S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 May, 2023

By Marvin Richards Jr and Gaurang Dholakia

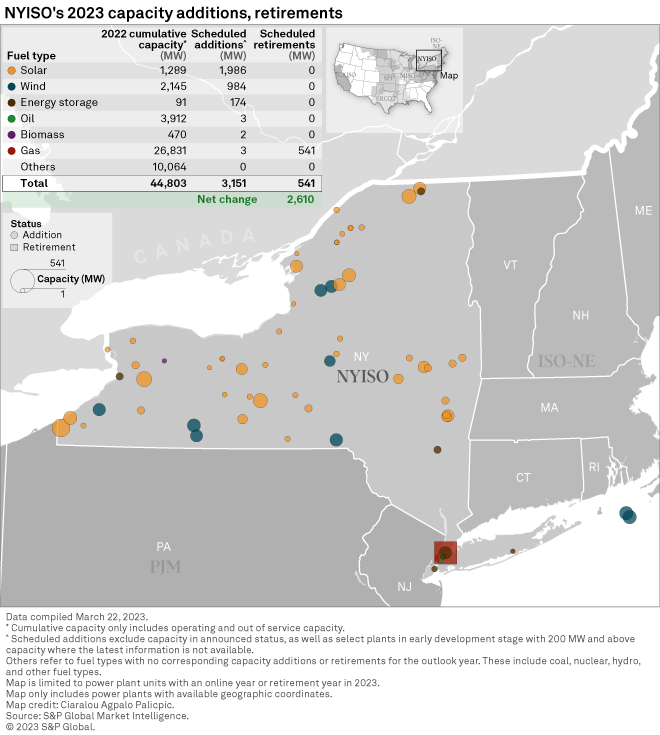

If construction schedules can hold, the New York ISO will in 2023 see the start of operations of the largest offshore wind facility in the US today.

The 132-MW South Fork Offshore Wind Project, being developed by Ørsted A/S and Eversource Energy, is among nearly 1 GW of wind capacity anticipated to start operations in 2023, according to S&P Global Market Intelligence data. It is the smaller of two offshore wind facilities the partners are building to supply power to New York.

Legislation approved in New York in 2019 targets the development of 9 GW of offshore wind resources by 2035, and the ISO's only planned power plant retirement is tied to that target.

Oil majors and offshore wind development partners Equinor ASA and BP PLC in January closed the acquisition of the 541-MW Astoria Gas Turbines facility in Queens, NY, from NRG Energy Inc. after state environmental regulators rejected plans by NRG to replace Astoria, which began operating in 1970, with a 437-MW simple-cycle, dual-fuel peaking generator because it was at odds with New York's 2019 clean energy law. The new owners intend to repurpose the site as a converter station to interconnect their planned 1,230-MW Beacon Offshore Wind Project beginning in the late 2020s.

The future of the Astoria site reflects New York's broader energy transition, as the state pursues a goal of 70% renewable energy by 2030 and the elimination of emissions from the state's electric sector by 2040. To hit the 2030 interim target, the New York ISO forecasts it will need 20 GW of new renewable capacity in operation, roughly doubling the 12.9 GW of new generation developed since 1999. To hit the 2040 goal, total installed capacity in the system must triple, bringing online at least 95 GW of new generation through new projects or modifications to existing plants.

The Astoria gas generators are slated for retirement in May to comply with New York City's "peaker rule," which aims to shut down units with high greenhouse gas emissions. The New York ISO recently warned that limits on emissions from fossil-fuel-fired peaker plants could lead to a major transmission shortfall for New York City in just two years and that the situation could get worse should a planned transmission line to carry hydropower from Quebec experience delays.

Overall in 2023, the New York grid is scheduled to add 3,151 MW of capacity, comprising 1,986 MW of solar, 984 MW of wind and 174 MW of energy storage, according to Market Intelligence data. A small project at New York University in Manhattan will add about 3 MW of gas-fired capacity.

Over the last five years, according to the New York ISO, 2.6 GW of renewable and gas-fired generation have come online and 4.8 GW, including two nuclear plants, have been deactivated.

Like other markets, the New York ISO also faces an interconnection backlog, with 475 active projects in the queue, nearly four times more than in 2018, when it had 120 projects in the queue, according to a March interconnection fact sheet.

Additions

Among the larger solar projects expected to come online in 2023 are ConnectGen LLC's 175-MW Big Tree Solar Project in Wyoming County; National Grid Renewables LLC's 150-MW Franklin Solar Project (Geronimo) in Franklin County; AES Corp.'s 125-MW Empire Solar Project in Chautauqua County; and NextEra Energy Inc.'s 90-MW High River Energy Center in Montgomery County.

Along with the South Fork offshore wind facility, other anticipated wind projects include RWE Renewables Americas LLC's 122-MW Baron Winds Project in Steuben County; NextEra's 102-MW Eight Point Wind Project in Steuben County; and Avangrid Inc.'s 101-MW Deer River Wind Farm Project in Lewis County.

Hanwha Energy USA Holdings Corp.'s 100-MW East River Battery Storage System Project in Queens County is among the major energy storage projects coming online in 2023. Others include GlidePath Power Solutions LLC's 20-MW Lincoln Park Grid Support Center (Battery Storage) in Ulster County; Key Capture Energy LLC's 20-MW KCE NY 6 Battery Storage Project in Erie County; and New York Power Authority's 20-MW North County Battery Storage (Franklin Battery Storage) (Willis Battery) in Franklin County.

Wholesale power prices in New York Zone J, covering New York City, are expected to peak at $56.38/MWh in July for the summer and at $90.98/MWh in December for the winter. Zone A, in western New York, is forecast to see a peak of $41.11/MWh in July. Wholesale natural gas prices at Transco Zone 6 are expected to peak December at $6.771/MMBtu, and Dawn hub prices in Ontario during that month will peak at $3.557/MMBtu.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.