Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Mar, 2022

By Joseph Williams and Darakhshan Nazir

Alphabet Inc.'s $5.40 billion acquisition of Mandiant Inc. is setting the pace for more red-hot multiples in the cybersecurity sector in 2022.

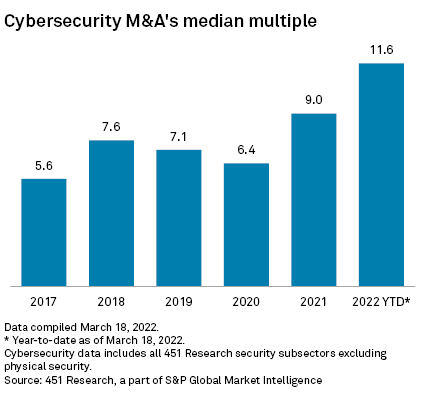

The median 2022 cybersecurity deal valuation as of March 18 was 11.6x trailing-12-month, or TTM, revenue, matching the Mandiant deal multiple. That compared to 12.9x TTM revenue for the same period of 2021.

Full year 2021 overall saw sector deal multiples well above historical valuations at 9.0x TTM revenue.

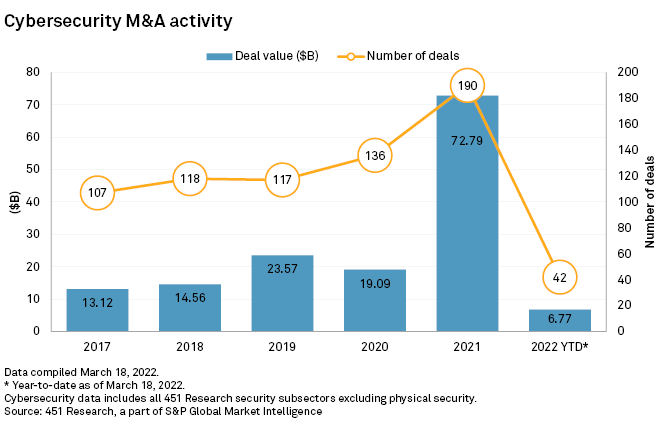

The Mandiant deal accounted for the majority of the $6.77 billion in aggregate transaction value announced in the cybersecurity sector this year to date.

There were 42 cybersecurity transactions announced through March 18, with a median deal value of $96.9 million, according to 451's M&A KnowledgeBase data. That compares to 36 transactions announced over the same period of 2021, with a median deal value of $185 million.

Mandiant, which reported $483.5 million in revenue in 2021, could catapult Google into "major player in cybersecurity," 451's tech analysts noted in a profile of the deal. Google's Big Tech rivals have shown cybersecurity to be a lucrative pairing with cloud services, the analysts wrote, pointing to Microsoft Corp., for instance, which they estimated collects about $15 billion annually from its cybersecurity business alone.

The deal announcement also comes during a time of heightened interest in cybersecurity as many believe the threat of cyberattacks emanating from Russia is rising following that country's invasion of Ukraine.

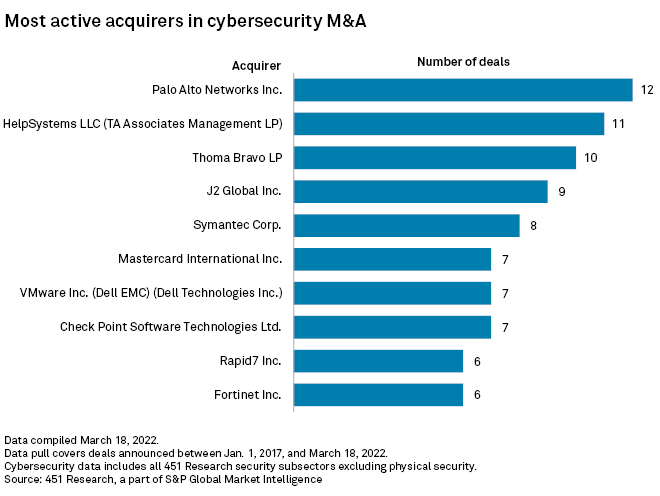

Most of the deal activity in cybersecurity in recent years reflected sector consolidation and outside investment. Cybersecurity company Palo Alto Networks Inc. ranks as the most active deal-maker by volume since 2017, completing 12 transactions.

Private equity firm Thoma Bravo LP, which ranks third by deal volume, has paid the largest aggregate sum for cybersecurity targets, spending $22.95 billion for 10 transactions.

451 Research is part of S&P Global Market Intelligence.