S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Mar, 2021

Large e-commerce players including Amazon.com Inc., Walmart Inc. and Target Corp. are likely to benefit from a third round of stimulus checks included in U.S. President Joe Biden's $1.9 trillion COVID-19 rescue package bill, with the cash infusion expected to spike already elevated digital retail sales.

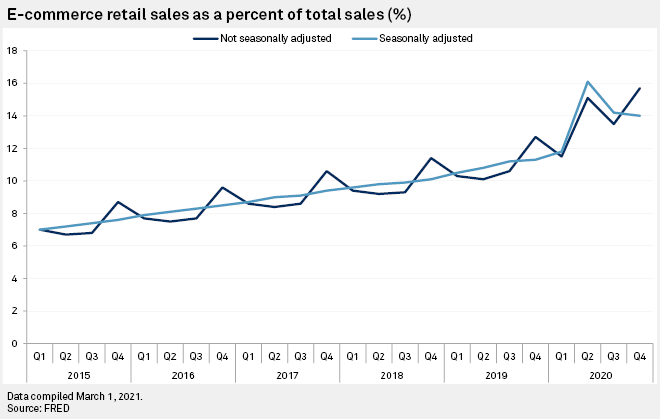

U.S. e-commerce sales in 2020 hit an estimated $791.7 billion, accounting for 14% of total retail sales that year, according to figures from the U.S. Census Bureau. That is up from 11% of total sales in 2019 and 9.7% in 2018.

Biden's proposal includes relief checks of $1,400 for individuals. While the income qualifications and cut-off limits are still being debated by Congress, earlier stimulus payments corresponded with an uptick in e-commerce sales. Camilla Yanushevsky, senior equity research analyst with CFRA Research, noted that the new round of checks would be larger than the two approved in 2020, potentially driving consumers to splurge on discretionary items such as wearables, gaming and appliances.

Companies like Best Buy Co. Inc., whose physical stores are expected to play a key role in the company's e-commerce fulfillment efforts, are likely to benefit from that lift as many elements of the stay-at-home economy are here to stay, Yanushevsky said.

"We think that Covid-19 winners have more room to run," she said.

Seasonally adjusted e-commerce sales as a percentage of total U.S. retail sales rose to 16.1% in the second quarter of 2020, up from 11.8% in the first quarter, thanks in part to the first round of stimulus checks worth $1,200 issued in March 2020 under the CARES Act. That is also an increase from 10.7% in the second quarter of 2019 and 9.6% in the second quarter of 2018, according to U.S. Census Bureau figures.

By the fourth quarter of 2020, e-commerce sales as a percentage of total retail moderated to 14% but were still up from 11.3% in the fourth quarter of 2019. Retail sales overall grew sharply in January thanks in part to a $900 billion pandemic relief bill passed in late December 2020 that included $600 stimulus checks to individuals earning up to $75,000. Yanushevsky said the late passage of the bill made January a larger gift-giving month.

A third round of stimulus dollars will likely cause a spike in online sales followed by a moderation, but the "14% range is what we are going to continue to see in 2021," Yanushevsky said.

While an additional round of stimulus checks will certainly boost e-commerce, the cash infusion may result in a smaller lift in online spending overall as some consumers head back to the stores, said Nick Shields, a senior analyst with Third Bridge who covers the retail sector.

Shields said consumers already spent earlier stimulus checks on bigger-ticket items such as new cars and TVs, meaning the next round could go toward items such as apparel, grills, and golf and fishing equipment from retailers such as Dick's Sporting Goods.

"I think it is fair to say that you won't see the bump like you saw in this past round and certainly not what we saw with the $1,200 checks that went out back last spring," Shields said.

As COVID-19 cases decline and vaccinations rise, consumers may use their stimulus dollars to head back out to restaurants and travel again, said Katie Thomas, who leads the Kearney Consumer Institute, an internal think tank at management consulting firm Kearney.

"Maybe they're willing to go out to eat, travel, buy a new Apple Watch," Thomas said. "You're starting to see the upticks again in apparel and beauty as people kind of get excited to get dolled up and go out again."