Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Sep, 2021

|

An LNG tanker illuminates a port. |

The biggest U.S. LNG exporter, Cheniere Energy Inc., discussed commercially sanctioning an LNG growth project in 2022, and other LNG infrastructure developers have signed supply deals that could push projects forward after a dearth of final investment decisions in the last few years.

"There is a renewed enthusiasm, and you have got a group of American projects filled with people that are good at getting creative and solving problems," said Michael Webber, an independent LNG analyst and managing partner of investment research firm Webber Research & Advisory. "They've had a long runway to adjust their models, and the window looks like its opening, at least for a couple."

The next several months could be pivotal for determining whether new U.S. LNG production capacity will make it to the construction stage. The global gas market appears likely to continue its recovery from pandemic-driven disruptions that muted investors' appetite for new multibillion-dollar LNG infrastructure. But this may also be a time when projects that have struggled for a long time finally fade away.

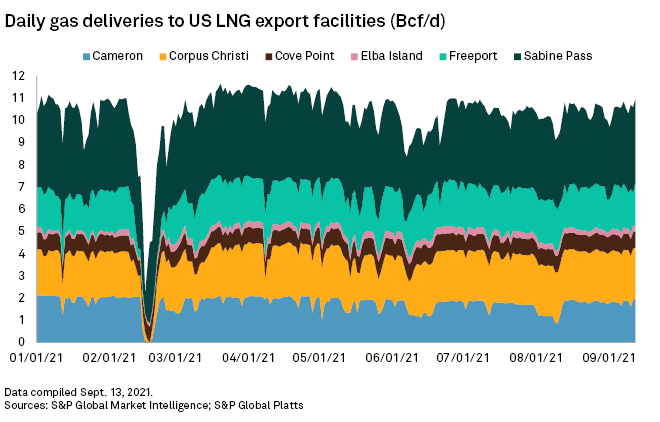

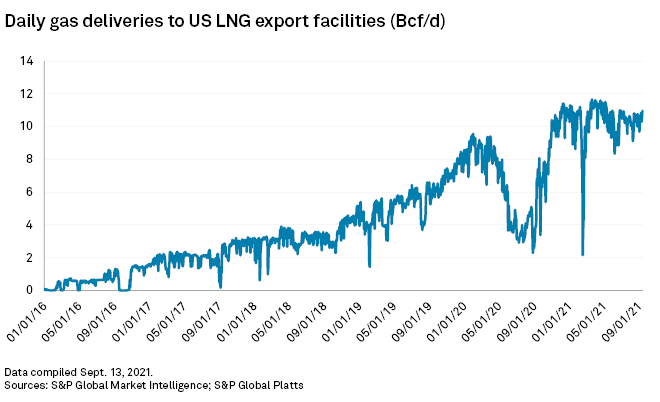

Favorable market dynamics have kept the six major LNG export terminals that operate in the U.S. running at close to full bore for months. And a large spread between U.S. Henry Hub gas prices and prices in end-user markets in Asia and Europe have fueled anticipation among project sponsors about increased buyer interest in supply deals that could be used to support building new facilities.

The outlook for U.S. LNG developers also improved after unexpected delays for competing LNG export projects abroad and growing concern about the supply picture among buyers who were jolted by winter gas shortages.

"If I were going to set an over-under on North American projects that get greenlit this cycle — larger-scale projects — I would set it at 2.5," Webber said in an interview. "If you were going to go back to 2020, I'd have taken the under. Today, I'd probably lean toward the over."

More than a dozen North American LNG developers are competing to advance their projects, but those who have managed to sign new off-take deals in recent months have been limited to a relatively small group, including Cheniere and the export hopeful Tellurian Inc. Lingering challenges have included pressure from buyers to be flexible on pricing and contract terms, as well as pressure to bring down project costs. Developers also faced mounting concerns over greenhouse gas emissions associated with U.S. LNG throughout the natural gas supply chain.

Nine months into the year, no new projects have received final investment decisions, or FIDs, and some developers canceled or pushed back projects. For Erin Blanton, a senior research scholar at the Center on Global Energy Policy, it is no surprise that the market has not jumped in to finance new projects.

"Are we fully back to recovery? This virus is still very much with us. There are still a lot of questions," Blanton said in an interview.

Blanton cited other factors, such as pressures on large European portfolio buyers to move away from LNG. "There is a lot that is going against the signing of these long-term agreements that would take these projects across the finish line in terms of financing and getting to FID."

The coming winter may be a test for the global gas market, Blanton said. "I do think there is room for more LNG out of the U.S.," Blanton said. "I just think we have to know that what we are seeing right now isn't an aberration — that it's actually a sustained recovery in demand."

The following is a compilation of updates to major U.S. LNG export projects in recent months.

Cheniere eyes 2022 decision on expansion

Cheniere is on the verge of reaching 45 million tonnes of LNG production capacity, once it begins to release LNG from its ninth liquefaction train across its two export terminals. The liquefaction unit — the sixth 5-Mt/y train at the company's flagship Sabine Pass terminal in Louisiana — is expected to reach that milestone by the end of the year before reaching substantial completion in the first quarter of 2022.

Executives expressed confidence during a Sept. 7 investor call that the company will be able to reach FID in 2022 on a 10-Mt/y midscale train expansion at its Corpus Christi LNG facility in Texas. Cheniere said it needs to contract about another 4 Mt/y of LNG supplies to advance the Stage 3 expansion project to construction, following up on commercial progress that included a 15-year deal struck in July with Canada's Tourmaline Oil Corp.

Cheniere also plans to start providing customers with greenhouse gas emissions data for each of its cargoes, from wellhead to delivery point, starting in 2022. The emissions tags are part of a series of Cheniere climate initiatives introduced as exporters are competing to meet demand for cleaner supplies.

