Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Jun, 2021

By Esther Whieldon and Robert Clark

This piece is produced by S&P Global Sustainable1, S&P Global's single source of essential sustainability intelligence to navigate the transition to a low-carbon, sustainable and equitable future.

More than half of the environmental, social and governance-linked funds outperformed the S&P 500 in the first several months of 2021 even as two new reports laid out opposing views about the factors driving the trend.

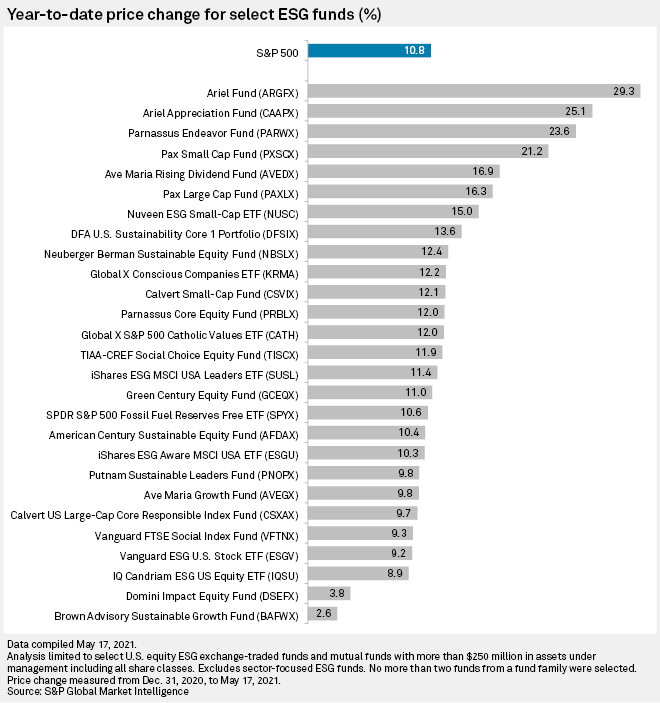

Using S&P Global Market Intelligence data, we tracked the price change for 27 ESG exchange-traded funds and mutual funds with more than $250 million in assets under management. The data shows that from Dec. 31, 2020, to May 17, 2021, 16 of those funds performed better than the S&P 500. Those outperformers rose between 11% and 29.3% over that period. In comparison, the S&P 500 increased 10.8%.

The 27 ESG funds in our analysis all saw their performance improve during the period reviewed, although to varying degrees. The top two performers — Ariel Fund and Ariel Appreciation Fund — are both managed by Ariel Investments LLC. Parnassus Investments' Parnassus Endeavor Fund had the third-best performance with a 23.6% price increase.

The 11 funds that underperformed compared to the S&P 500 saw a price increase ranging from 2.6% for the Brown Advisory Sustainable Growth Fund, managed by Brown Advisory LLC, to 10.6% for the SPDR S&P 500 Fossil Fuel Reserves Free ETF, managed by a unit of State Street Global Advisors Inc. The SPDR S&P 500 Fossil Fuel Reserves Free ETF performed the same as the S&P 500 during the first year of the pandemic and appears thus far to be tracking closely heading into mid-2021.

A prior review of how funds performed during the first year of the pandemic found that 19 out of 26 ESG-linked funds saw greater improvements than the S&P 500.

Are ESG factors driving outperformance?

Funds that identify as "ESG-focused" often screen for stocks based on value and growth, like many other funds, but may add criteria such as ESG-focused governance practices, ESG scores, disclosure practices, fossil fuel exposure, adherence to religious principles and workplace diversity. ESG fund managers have said their focus on nontraditional risks led to portfolios of companies that proved resilient during the COVID-19 downturn.

But critics of ESG investing often question whether the strategy can deliver premium returns. And a new study released in April by a "smart factor" index platform called Scientific Beta poses those questions again.

The report, "Honey, I shrunk the ESG Alpha: Risk-Adjusting ESG Portfolio Returns," suggests that "ESG ratings do not add value" beyond the kind of information already contained in sector classifications and factor attributes that are already used to attribute potential risk and performance in stocks. Moreover, nonfinancial ESG strategies "do not offer downside risk protection," wrote Scientific Beta, which is linked to the French academic think tank Edhec-Risk Institute.

But another analysis by professors at New York University's Stern Center for Sustainable Business and researchers at Rockefeller Asset Management suggests that improved financial performance related to ESG becomes more noticeable over longer time horizons — something the Scientific Beta paper contends does not happen.

The NYU/Rockefeller report examined more than 1,000 research projects conducted from 2015 through 2020 on ESG and corporate financial performance. It found that "everything else being constant, a study with an implied long-term focus is 76% more likely to find a positive or neutral result" than one looking at the performance of ESG-focused companies over a shorter time period. For example, corporate investments in environmental sustainability did not improve short-term financial performance "but had positive effects over the longer term." In addition, when CEOs communicate long-term ESG plans, it can result in an "abnormal positive reaction" by the stock market, the paper found.

More broadly, of the studies reviewed, the researchers found a positive relationship between ESG and corporate financial performance 58% of the time, while 21% had mixed results and 13% saw no impact.

The results of the February study appear to align with S&P Global Sustainable1's analyses of ESG fund performance over the past year: A majority of funds have outperformed the S&P 500 but to varying degrees.