Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Mar, 2022

By Sanne Wass and Cheska Lozano

Nordic banks could get caught up in the fallout from sanctions against Russia, even with limited direct exposure to the nation.

The two Swedish lenders' Baltic operations have come into focus due to the likelihood that Estonia, Latvia and Lithuania will suffer if Russia's economy enters freefall as a result of embargos following the invasion of Ukraine. Those risks could undermine the appeal of investing in Nordic banks, which have traditionally been seen as shelters from turbulence due to strong capital buffers and low levels of problem loans.

"If downside risks materialize, we question whether Nordics will broadly be seen as relative 'safe havens' this time," Credit Suisse said in a March 8 note.

Credit Suisse reduced its share price target for SEB by 16% and cut net profit estimates for 2022 and 2023 by 7%, saying that indirect effects from the conflict are likely to channel into earnings. Swedbank sustained a 15% reduction in its share-price target and a 6% cut in profit forecasts for this year and next.

Finland-based Nordea Bank Abp could also feel a pinch due to its home country's traditional trade ties with Russia, according to Credit Suisse.

Knock-on effect

Swedbank and SEB will both provide updates about the earnings impact from the conflict in their next interim reports, according to separate spokespeople. Both lenders also said they have little direct exposure to Ukraine or Russia.

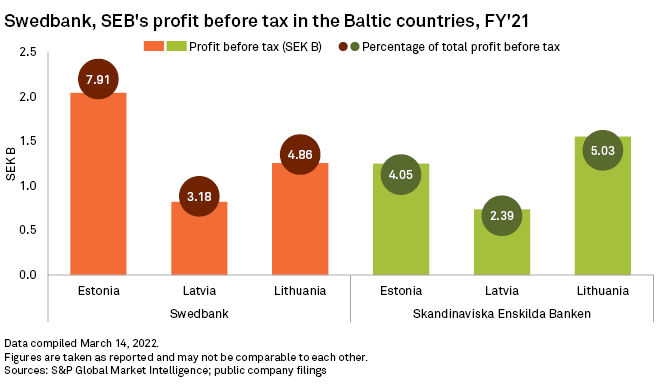

SEB said the invasion did not directly affect business in its home markets, including the Baltic countries. "However, the war is having a major impact on the world economy, on trade, on energy prices and on markets, which of course will affect both us and our customers," a spokesperson said by email. The bank got 11.5% of 2021 pretax earnings from the Baltic region.

Swedbank said that "uncertainty is causing negative reactions on the market, but the bank stands strong." It did not directly comment on its Baltic operations, which contributed 16% of 2021 pretax earnings. Nordea declined to comment.

The secondary impact from the war on the Baltic countries is a "key concern" for lenders, said Salla von Steinaecker, bank analyst at S&P Global Ratings. Swedbank and SEB's Baltic operations will face a more challenging and volatile operating environment from the Russia-Ukraine conflict, von Steinaecker said.

The Baltic nations are at risk if Russia suffers an economic slump because of their trade links. Credit Suisse expects a more than 50% drop in Russian imports in 2022, which would cause a 3.9% decrease in Lithuania's GDP, while Estonia and Latvia would suffer a 2.4% and 2.0% hit, respectively, according to Credit Suisse. Finland would see a 0.8% knock, compared with declines of 0.3% for the EU, 0.1% for the U.K. and between 0.1% and 0.2% for Sweden, Denmark and Norway, the bank said.

The Baltic economies would also suffer due to soaring energy costs and high inflation, and because war uncertainties dampen consumer confidence, DBRS Morningstar said in a March 7 report. These pressures risk lowering loan demand, asset quality and profitability at SEB's and Swedbank's Baltic subsidiaries, said Mario De Cicco, the credit rating provider's vice president of global financial institutions.

"The Russia-Ukraine conflict adds further uncertainty in an operating environment which has already been affected by the COVID-19 pandemic," De Cicco said. Still, there is yet to be any significant credit deterioration among the Nordic banks, and their Baltic branches have large capacities to absorb losses, De Cicco said.

Swedbank's lending to Estonia, Latvia and Lithuania amounted to 204.26 billion Swedish kronor at the end of 2021, representing 11.7% of total loans, while for SEB this figure stood at 158.82 billion kronor, or 9.0% of total loans.

Strong defensive candidates

Large Nordic lenders have so far avoided the worst of a European bank sell-off since the U.S. government warned of an imminent Russia invasion of Ukraine on Feb. 11, but the performance has been mixed. Swedbank and SEB shares have dropped 16.5% and 17.7%, respectively, while the stock of Nordic peers DNB Bank ASA and Svenska Handelsbanken AB (publ) are down less than 10%.

A Berenberg analysis of bank stock performance over the past two decades found that the six largest Nordic lenders have historically outperformed their European peers in periods of crises. Exposures to the Baltics in the context of the war have now slightly impaired this status as a "collective crisis safe-haven," Berenberg said in a March 4 note.

Still, Berenberg labeled Nordea, DNB and Handelsbanken "strong defensive candidates" given immaterial Baltic, Russian and Ukrainian exposures and strong capital return prospects.

Credit Suisse analysts, meanwhile, favor DNB, Handelsbanken and Danske Bank A/S as the "most removed" from geopolitical risks.

As of March 16, US$1 was equivalent to 9.45 Swedish kronor.