Tellurian focuses on financing, upstream supplies

Tellurian said in August that it is in talks with bank groups about financing its proposed Driftwood LNG export terminal in Louisiana after signing a series of supply deals with buyers totaling 9 Mt/y, enough to cover the project's first phase. The developer expected to reach FID on the $12 billion project in the first quarter of 2022.

Questions remained about whether the company's strategy of using medium-term supply contracts to finance an export project will be successful. Tellurian also said it will not sanction the project until it secures sufficient upstream reserves for the first phase — about 1.5 Bcf/d, compared to the almost 100 MMcf/d that Tellurian expects to have in production by the end of the year from its drilling program in the Haynesville Shale province.

The developers of the two U.S. LNG terminals under construction — Venture Global LNG's 10-Mt/y Calcasieu Pass terminal in Louisiana and the 18.1-Mt/y Golden Pass LNG Terminal backed by Qatar Petroleum and Exxon Mobil Corp. — continue to move forward.

Commissioning work is underway at Calcasieu Pass, and the developer described plans to federal regulators for a phased operational startup that could release the first exports of LNG in late 2021, about a year earlier than originally anticipated. Venture Global expected full operations at Calcasieu Pass, which will be the country's seventh major LNG export plant, to begin in 2022.

The Golden Pass developers planned to have the first of three trains operational in 2024.

Besides Calcasieu Pass, Venture Global is developing other projects that include the proposed Plaquemines LNG export facility in Louisiana, which would have a production capacity of up to 20 Mt/y. Plaquemines has not received a formal FID, but there has been commercial progress.

Sempra shifts focus

Sempra executives said in early August that their LNG growth ambitions will focus next on expanding the Cameron LNG terminal in Louisiana, after pushing back plans to sanction the proposed Port Arthur LNG terminal in Texas amid commercial challenges. Delays in developing Port Arthur prompted Polish Oil and Gas Co. to end a deal for buying 2 Mt/y of LNG from the facility and to instead sign purchase agreements for the same amount from Venture Global terminals. Sempra also confirmed that a Port Arthur deal with Saudi Arabian Oil Co. expired.

Mexico Pacific Ltd. in commercial talks

Mexico Pacific Ltd. LLC has been quietly building commercial support to commercially sanction its project on the Sea of Cortez in Mexico, which would be capable of producing up to 12.9 Mt/y. The company expected to reach a final investment decision on the first two LNG trains of the project by early 2022 and to begin exports by 2025. The project still needs an export permit from the Mexican government, which the developer said it should receive in the coming months.

Brownsville LNG projects face review

The U.S. Court of Appeals for the District of Columbia Circuit issued an August ruling that found problems with the Federal Energy Regulatory Commission's climate and environmental reviews for NextDecade Corp.'s Rio Grande LNG export project and the Texas LNG LLC export project. The federal appeals court remanded the orders authorizing the projects but did not vacate them, finding that it is "reasonably likely" that FERC could address the problems with the reviews. The court dismissed as moot a similar challenge to Exelon Corp.'s now-scrapped 6-Mt/y Annova LNG project.

NextDecade is the only Brownsville project that announced any firm long-term contracts: a single deal for 2 Mt/y with Royal Dutch Shell PLC. Rio Grande would be capable of producing up to 27 Mt/y. The developer said in an investor presentation that it is targeting an FID by the end of 2021 on the first phase, which would include two trains capable of producing 11 Mt/y.

For months, NextDecade has pursued ways to reduce the emissions profile of the Rio Grande facility, including a carbon capture and storage project. In late 2020, France's Engie SA halted talks over a potential long-term deal tied to the NextDecade project, in what some industry officials interpreted as a potential warning that U.S. projects could suffer from customer concerns over methane emissions.

Freeport asks to boost production

Freeport LNG Development LP in August urged FERC to reject environmental activists' objections to a proposal to increase the authorized production capacity of its Texas export terminal by the equivalent of nearly 90 Bcf per year.

Freeport is also building commercial support to sanction a fourth liquefaction train at the terminal that FERC already authorized.

Commonwealth LNG awaits permit

Commonwealth LNG LLC was a late entry into the field of U.S. LNG export developers when it applied for a federal Natural Gas Act permit for its 8.4-Mt/y project in Louisiana in August 2019. The company faced hurdles in the permitting process, including environmental opposition. But the developer continued to target FID in late 2022 and first LNG in 2025.

Commonwealth announced Aug. 2 that it is signing a preliminary agreement with Bangladesh's Summit Oil & Shipping Co. Ltd to contract up to 1 Mt/y of LNG from the proposed terminal. It was the first deal announced since the developer issued a tender for terminal supplies in January with plans to execute contracts by the end of June. Commonwealth said talks with other potential counterparties were ongoing.

US West Coast projects in limbo

The proposed 20-Mt/y Alaska LNG export terminal and Pembina Pipeline Corp.'s proposed 7.5-Mt/y Jordan Cove LNG export project in Oregon continued to face major headwinds, including a lack of commercial support.

The state-run Alaska Gasline Development Corp. sought to revive its effort to develop an LNG export terminal by shifting focus to a pipeline project as a way to de-risk the LNG project. To that end, the developer is seeking federal energy infrastructure funding to cover most of the pipeline costs.

Pembina decided to pause the development of Jordan Cove to assess the impact of regulatory decisions that threaten the project.

Lake Charles LNG continues without Shell

Energy Transfer LP decided to move forward as the sole developer of the proposed Lake Charles LNG export project after Shell pulled out in March 2020, but the developer has yet to announce any firm offtake deals tied to the facility.

Delfin seeks extension