Nexa Resources SA, Boliden AB and Grupo México SAB de CV also booked double-digit reductions in first-quarter zinc production year over year, comprising 16.7%, 14.3%, 14.0% and 10.6% decreases, respectively.

New Century Resources also experienced the largest quarter-over-quarter drop in production, down 25.4%.

Teck Resources Ltd. had the largest year-over-year production boost for the quarter in terms of tonnage with an output of 12,000 tonnes, just ahead of Zijin Mining Group Co. Ltd.'s 11,922-tonne increase.

Hindustan Zinc Ltd., Volcan Compañía Minera SAA and Newmont Corp. were the only other companies that increased zinc production during the first quarter, in terms of tonnage as compared to the first quarter of 2021.

Sandfire Resources Ltd. added 16,027 tonnes of production in the first quarter, following its Feb. 1 acquisition of the MATSA Project in Spain.

Among the top five producers, only Glencore and Industrias Peñoles SAB de CV booked year-over-year decreases in zinc output for the quarter.

Zijin Mining recorded the largest year-over-year percentage rise in production, up 12.4%, the only company to experience double-digit growth. Hindustan Zinc achieved the largest quarter-over-quarter percentage lift in production, up 17.1%.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.